New Hampshire Cleaning Services Contract - Self-Employed

Description

How to fill out Cleaning Services Contract - Self-Employed?

Have you found yourself in a scenario where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the New Hampshire Cleaning Services Contract - Self-Employed, which are designed to comply with federal and state requirements.

Once you find the right form, click Purchase now.

Select the pricing plan you want, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Cleaning Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and make sure it is for the correct city/state.

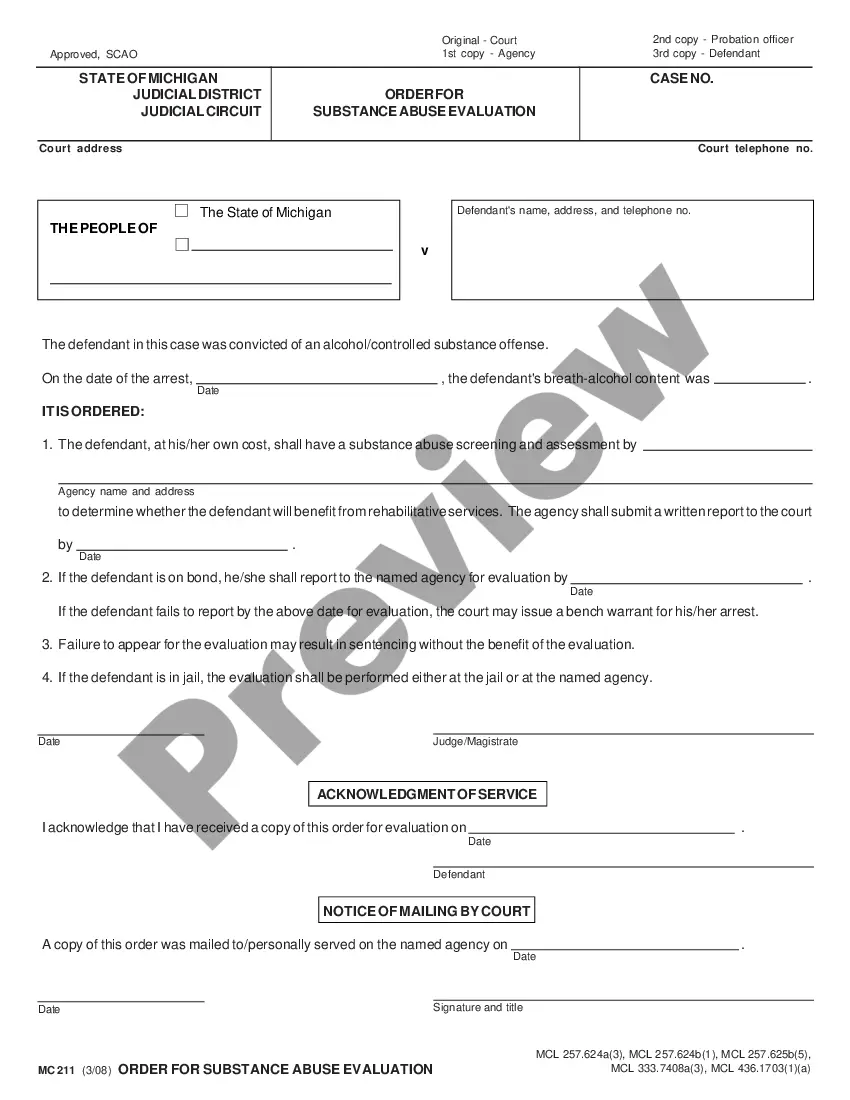

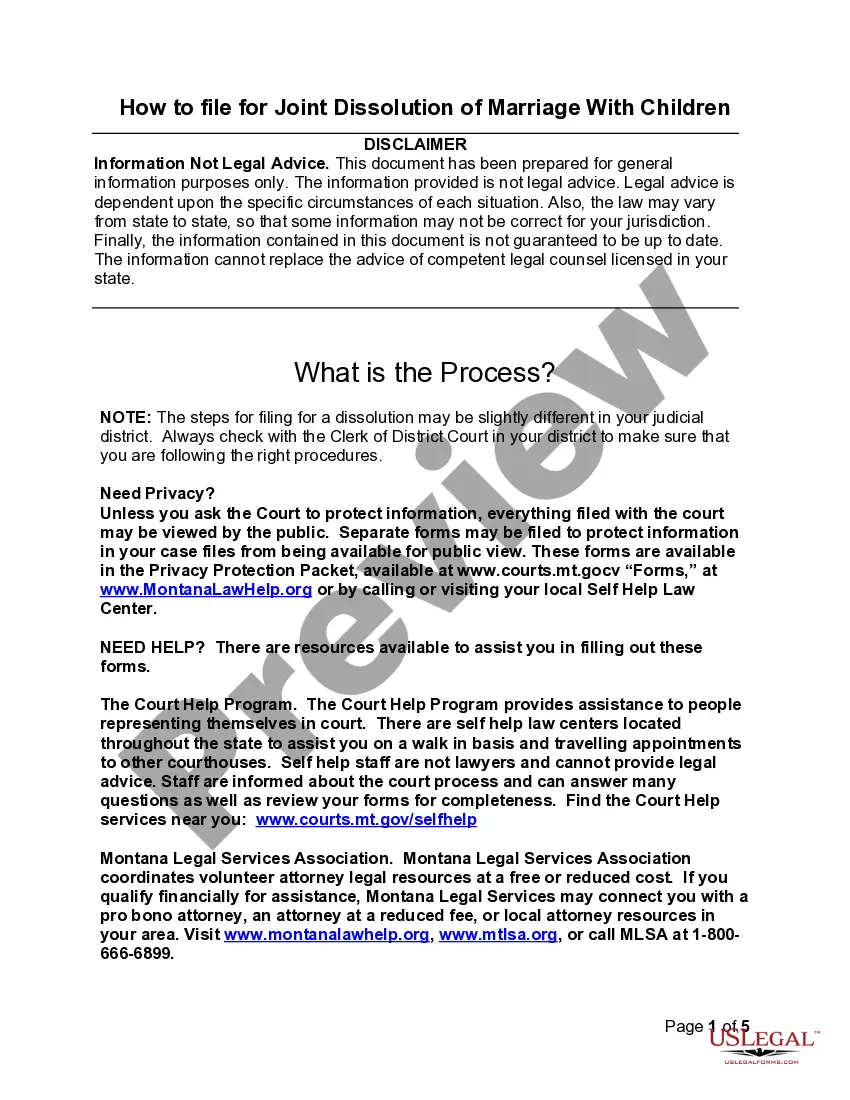

- Utilize the Preview button to view the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that suits your needs.

Form popularity

FAQ

Starting a cleaning business in NH requires several steps, including choosing a business name, setting up your business structure, and developing a marketing strategy. You should also utilize resources like US Legal Forms to obtain a New Hampshire Cleaning Services Contract - Self-Employed. This contract will help you set clear expectations with your clients, establishing a professional service from the outset.

To attract clients for your cleaning services, focus on marketing strategies such as social media advertising, local networking events, and word-of-mouth referrals. You can provide exceptional service and follow up with clients for testimonials. Having a New Hampshire Cleaning Services Contract - Self-Employed not only validates your professionalism but also reassures potential clients about your commitment.

Getting a cleaning business contract often involves bidding on projects and showcasing your expertise. Leverage platforms like US Legal Forms, which offer New Hampshire Cleaning Services Contract - Self-Employed templates to help you prepare a winning proposal. Tailor your contract to meet client needs, and you’ll create a strong foundation for a mutually beneficial relationship.

Becoming a subcontractor for cleaning services involves networking, building relationships, and showcasing your skills. Start by reaching out to local cleaning companies and inquire about opportunities. Having a solid New Hampshire Cleaning Services Contract - Self-Employed can help you present yourself as a professional, demonstrating your commitment to quality and reliability.

To get a contract for your cleaning business, start by defining your services and target clients. You can use platforms like US Legal Forms to find adaptable New Hampshire Cleaning Services Contract - Self-Employed templates. These templates provide a comprehensive foundation, ensuring you cover important aspects such as payment terms and service expectations.

Yes, New Hampshire does tax income reported on a 1099 form, which includes payments you receive as a self-employed individual. If you are working under a New Hampshire Cleaning Services Contract - Self-Employed, you must report this income when filing your taxes. Careful tax planning and considering using resources like uslegalforms can help streamline this process.

The 72 hour rule in New Hampshire relates to the duration contractors can work without needing a permit for certain cleaning jobs. Generally, if the work does not exceed 72 hours, you may avoid complex regulatory requirements. However, even short contracts like a New Hampshire Cleaning Services Contract - Self-Employed should be documented properly to ensure clarity.

In New Hampshire, all earnings from self-employment, including those generated through a New Hampshire Cleaning Services Contract - Self-Employed, are generally taxable. This income includes wages, profits from businesses, and various types of investment income. It's crucial to track all earnings to make accurate tax filings.

The independent contractor rule determines how a worker is classified for tax purposes. In New Hampshire, individuals providing cleaning services under a New Hampshire Cleaning Services Contract - Self-Employed typically qualify as independent contractors if they control how their work is performed. Understanding this classification can help prevent tax issues later.

Several states do not impose self-employment taxes, with some of the most notable being Florida and Texas. These states might appeal to self-employed individuals, including those in the cleaning services sector. However, for those operating under a New Hampshire Cleaning Services Contract - Self-Employed, it's essential to understand local regulations to ensure compliance.