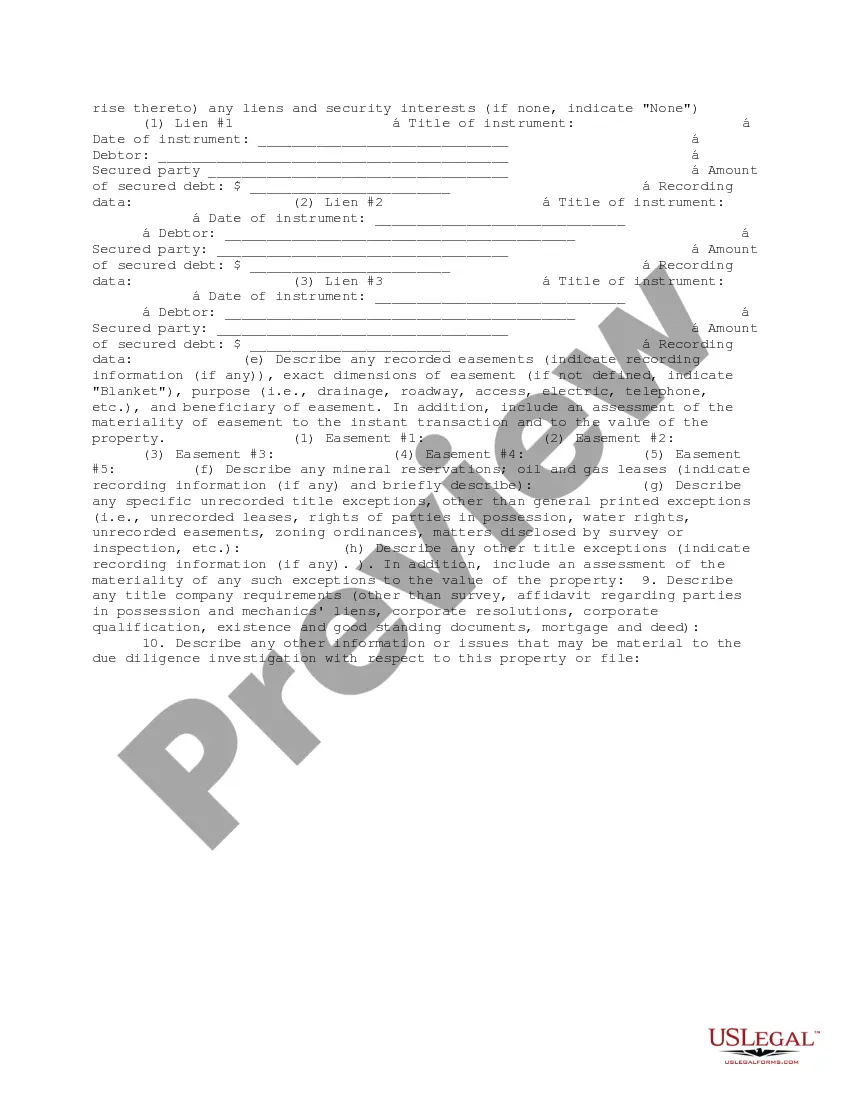

This due diligence workform is used to review property information and title commitments and policies in business transactions.

New Hampshire Fee Interest Workform

Description

How to fill out Fee Interest Workform?

Are you in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding ones that you can trust is challenging.

US Legal Forms offers thousands of form templates, including the New Hampshire Fee Interest Workform, which are designed to meet both federal and state regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or Visa/Mastercard.

Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents list. You can get another copy of the New Hampshire Fee Interest Workform at any time, if needed. Just follow the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service provides professionally created legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Fee Interest Workform template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

- Use the Preview button to check the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and requirements.

- Once you find the right form, click on Buy now.

Form popularity

FAQ

The NH interest and dividends form is a state-specific tax form used to report income earned from interest and dividends. Residents must complete this form if their income exceeds a certain threshold. Using the New Hampshire Fee Interest Workform can simplify this process, ensuring that you accurately report your earnings. This form is crucial for fulfilling your tax obligations in the state.

New Hampshire has not repealed the interest and dividend tax as of now. This tax applies to individuals and trusts earning interest and dividend income. If you need to report this income, you will likely have to use the New Hampshire Fee Interest Workform. Staying updated on tax changes is essential, and consulting reliable resources can help you navigate this.

The tax form used for reporting interest and dividends in New Hampshire is also the New Hampshire Fee Interest Workform. This form is vital for capturing all relevant financial details associated with your interest and dividend earnings. When you complete it diligently, you will better understand your tax liabilities and have a smoother tax filing process.

The primary form for reporting interest and dividends tax in New Hampshire is the New Hampshire Fee Interest Workform. This document ensures that you accurately disclose your earnings to the state, minimizing any risks of errors. By using this form, you can confidently navigate your tax responsibilities and ensure compliance with local laws.

Yes, New Hampshire taxes both interest and dividends earned by residents. The state requires you to report these types of income on the New Hampshire Fee Interest Workform. Understanding this taxation provides you with clarity on your financial obligations and allows you to plan your finances effectively.

In New Hampshire, interest income is subject to taxation through the interest and dividends tax. This means you must report your interest earnings on the appropriate forms, including the New Hampshire Fee Interest Workform. Being aware of these regulations helps you manage your finances wisely and stay on the right side of the law.

The NH form AU 208 is a specific tax form that residents in New Hampshire use to report interest income. This form is essential for tracking earnings from interest, ensuring compliance with state regulations. By accurately completing the New Hampshire Fee Interest Workform, you can present your financial information clearly and avoid potential issues with tax assessments.

Form DP-10 in New Hampshire is the state's form used for reporting personal income tax information, specifically related to dividend distributions. This form is crucial when filling out your New Hampshire Fee Interest Workform as it helps ensure accurate tax reporting. It's important to fill it out correctly to avoid errors in your returns. For assistance with this process, consider using the resources available on USLegalForms.

Yes, New Hampshire is indeed a reciprocal state, meaning it has agreements with certain states regarding the taxation of income earned by non-residents. If you live in a reciprocal state, you may find tax benefits when filling out the New Hampshire Fee Interest Workform. Understanding these agreements is vital for maximizing your benefits. USLegalForms provides helpful resources to navigate these important topics.

Yes, New Hampshire is in line with the compliance requirements of Section 163J. This affects how taxpayers calculate their fee interest deductions accurately. It is crucial to reference the New Hampshire Fee Interest Workform when preparing your tax submissions to ensure all deductions are handled properly. For more detailed guidance, USLegalForms offers comprehensive solutions for your needs.