This due diligence form is used to summarize data for each LLC associated with the company in business transactions.

New Hampshire Limited Liability Company Data Summary

Description

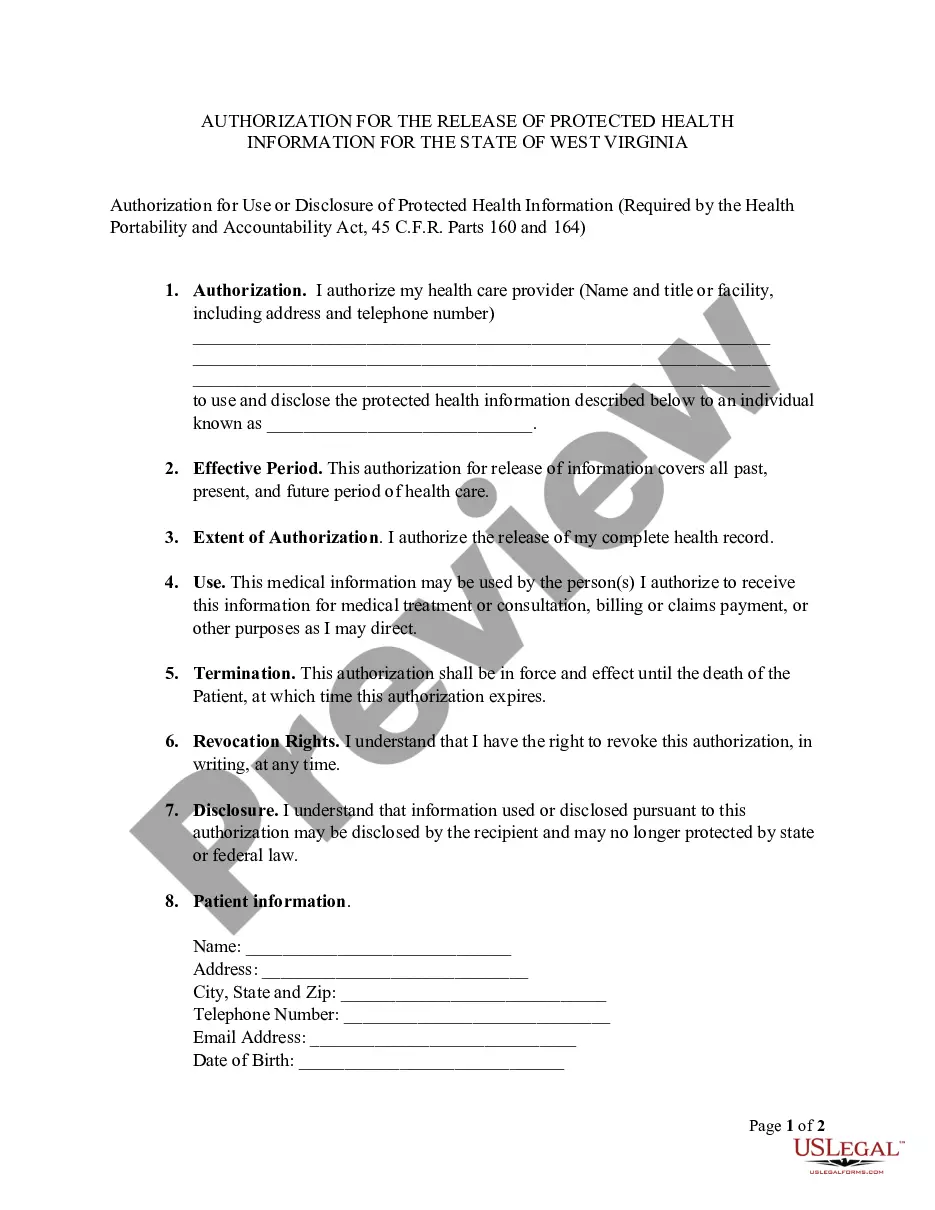

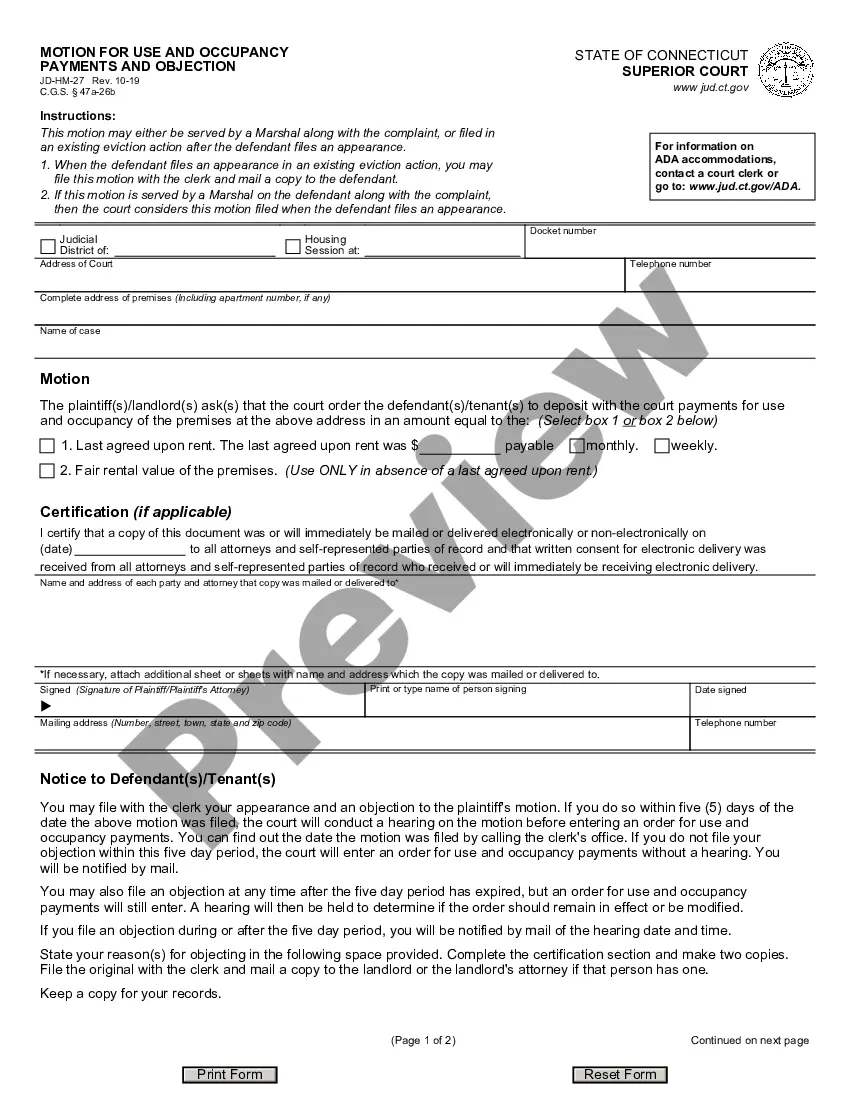

How to fill out Limited Liability Company Data Summary?

Locating the appropriate authorized document format can be a challenge. Clearly, there are numerous templates accessible online, but how can you discover the official format you need? Utilize the US Legal Forms site.

The service provides an extensive range of templates, including the New Hampshire Limited Liability Company Data Summary, suitable for both business and personal purposes. All documents are vetted by experts and comply with federal and state regulations.

If you are currently registered, sign in to your account and select the Download option to obtain the New Hampshire Limited Liability Company Data Summary. Use your account to search for the legal documents you have previously purchased. Visit the My documents tab of your account and download an extra copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to download properly crafted paperwork that adheres to state requirements.

- Firstly, ensure that you have chosen the correct document for your town/state. You can review the document using the Preview option and read the document details to confirm it is suitable for you.

- If the document does not meet your requirements, utilize the Search field to find the appropriate document.

- Once you are certain that the document is correct, click the Purchase now option to acquire the document.

- Select the payment plan you desire and enter the necessary information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document to your device.

- Finally, complete, modify, print, and sign the obtained New Hampshire Limited Liability Company Data Summary.

Form popularity

FAQ

Looking up a New Hampshire LLC is a straightforward process. You can access the New Hampshire Secretary of State’s online database to enter the business name and retrieve its information. For more detailed data, you can utilize the New Hampshire Limited Liability Company Data Summary, which consolidates essential information about the LLC, including its history and legal standing. This is an effective way to ensure you are dealing with a reputable company.

To check if an LLC exists, you can visit the New Hampshire Secretary of State’s website and search for the business in their online database. By entering the name of the LLC, you can easily retrieve its status and registration details. Utilizing the New Hampshire Limited Liability Company Data Summary will provide more comprehensive insights, enabling you to make informed decisions about partnerships or contracts.

Yes, you can discover if someone owns an LLC by searching the New Hampshire Secretary of State’s database. This will reveal the official records, including the names of the members or managers, if applicable. Exploring the New Hampshire Limited Liability Company Data Summary can also help you access valuable ownership information. This transparency bolsters trust when engaging with businesses.

To verify if an LLC is legitimate, you should check its registration status with the New Hampshire Secretary of State. This will include confirming its filing date, active status, and compliance with state regulations. Additionally, a comprehensive review of the New Hampshire Limited Liability Company Data Summary can provide insights into any legal filings or issues. This ensures you engage with a reliable business.

A BOI report in New Hampshire refers to a Business Organization Information report. This document provides essential details about a business entity, including its formation date, registered agent, and current status. These reports are useful for understanding the health and credibility of businesses in the state. You can find this information through the New Hampshire Limited Liability Company Data Summary.

Setting up a New Hampshire Limited Liability Company involves several steps. First, you need to choose a unique name for your LLC that complies with state rules. Next, you will file the necessary documents with the Secretary of State, appoint a registered agent, and possibly create an operating agreement. For detailed assistance and to ensure everything is done correctly, consider leveraging uslegalforms to guide you through the setup process.

Determining if an LLC is worth it in New Hampshire often depends on your specific income and business expenses. Generally, an LLC may start to become beneficial when your income exceeds the threshold at which personal liability becomes a concern, often around $50,000 annually. This legal structure can provide personal asset protection while reducing potential tax burdens. Evaluating your financial situation with resources like the New Hampshire Limited Liability Company Data Summary can help you make an informed decision.

Filing for a New Hampshire Limited Liability Company involves submitting the required forms to the Secretary of State's office. You will need to provide essential details about your LLC, including its name and registered agent. You can easily access these forms on the official state website or utilize platforms like uslegalforms for guidance. This makes the filing process straightforward and ensures you meet all necessary requirements.

The approval process for a New Hampshire Limited Liability Company typically takes about one to two weeks. However, the timeframe may vary based on the volume of applications the state receives. To expedite your approval, ensure that all your documents are complete and accurate. Using a service like uslegalforms can help streamline this process for you.

To look up a business in New Hampshire, you can access the online database provided by the state government. By entering the business name or the owner's details, you can retrieve comprehensive information about the business. This resource is valuable for verifying legitimacy or researching potential partners. For more in-depth insights, utilize the New Hampshire Limited Liability Company Data Summary available on the US Legal Forms platform.