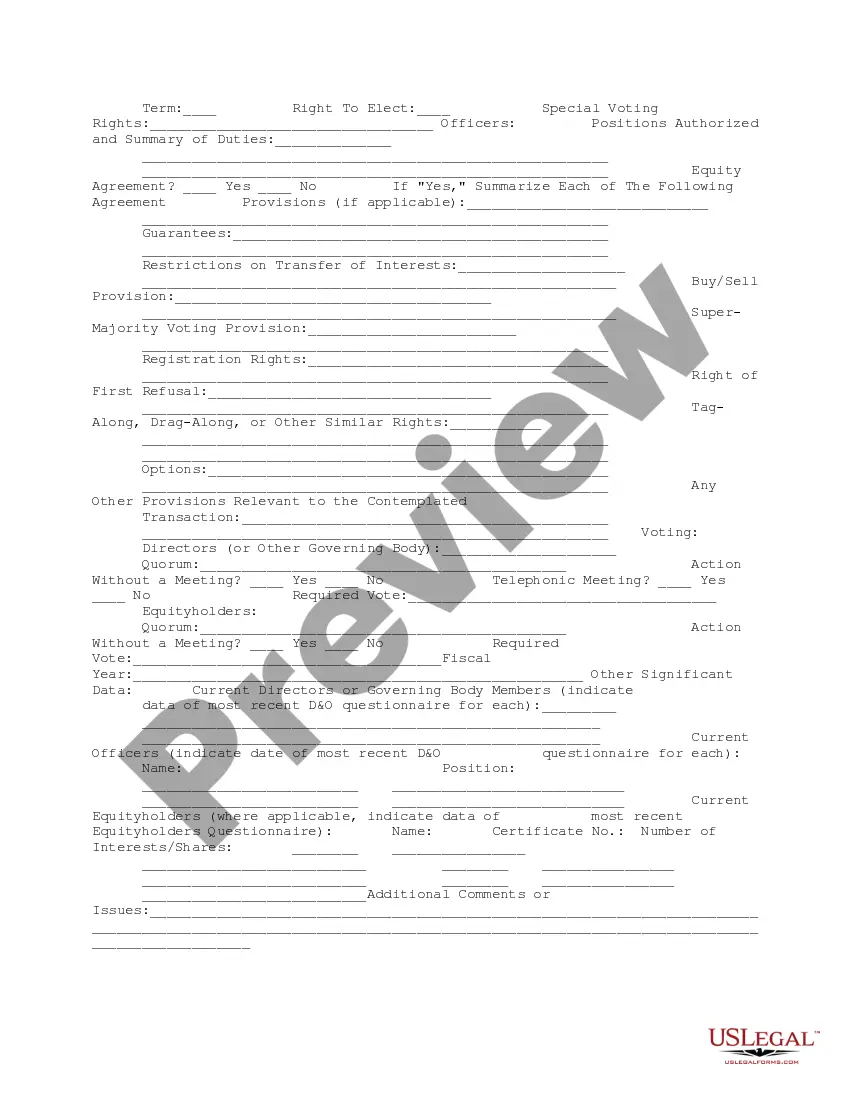

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

New Hampshire Company Data Summary

Description

How to fill out Company Data Summary?

Are you presently in a situation where you require documents for occasional business or personal needs almost daily.

There are numerous legal document templates accessible online, but finding ones you can rely on isn’t easy.

US Legal Forms provides thousands of form templates, including the New Hampshire Company Data Summary, designed to meet state and federal requirements.

Once you find the correct form, click Buy now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for the order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Company Data Summary template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

- Click the Preview button to view the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you're looking for, use the Search section to find one that fits your requirements.

Form popularity

FAQ

You can look up a business in New Hampshire through the Secretary of State's website, which provides access to a comprehensive database. By searching with the business name or the owner’s name, you can obtain a New Hampshire Company Data Summary that includes essential details such as registration status, business type, and more. This information can help you verify the legitimacy of a business or learn about competitors in your industry. If you need additional assistance, U.S. Legal Forms offers resources that make business information searches more efficient.

Yes, New Hampshire does require a business license, but it's important to note that the requirements can vary depending on the type of business you operate. A New Hampshire Company Data Summary can help you understand what licenses or permits you may need based on your specific business activities. You can check with your local town or city offices to ensure you have the right documentation for compliance. Additionally, some professions may need special licenses, so it's a good idea to research thoroughly.

Businesses operating in New Hampshire must file the NH 1120. This includes corporations that conduct business activities, earn income, or hold assets in the state. Additionally, if your corporation meets the criteria outlined in the New Hampshire Company Data Summary, timely filing is essential to avoid penalties. By using resources from uslegalforms, you can navigate the filing process with ease and ensure compliance with state regulations.

The Business Profits Tax (BPT) and the Business Enterprise Tax (BET) in New Hampshire serve different purposes. BPT taxes the profits of businesses, while BET is assessed on the enterprise's gross receipts and payroll. Understanding these distinctions is crucial for accurate financial planning, and referring to a New Hampshire Company Data Summary can provide clarity on the specifics of your business's tax obligations. Knowing the differences helps ensure compliance and optimize tax strategy.

To calculate your New Hampshire business enterprise tax (NH BET), you need to take your gross business income and subtract any allowable deductions. This calculation gives you the taxable income figure, which is then multiplied by the current tax rate. Utilizing a New Hampshire Company Data Summary can help you gather the necessary financial data to ensure accuracy in your calculations. It’s important to stay updated with any changes in tax regulations to avoid potential pitfalls.

New Hampshire's primary source of income comes from various sectors, including services, manufacturing, and tourism. The service industry, in particular, plays a significant role in driving the state’s economy. Understanding these economic factors is crucial for anyone considering starting a business in the state. You can explore a New Hampshire Company Data Summary for deeper insights into economic trends and business opportunities.

Finding the owner of a business in New Hampshire can be done through several avenues. The New Hampshire Secretary of State’s website provides a searchable database for business registration records. Also, a New Hampshire Company Data Summary consolidates vital information about businesses, making it easier for you to identify ownership details.

The NH form AU 208 is a form used for applying for an exemption from the New Hampshire meals and rooms tax. This form is typically filed by organizations that qualify for tax exemption. If you're involved in a business, obtaining the correct forms is essential. A New Hampshire Company Data Summary can guide you on the proper documents and processes needed.

New Hampshire is often considered a tax-friendly state, especially for businesses. It does not impose an income tax on earned wages or a general sales tax. However, businesses are subject to certain business taxes. For a comprehensive understanding, you can refer to a New Hampshire Company Data Summary, which details state regulations and tax obligations.