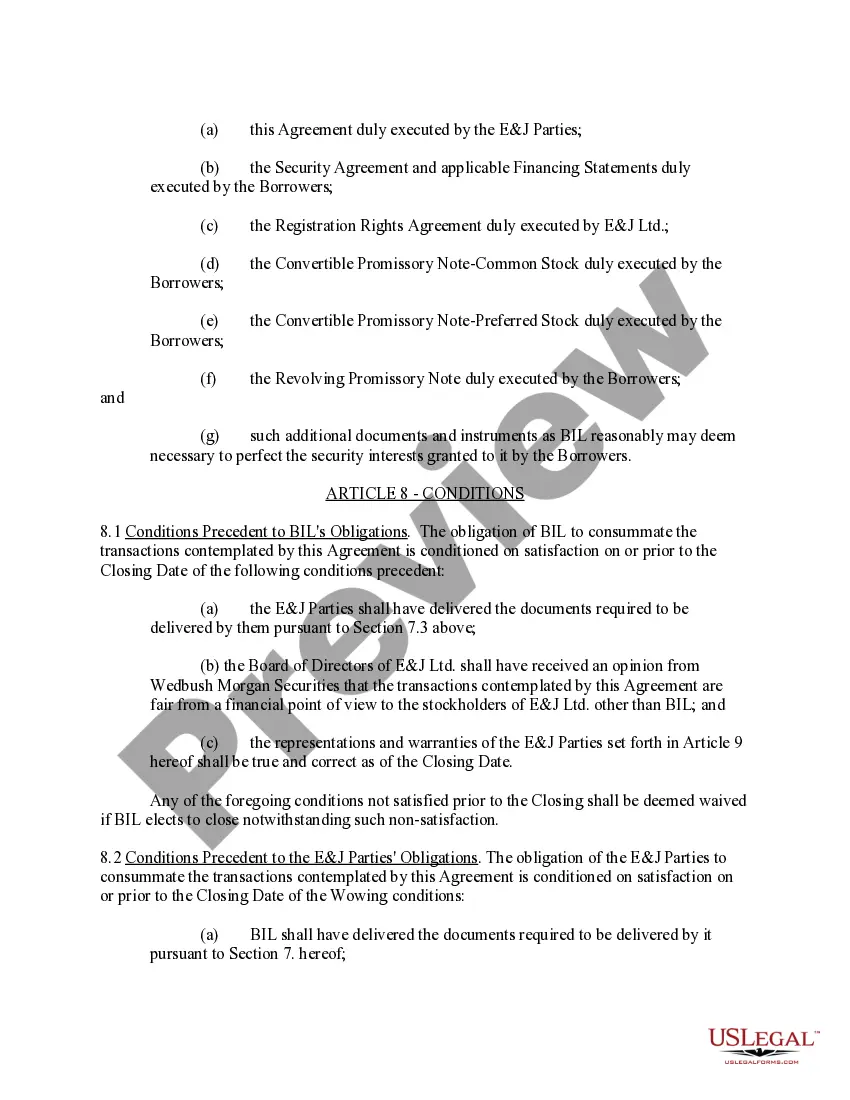

New Hampshire Debt Conversion Agreement with exhibit A only

Description

How to fill out Debt Conversion Agreement With Exhibit A Only?

You can invest time on the Internet attempting to find the legitimate record template that suits the state and federal specifications you will need. US Legal Forms gives a large number of legitimate types that are examined by professionals. It is simple to acquire or printing the New Hampshire Debt Conversion Agreement with exhibit A only from the assistance.

If you already possess a US Legal Forms account, it is possible to log in and click the Download key. Afterward, it is possible to full, revise, printing, or indicator the New Hampshire Debt Conversion Agreement with exhibit A only. Each and every legitimate record template you purchase is the one you have eternally. To acquire one more version associated with a acquired form, visit the My Forms tab and click the related key.

If you work with the US Legal Forms site the very first time, keep to the straightforward instructions below:

- First, ensure that you have chosen the correct record template to the county/area that you pick. See the form information to make sure you have picked the appropriate form. If available, use the Preview key to appear through the record template as well.

- If you would like discover one more variation of your form, use the Research discipline to get the template that fits your needs and specifications.

- When you have identified the template you desire, just click Purchase now to proceed.

- Choose the costs plan you desire, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal account to cover the legitimate form.

- Choose the formatting of your record and acquire it in your device.

- Make modifications in your record if needed. You can full, revise and indicator and printing New Hampshire Debt Conversion Agreement with exhibit A only.

Download and printing a large number of record themes while using US Legal Forms Internet site, that provides the largest collection of legitimate types. Use skilled and status-specific themes to deal with your business or personal demands.

Form popularity

FAQ

With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

A debt/equity swap is a refinancing deal in which a debt holder gets an equity position in exchange for the cancellation of the debt. The swap is generally done to help a struggling company continue to operate. The logic behind this is an insolvent company cannot pay its debts or improve its equity standing.

Immediately after the issuance of any senior security representing indebtedness (as determined pursuant to the Investment Company Act), and after giving pro forma effect thereto and the application of the proceeds thereof, the Company will not permit the Debt to Equity Ratio, to be greater than 1.65 to 1.00.

Key Takeaways The ratio at which debt is exchanged for equity can vary, with more favorable ratios making the swap more enticing. Advantages include cost-effective financing and reputation preservation, while disadvantages include loss of control and potential financial instability.

Section 62 (3) of the Companies Act, 2013 provides Companies with the opportunity to convert their loan into equity, provided that the loan has a feature allowing it to be transformed into equity at a future date, and this feature has been approved by shareholders through a special resolution.

The accounting treatment of debt-equity swap involves debiting the entire debt component of the business, which is earmarked for swap purposes,s and crediting the same into a new equity issue account. This journal entry extinguishes the debt liability and generation of equity capital.

An equity swap is an exchange of future cash flows between two parties that allows each party to diversify its income for a specified period of time while still holding its original assets.

In the case of an equity-for-debt swap, all specified shareholders are given the right to exchange their stock for a predetermined amount of debt in the same company. Bonds are usually the type of debt that is offered.