New Hampshire Approval of authorization of preferred stock

Description

How to fill out Approval Of Authorization Of Preferred Stock?

Have you been within a situation that you will need paperwork for sometimes business or person purposes almost every working day? There are plenty of lawful document themes available online, but locating ones you can trust isn`t simple. US Legal Forms provides a large number of form themes, like the New Hampshire Approval of authorization of preferred stock, that are published to satisfy federal and state specifications.

When you are currently familiar with US Legal Forms internet site and get an account, simply log in. After that, you can acquire the New Hampshire Approval of authorization of preferred stock design.

Unless you offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is to the correct area/county.

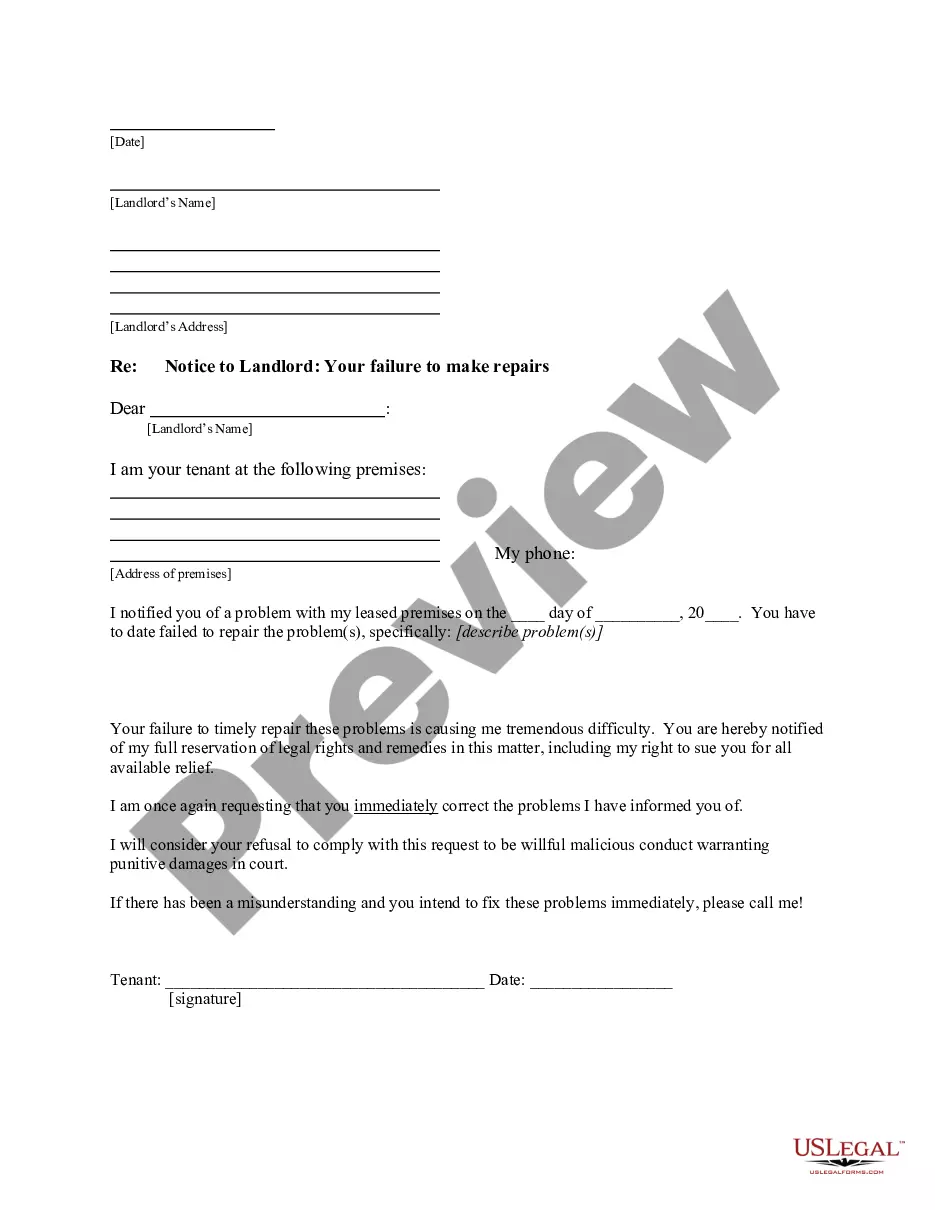

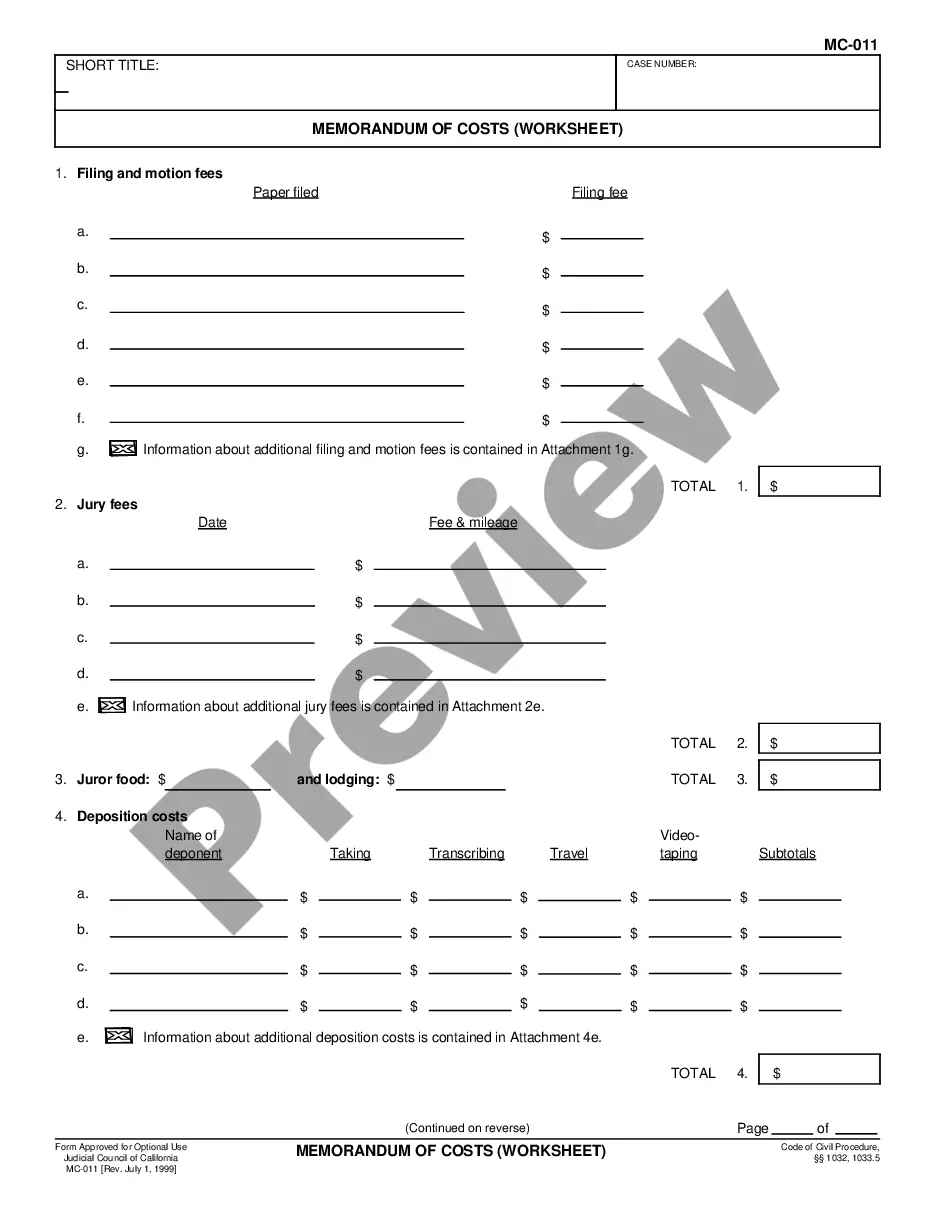

- Take advantage of the Review button to analyze the form.

- Browse the description to ensure that you have selected the right form.

- When the form isn`t what you are looking for, take advantage of the Lookup discipline to obtain the form that meets your requirements and specifications.

- Once you find the correct form, just click Get now.

- Opt for the pricing plan you want, fill out the necessary information to create your account, and pay money for an order with your PayPal or Visa or Mastercard.

- Choose a hassle-free data file file format and acquire your duplicate.

Discover all the document themes you might have bought in the My Forms menus. You can get a extra duplicate of New Hampshire Approval of authorization of preferred stock whenever, if necessary. Just go through the required form to acquire or produce the document design.

Use US Legal Forms, probably the most comprehensive selection of lawful kinds, to conserve some time and stay away from errors. The services provides professionally produced lawful document themes that can be used for a variety of purposes. Generate an account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. Companies issuing preferreds may have more than one offering for you to vet. Often you may find several different offerings of preferreds from the same issuer but with different yields.

Most notably, shareholders must approve the issuance of common stock, exceeding 1% of the total number of shares or 1% of the outstanding voting power, to related parties. Related parties include directors, officers, 5% or greater shareholders, subsidiaries, and other persons with a substantial interest in the company.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ...

To start a corporation in New Hampshire, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Corporation Division. You can file this document online or by mail. The articles cost $100 to file.