New Hampshire Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005

Description

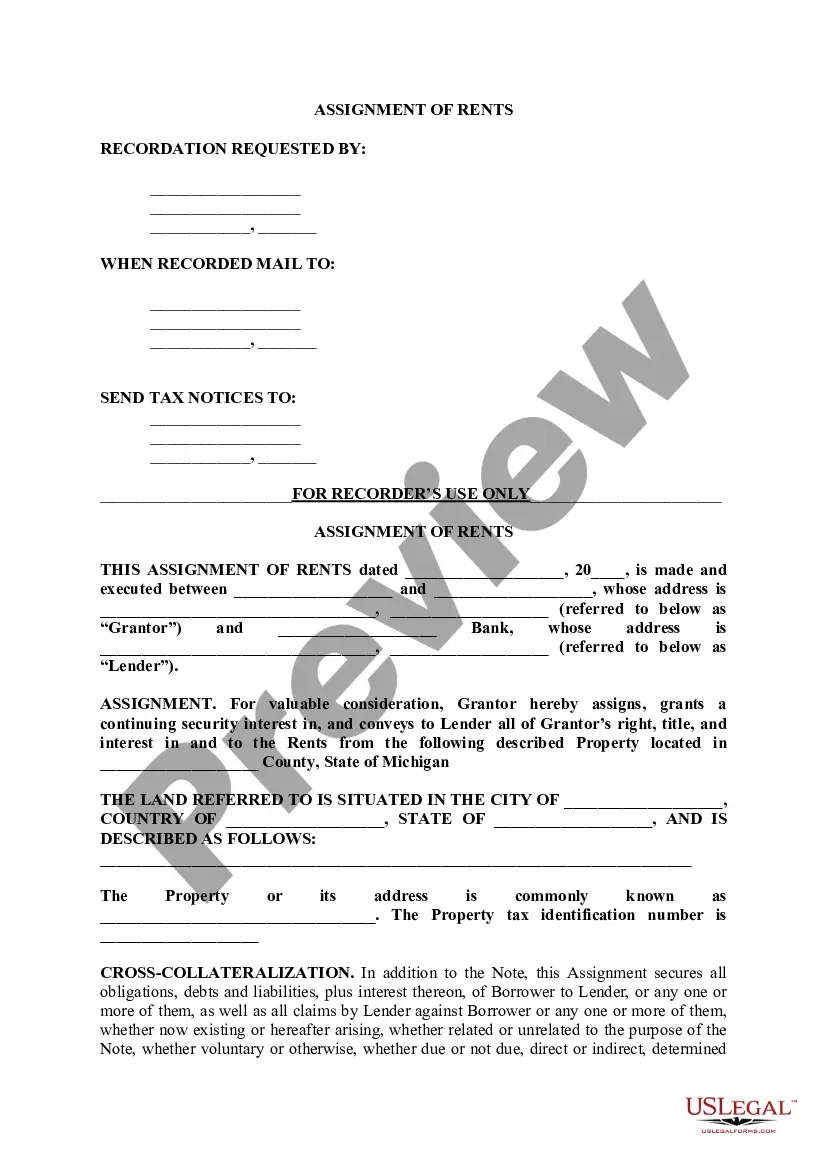

How to fill out Declaration Under Penalty Of Perjury On Behalf Of A Corporation Or Partnership - Form 2 - Pre And Post 2005?

Finding the right legitimate document template can be quite a have a problem. Naturally, there are tons of layouts accessible on the Internet, but how will you get the legitimate type you require? Use the US Legal Forms web site. The assistance provides a huge number of layouts, such as the New Hampshire Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005, which can be used for organization and private demands. All of the kinds are examined by professionals and meet up with state and federal requirements.

When you are previously listed, log in in your bank account and click on the Acquire key to find the New Hampshire Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005. Make use of your bank account to look through the legitimate kinds you possess ordered earlier. Proceed to the My Forms tab of your own bank account and obtain an additional copy of the document you require.

When you are a fresh user of US Legal Forms, here are straightforward guidelines so that you can follow:

- Initial, make sure you have selected the correct type for your personal city/county. You may examine the form while using Preview key and browse the form outline to make certain it is the right one for you.

- In case the type fails to meet up with your preferences, use the Seach discipline to get the correct type.

- When you are positive that the form would work, select the Get now key to find the type.

- Select the costs strategy you want and type in the required information and facts. Build your bank account and pay for an order with your PayPal bank account or bank card.

- Pick the data file formatting and down load the legitimate document template in your system.

- Comprehensive, revise and print and indicator the obtained New Hampshire Declaration under penalty of perjury on behalf of a corporation or partnership - Form 2 - Pre and Post 2005.

US Legal Forms will be the most significant catalogue of legitimate kinds that you will find a variety of document layouts. Use the company to down load skillfully-made papers that follow state requirements.

Form popularity

FAQ

A declaration under penalty of perjury typically follows such language: ?I declare (or certify, verify, or state) under penalty of perjury under the laws of the United States of America that the foregoing is true and correct.?

The purpose of the notarial act of taking an affidavit is to have an individual make a statement under penalty of perjury by personally swearing to or affirming the statement.