Wisconsin Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor

Description

How to fill out Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor?

Are you presently inside a position where you need files for sometimes business or person purposes just about every day time? There are tons of legal file layouts available on the Internet, but locating kinds you can rely isn`t easy. US Legal Forms offers 1000s of form layouts, much like the Wisconsin Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor, that are published to meet federal and state requirements.

In case you are previously knowledgeable about US Legal Forms web site and also have a merchant account, merely log in. Following that, you can down load the Wisconsin Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor web template.

Should you not provide an account and would like to start using US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for your right city/state.

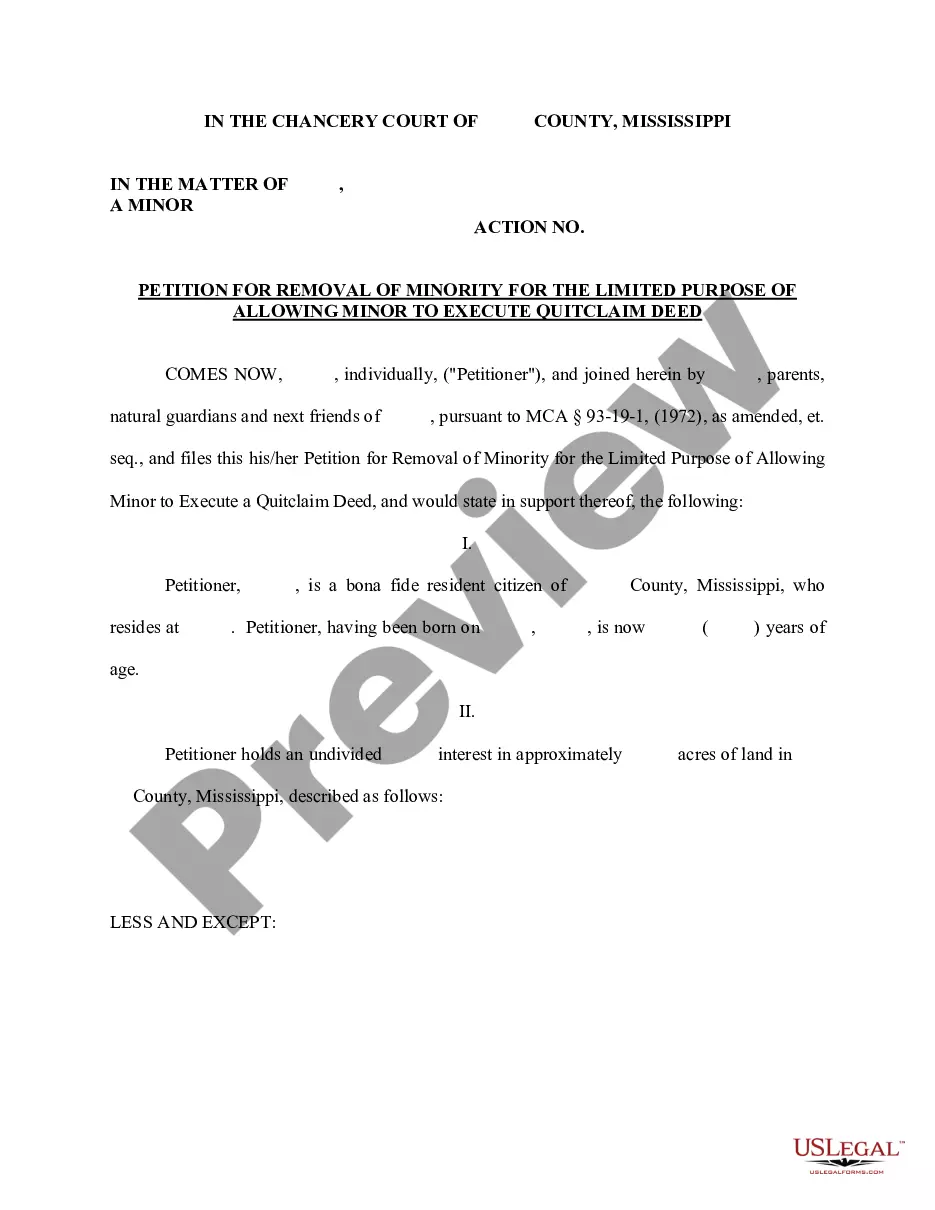

- Utilize the Preview switch to review the shape.

- See the information to ensure that you have selected the correct form.

- If the form isn`t what you are searching for, make use of the Lookup industry to obtain the form that suits you and requirements.

- If you find the right form, just click Buy now.

- Opt for the prices strategy you need, submit the desired information to produce your bank account, and pay money for an order using your PayPal or Visa or Mastercard.

- Choose a handy document file format and down load your backup.

Find all of the file layouts you have purchased in the My Forms menus. You may get a more backup of Wisconsin Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor at any time, if possible. Just click on the required form to down load or print out the file web template.

Use US Legal Forms, the most considerable selection of legal forms, to save lots of efforts and avoid faults. The support offers appropriately made legal file layouts that can be used for a selection of purposes. Generate a merchant account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

Jury instructions are given to the jury by the judge, who usually reads them aloud to the jury. The judge issues a judge's charge to inform the jury how to act in deciding a case. The jury instructions provide something of a flowchart on what verdict jurors should deliver based on what they determine to be true.

Judge's Instructions on the Law Either before or after the closing arguments by the lawyers, the judge will explain the law that applies to the case to you. This is the judge's instruction to the jury.

At the end of a trial, the judge instructs the jury on the applicable law. While the jury must obey the judge's instructions as to the law, the jury alone is responsible for determining the facts of the case from the differing versions presented by the parties at trial.

If the jury is allowed to separate (leave the courthouse) during deliberation, the judge will have the jury come to the box and will instruct them regarding the separation. In a criminal case, the bailiff should check with the judge about whether the defendant should be present.

After the closing arguments, the judge will give the jury its final instructions. Both sides may contest the content of those instructions because they can have an enormous effect on the jury's verdict. During deliberations, the jurors may have questions about the evidence or the instructions.