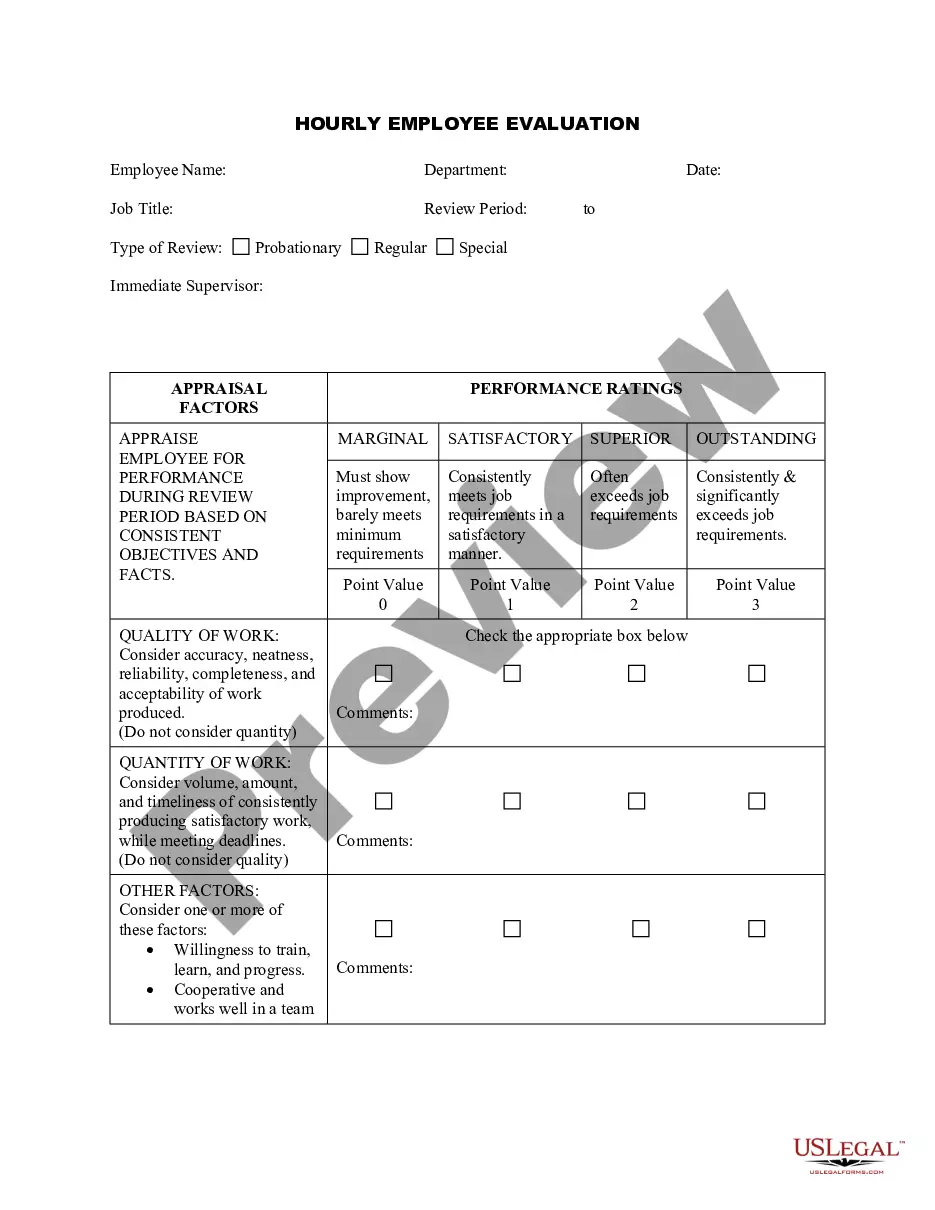

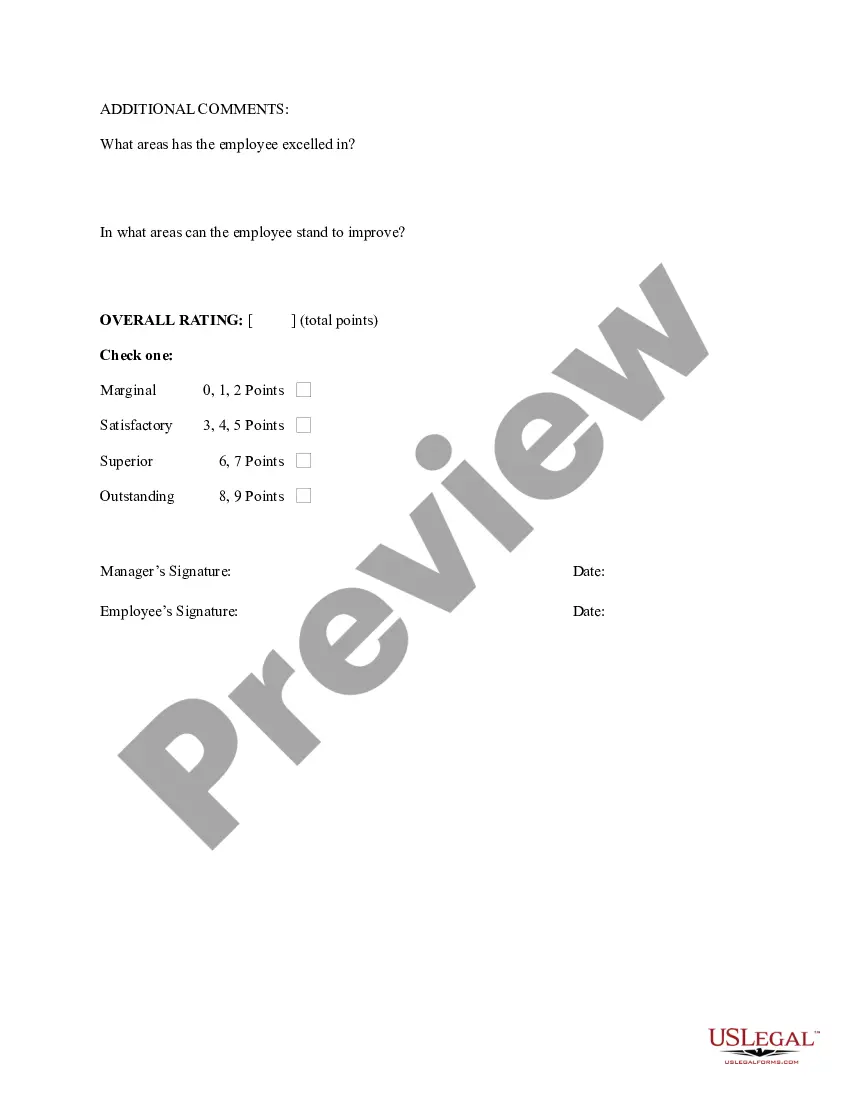

New Hampshire Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

Finding the appropriate valid document template can be challenging. Naturally, there are numerous templates accessible online, but how do you locate the valid form you require? Visit the US Legal Forms website.

The service offers thousands of templates, such as the New Hampshire Hourly Employee Evaluation, that you can utilize for professional and personal purposes. All forms are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to download the New Hampshire Hourly Employee Evaluation. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section in your account and obtain another copy of the document you need.

Complete, edit, print, and sign the acquired New Hampshire Hourly Employee Evaluation. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to download properly crafted paperwork that comply with state regulations.

- If you are a new user of US Legal Forms, follow these simple steps.

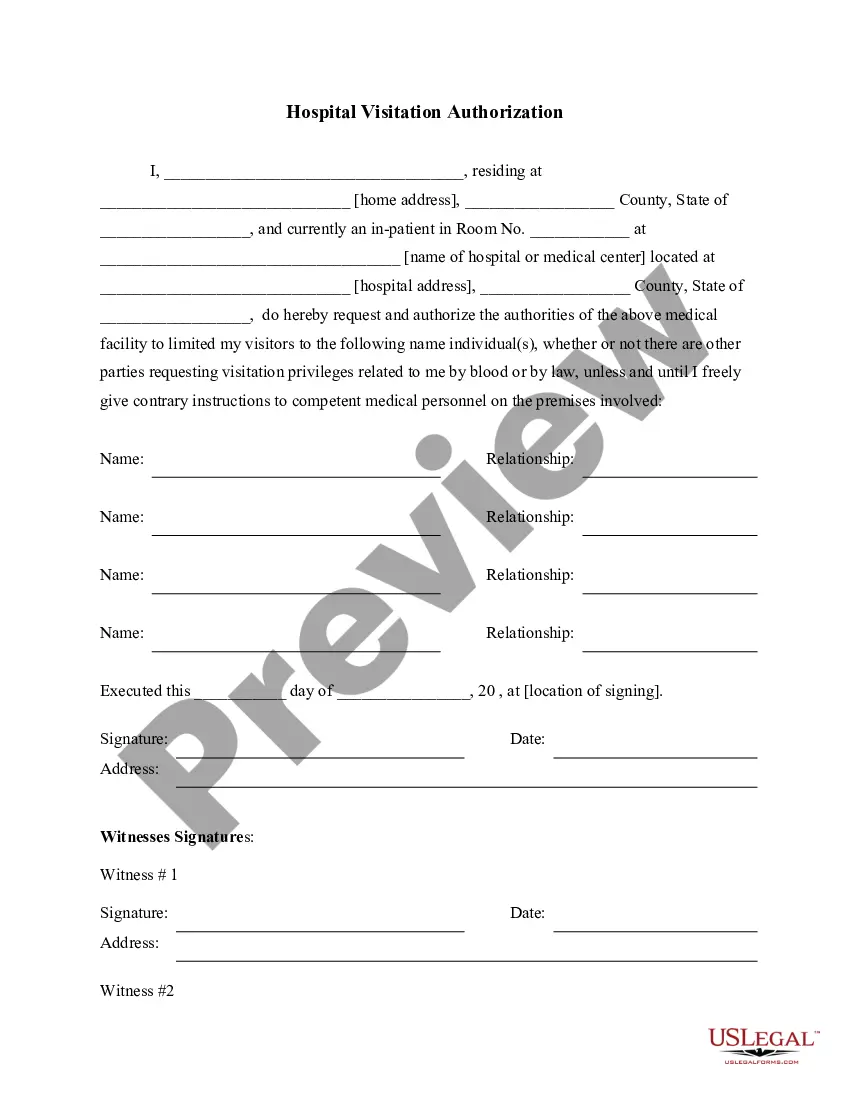

- First, ensure you have selected the correct form for your area/state. You can browse the form using the Preview button and review the form summary to verify it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are confident the form is correct, click the Purchase now button to acquire the form.

- Choose the pricing plan you wish and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

The FLSA exempts employees from the minimum wage and overtime requirements who are paid a salary of not less than $455 per week, or $23,660 per year, and who are employed in a bona fide executive, administrative, professional, certain computer professions or creative professions, or outside sales capacity as defined

Most employers generally agree that full-time work is anything around 35 hours and above. However, there's actually no official amount of hours which classifies a job as being full-time, and it could drop as low as 30 hours per week for some roles (which is why this is often considered the minimum).

Full-Time Job vs. Part-time employees typically work less than 32 hours per week, full-time is usually 32-40. Part-time employees are usually offered limited benefits and health care. Often a part-time employee is not eligible for paid time off, healthcare coverage, or paid sick leave.

Official employer designations regarding full-time employment generally range from 35 to 45 hours, with 40 hours being by far the most common standard. Some companies consider 50 hours a week full-time for exempt employees.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

If your employer violates minimum wage laws, you can recover the money you are owed in a wage and hour lawsuit or a wage and hour class action lawsuit. In 2022, the statewide minimum wage in California is $15.00 per hour (or $14.00 per hour for employers with 25 or fewer employees).

There is no legally defined number of hours for full time employment, where individual employers can decide how many hours per week are to be considered full time. The hours that workers are expected to work will usually be set out in the company working hours policy and/or within individual contracts of employment.

Employees who usually work more than 35 hours per week (at all jobs within an establishment) regardless of the number of hours actually worked. Persons who were at work for 35 hours or more during the survey reference week are designated as working full time.

An employer cannot usually impose a pay cut unilaterally on employees. However, there are situations where this may be possible for example, the right to reduce their remuneration package may be covered in the employment contract.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.