New Hampshire Performance Evaluation for Exempt Employees

Description

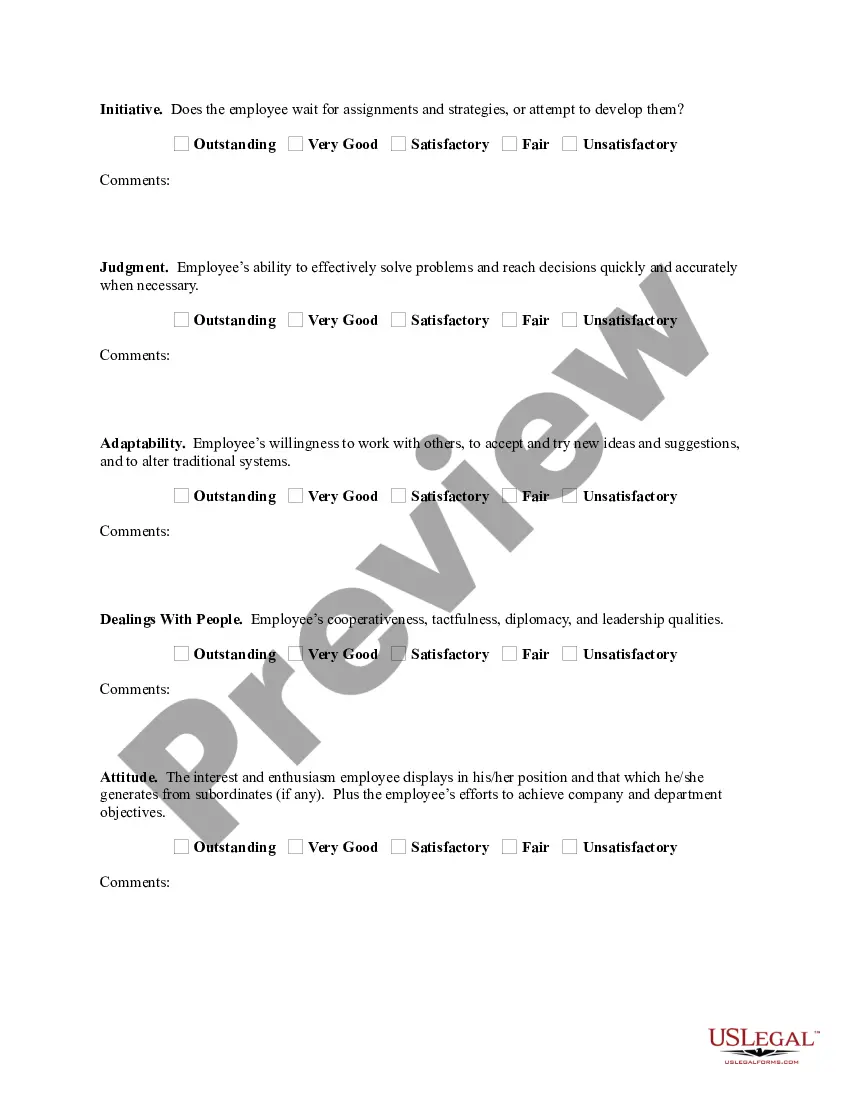

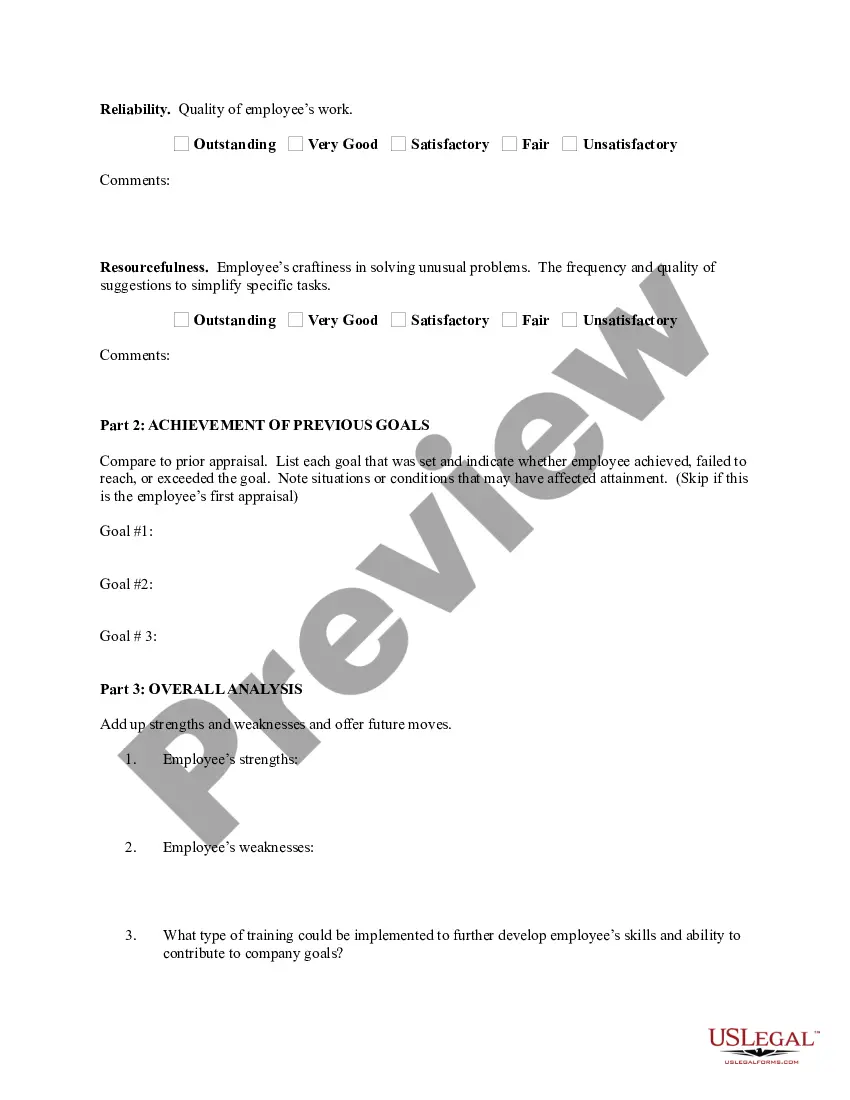

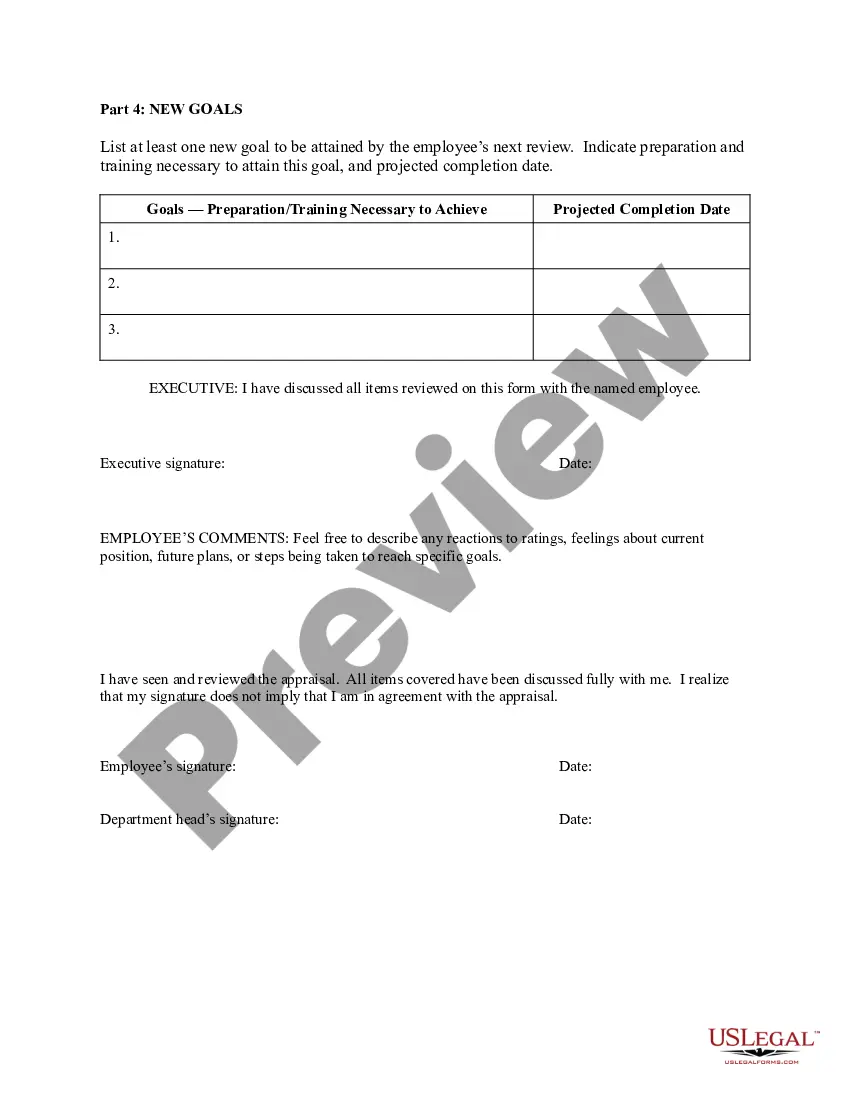

How to fill out Performance Evaluation For Exempt Employees?

Are you in a situation where you will require documents for occasional business or specific reasons almost every workday.

There are many authorized document templates accessible online, but finding versions you can rely on is challenging.

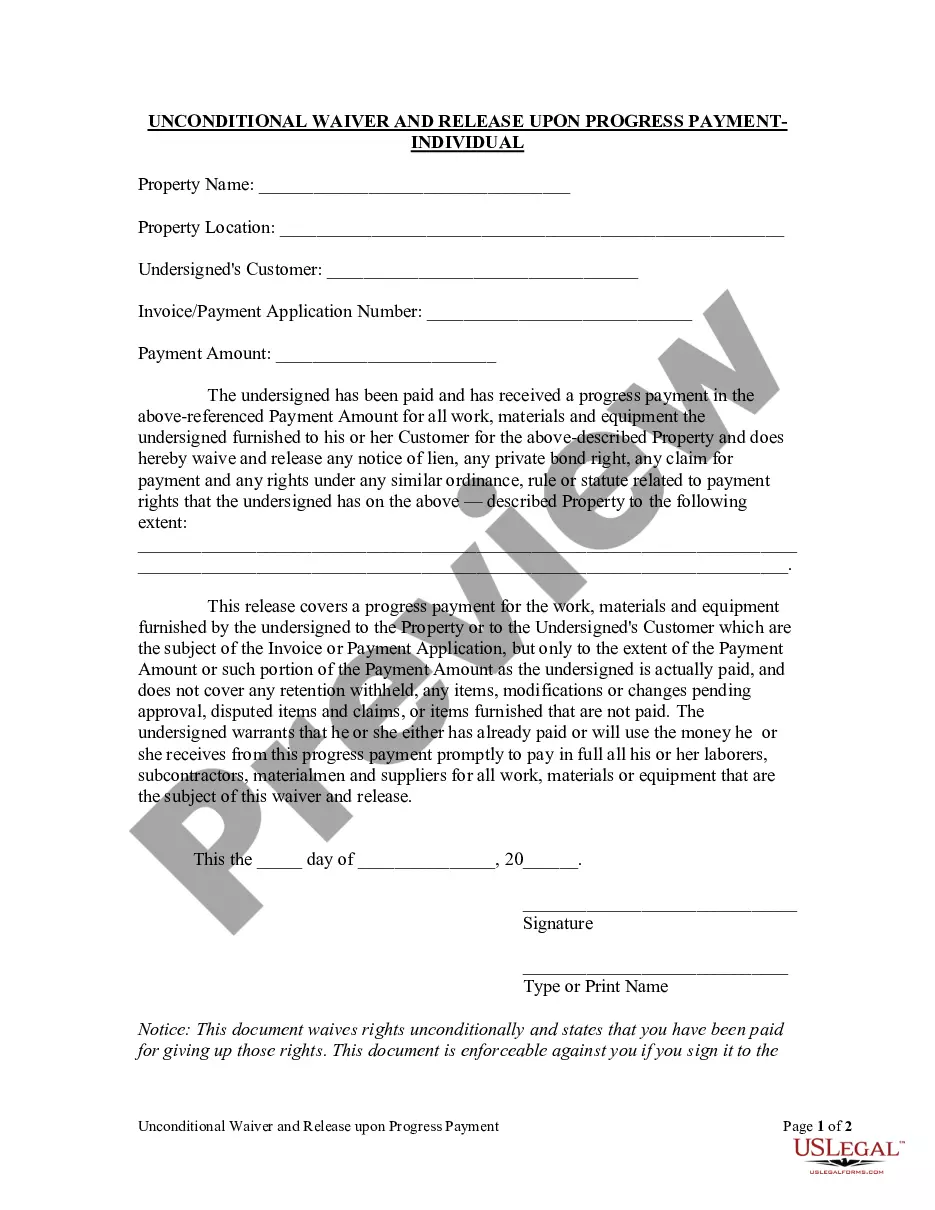

US Legal Forms offers a wide array of form templates, including the New Hampshire Performance Evaluation for Exempt Employees, that are designed to meet state and federal regulations.

When you locate the right form, click Purchase now.

Select the payment plan you want, provide the necessary information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the New Hampshire Performance Evaluation for Exempt Employees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Review option to examine the document.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

The FLSA exempts employees from the minimum wage and overtime requirements who are paid a salary of not less than $455 per week, or $23,660 per year, and who are employed in a bona fide executive, administrative, professional, certain computer professions or creative professions, or outside sales capacity as defined

10 Easy Ways to Evaluate an Employee's PerformanceLevel of execution.Quality of work.Level of creativity.Amount of consistent improvement.Customer and peer feedback.Sales revenue generated.Responsiveness to feedback.Ability to take ownership.More items...

A salaried employee must be paid their full salary for any pay period in which the employee performs any work, regardless of the number of days or hours worked, except for the following instances: Any pay period in which the employee performs no work.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

As a general rule, most companies conduct performance reviews every 3-6 months. This keeps employees' focused and motivated, and ensures feedback is relevant and timely.

Why Employers Use Employee Evaluations Regular employee evaluation helps remind workers what their managers expect in the workplace. They provide employers with information to use when making employment decisions, such as promotions, pay raises, and layoffs.

In an employee performance review, managers evaluate that individual's overall performance, identify their strengths and weaknesses, offer feedback, and help them set goals. Employees typically have the opportunity to ask questions and share feedback with their manager as well.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

New Hampshire is an at-will state, which means employers can generally fire their employees at any time and for any reasonwith some important exceptions. Note that the state's at-will laws do not apply to union employees or those working on employment contracts.