New Hampshire Confirmation of Orally Accepted Employment Offer from Company to Applicant - Exempt Position

Description

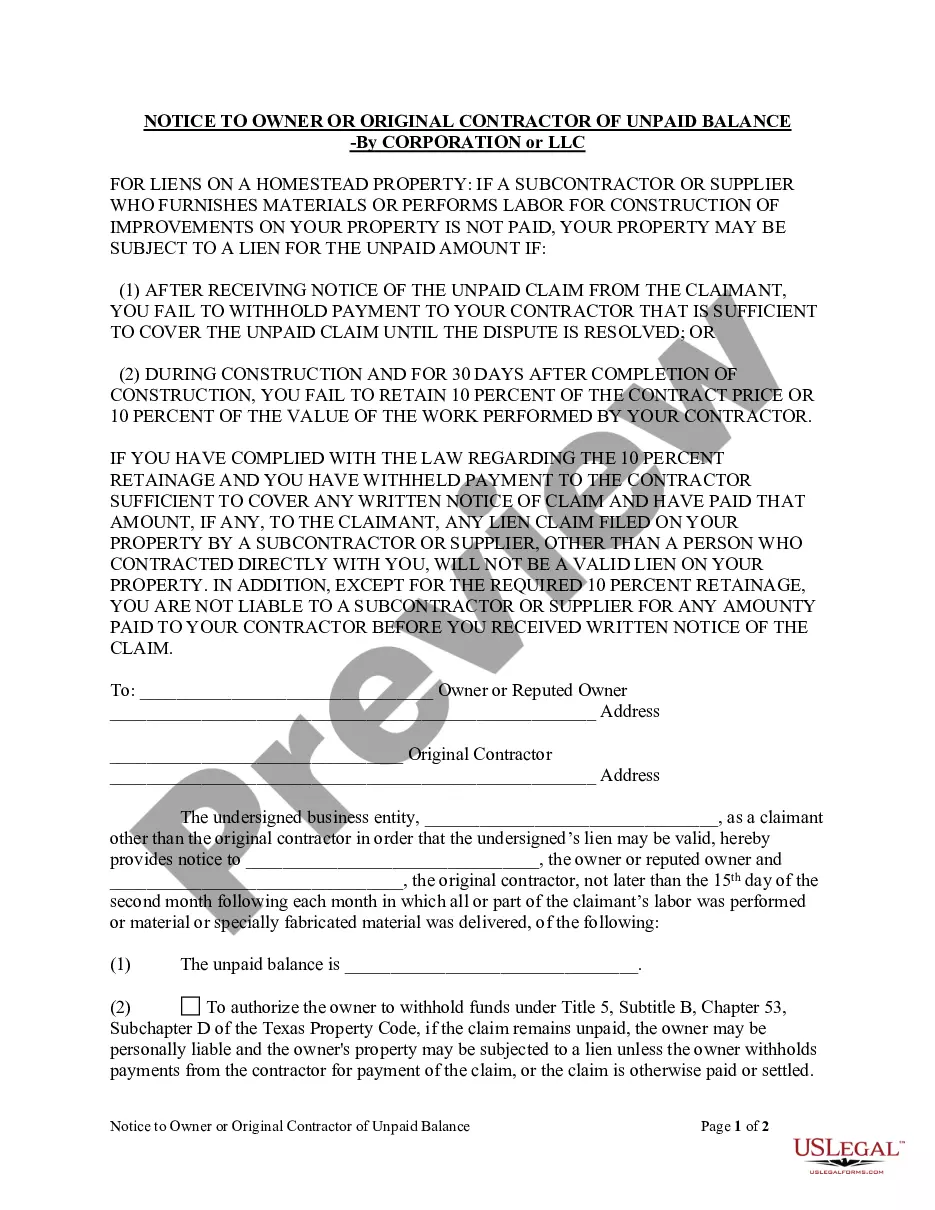

How to fill out Confirmation Of Orally Accepted Employment Offer From Company To Applicant - Exempt Position?

Are you presently at the location where you need documentation for either business or personal use nearly every day.

There is a plethora of legitimate document templates available online, but finding reliable forms to trust is not simple.

US Legal Forms offers thousands of document templates, including the New Hampshire Confirmation of Orally Accepted Employment Offer from Company to Applicant - Exempt Position, which can be crafted to meet state and federal requirements.

Once you obtain the right document, click Get now.

Choose the payment plan you need, fill in the required details to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have acquired in the My documents menu. You can download an additional copy of New Hampshire Confirmation of Orally Accepted Employment Offer from Company to Applicant - Exempt Position at any time, if needed. Simply click the desired document to download or print the file template. Use US Legal Forms, the most extensive selection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Confirmation of Orally Accepted Employment Offer from Company to Applicant - Exempt Position template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it corresponds to the right city/region.

- Utilize the Review option to assess the form.

- Check the description to make sure you have selected the correct document.

- If the document is not what you are looking for, use the Search box to find the form that meets your needs and specifications.

Form popularity

FAQ

Form 1099Gs issued from 2009 through 2020 are available online by logging into the unemployment benefit system and going to your correspondence box. If you need a Form 1099G for a year prior to 2009 please contact the Unemployment Hotline at (603) 271-7700 and speak with a customer service representative.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.

The FLSA exempts employees from the minimum wage and overtime requirements who are paid a salary of not less than $455 per week, or $23,660 per year, and who are employed in a bona fide executive, administrative, professional, certain computer professions or creative professions, or outside sales capacity as defined

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

NH employees do not pay any taxes for the unemployment program.

New Hampshire's unemployment tax rates for the third quarter of 2021 are unchanged, the state Employment Security department said July 9. Effective from July 1, 2021, to Sept 30, 2021, tax rates for positive-rated employers range from 0.1% to 2.7% and rates for negative-rated employers range from 4.3% to 8.5%.

And if you're one of the millions of Americans who received unemployment benefits last year, you're probably wondering if you have to pay taxes on those payments. When it comes to federal income taxes, the general answer is yes.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

You will receive a 1099G if the total amount of Unemployment Benefits paid to you during calendar year 2021 is at least $10. Additionally, a separate 1099G will be issued to all claimants paid a Summer Stipend Bonus during the 2021 calendar year.

If you have a firm start work date and can provide your NH Works Office with a letter or contact name and phone number that can confirm your start work date, your work search requirement may be waived for up to four (4) weeks.