Wisconsin Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

If you want to total, acquire, or produce legitimate document layouts, use US Legal Forms, the biggest selection of legitimate varieties, that can be found on the Internet. Make use of the site`s simple and handy research to get the paperwork you require. Numerous layouts for enterprise and individual reasons are categorized by categories and says, or search phrases. Use US Legal Forms to get the Wisconsin Loan Commitment Agreement Letter within a handful of click throughs.

If you are already a US Legal Forms customer, log in to the profile and click on the Download option to get the Wisconsin Loan Commitment Agreement Letter. You can even gain access to varieties you formerly saved within the My Forms tab of your profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate town/country.

- Step 2. Use the Review option to look over the form`s content. Never forget to see the description.

- Step 3. If you are unsatisfied using the develop, make use of the Search industry towards the top of the monitor to locate other versions from the legitimate develop format.

- Step 4. Once you have identified the form you require, click the Buy now option. Choose the pricing plan you prefer and put your credentials to register to have an profile.

- Step 5. Method the transaction. You may use your credit card or PayPal profile to complete the transaction.

- Step 6. Choose the format from the legitimate develop and acquire it in your system.

- Step 7. Full, change and produce or indicator the Wisconsin Loan Commitment Agreement Letter.

Every legitimate document format you purchase is your own permanently. You may have acces to every develop you saved with your acccount. Click on the My Forms section and select a develop to produce or acquire again.

Remain competitive and acquire, and produce the Wisconsin Loan Commitment Agreement Letter with US Legal Forms. There are many skilled and state-particular varieties you may use for the enterprise or individual demands.

Form popularity

FAQ

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met.

How long does it take to get a loan commitment letter? It varies, but receiving a mortgage commitment letter generally takes three to six weeks. Once you submit your application with all required documents, an appraisal can be ordered, and the loan file can be processed.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.

To obtain a conditional or final commitment letter, you'll need to go through your chosen lender's mortgage preapproval process. Doing so may require you to provide documentation such as pay stubs, bank statements, and other materials that provide proof of employment and earnings.

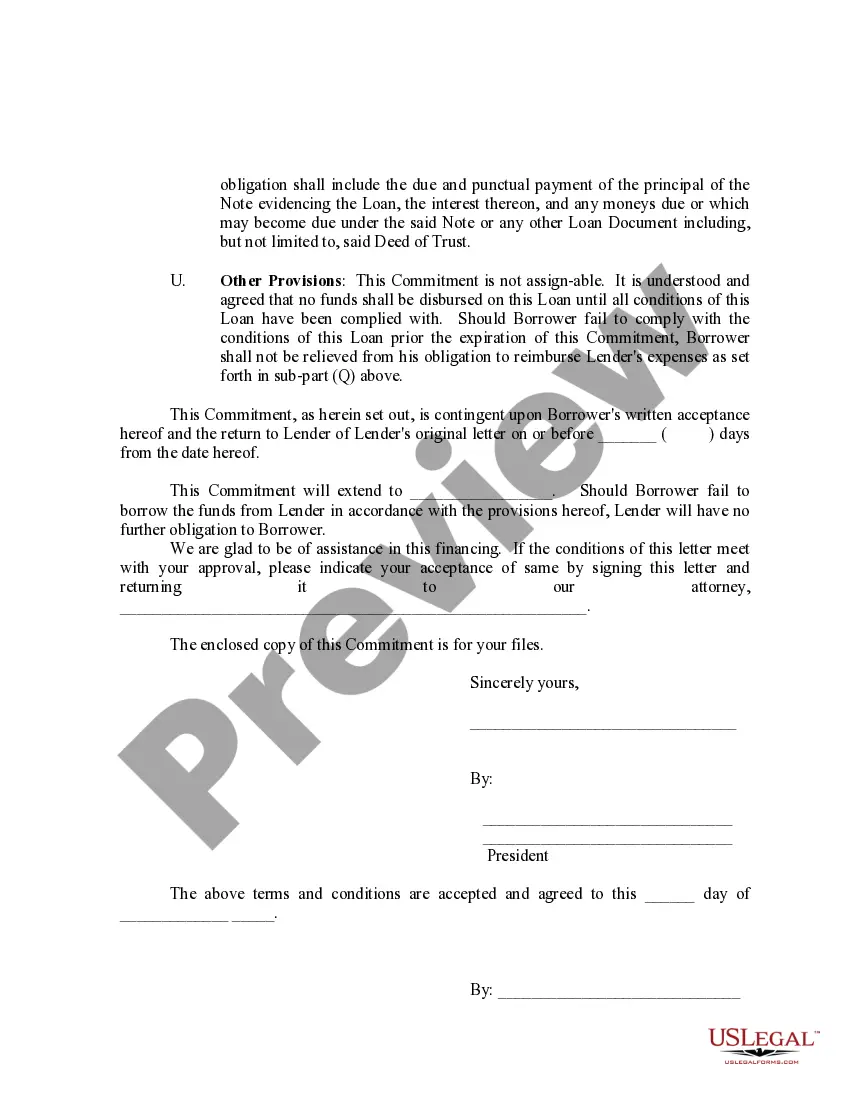

A letter agreement in which a lender sets out the terms on which it is prepared to lend money to the borrower. It is generally accompanied by a term sheet which sets out the terms of the loan.

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

How Long Does it Take to Get a Mortgage Commitment Letter? Exactly when you'll receive the letter varies, but it typically takes between 20 and 45 days. The commitment letter is issued after you submit your application with all the required documents, such as pay stubs, bank statements, etc.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.