Virgin Islands Loan Commitment Agreement Letter

Description

How to fill out Loan Commitment Agreement Letter?

You may devote hours on-line looking for the legal file web template that meets the state and federal needs you will need. US Legal Forms offers 1000s of legal varieties which are examined by pros. You can actually obtain or printing the Virgin Islands Loan Commitment Agreement Letter from the support.

If you have a US Legal Forms profile, you can log in and click on the Obtain key. Afterward, you can total, modify, printing, or sign the Virgin Islands Loan Commitment Agreement Letter. Every single legal file web template you buy is your own property eternally. To acquire another backup of the purchased type, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms site for the first time, keep to the simple recommendations below:

- Very first, ensure that you have chosen the proper file web template for that region/metropolis of your choice. Look at the type description to make sure you have selected the appropriate type. If accessible, take advantage of the Preview key to search with the file web template as well.

- If you would like locate another model in the type, take advantage of the Lookup area to obtain the web template that meets your requirements and needs.

- When you have found the web template you need, simply click Purchase now to continue.

- Select the pricing strategy you need, key in your accreditations, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You should use your credit card or PayPal profile to purchase the legal type.

- Select the file format in the file and obtain it to the gadget.

- Make adjustments to the file if required. You may total, modify and sign and printing Virgin Islands Loan Commitment Agreement Letter.

Obtain and printing 1000s of file layouts using the US Legal Forms website, which offers the biggest variety of legal varieties. Use specialist and express-particular layouts to deal with your company or individual needs.

Form popularity

FAQ

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

The final approval usually occurs after all the conditions outlined in the commitment letter have been satisfied. At that point, the lender thoroughly reviews the documentation and confirms that all requirements have been met.

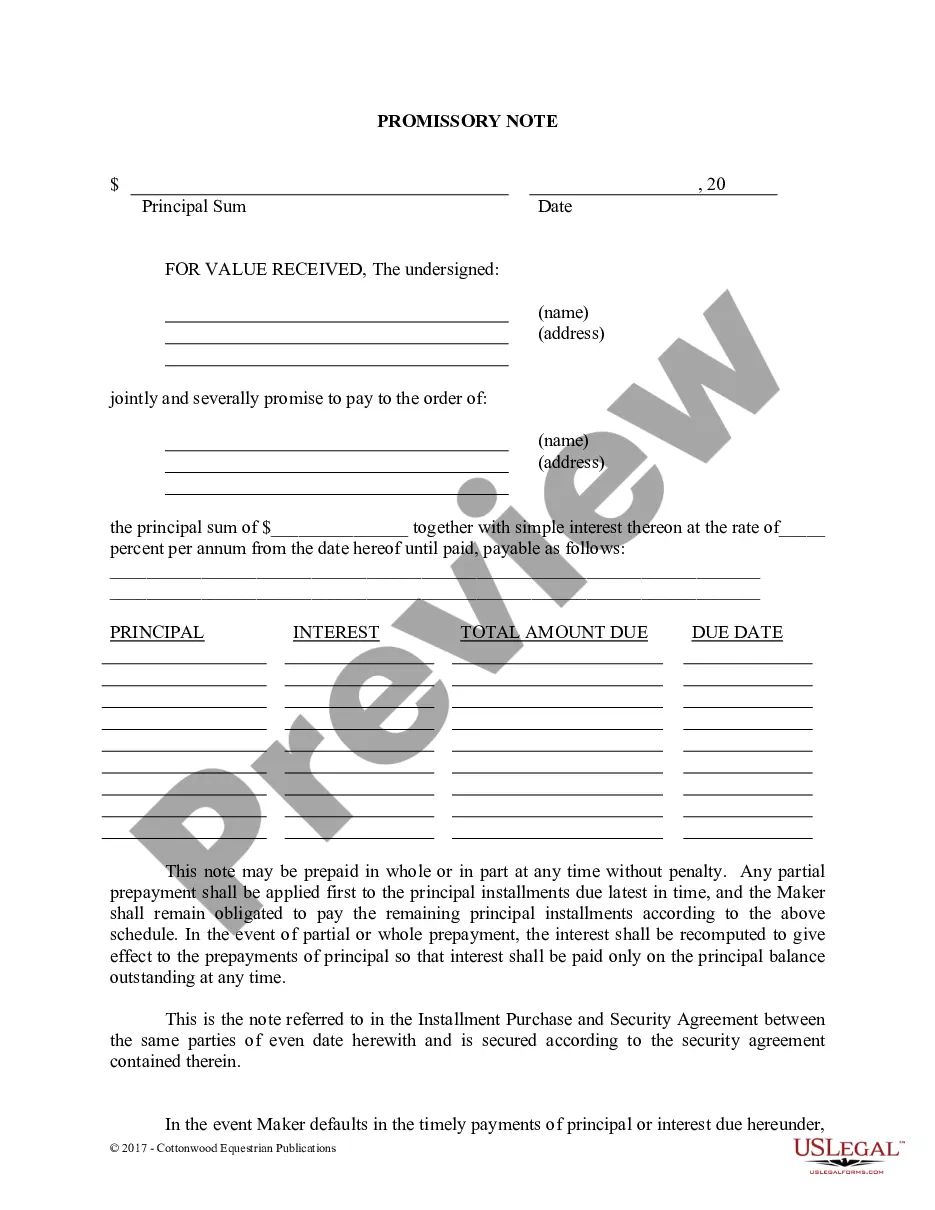

The basic contents of a letter of commitment include the following details: Names and addresses of the borrower and lender. The type of loan applied for. The loan amount. The agreed upon loan repayment period. The interest rate for the loan. Date of lock expiration (if the loan is locked in) for the interest rate.

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met.

While a mortgage commitment letter is an assurance from a lender that they'll loan money to you, receiving the letter only means you've completed the underwriting process for the loan you've requested.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.