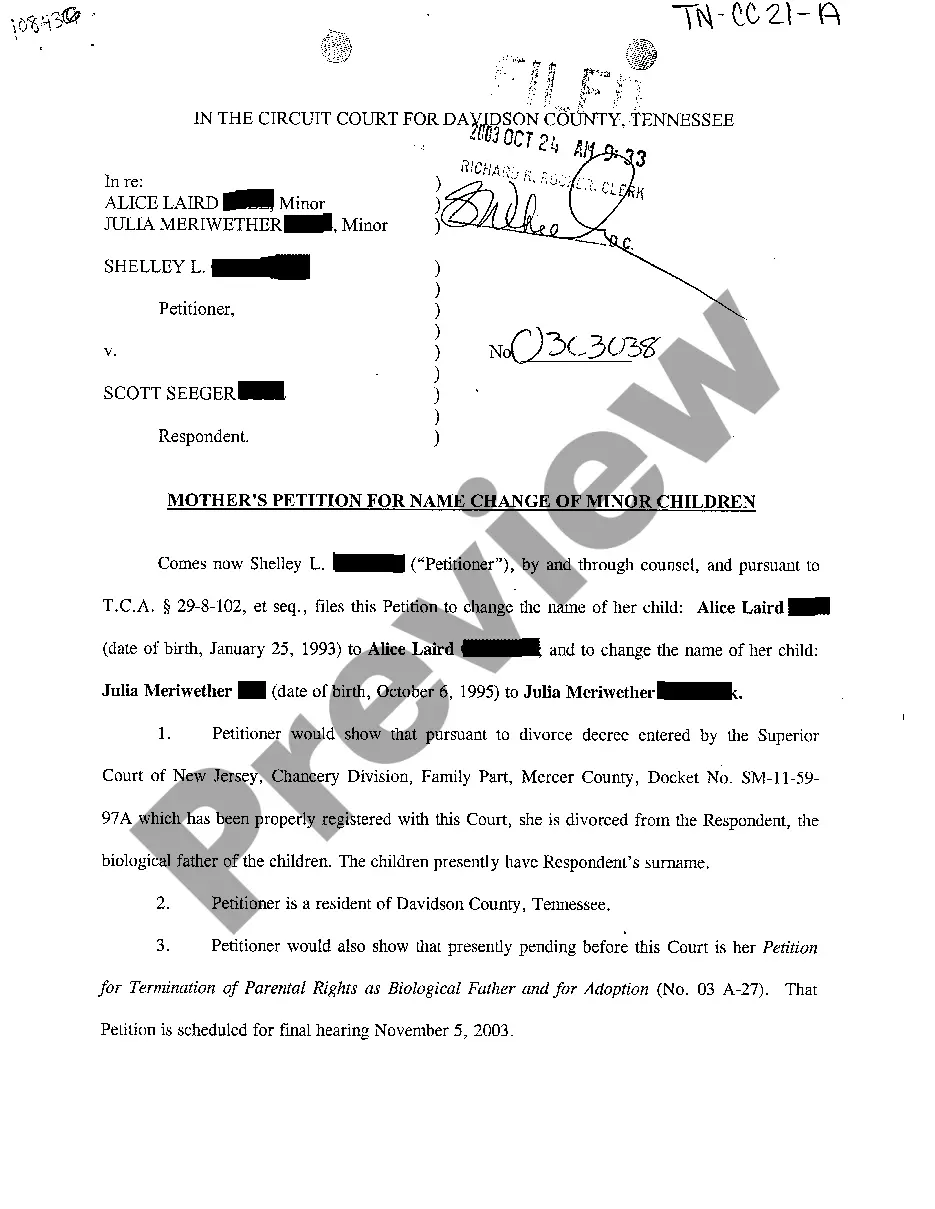

New Hampshire Demand for Payment of Account by Business to Debtor

Description

How to fill out Demand For Payment Of Account By Business To Debtor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the New Hampshire Demand for Payment of Account by Business to Debtor within moments.

If you already possess a subscription, Log In to access the New Hampshire Demand for Payment of Account by Business to Debtor in the US Legal Forms library. The Acquire button will appear on every form you view. You can access all previously purchased forms within the My documents tab of your account.

Process your payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, modify, print, and sign the downloaded New Hampshire Demand for Payment of Account by Business to Debtor. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply navigate to the My documents area and click on the form you desire. Access the New Hampshire Demand for Payment of Account by Business to Debtor with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are some basic instructions to help you get started.

- Ensure you have selected the correct form for your city/region. Click the Review button to check the details of the form.

- Read the form description to verify that you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your information to sign up for an account.

Form popularity

FAQ

A bank account levy allows a creditor to legally take funds from your bank account. When a bank gets notification of this legal action, it will freeze your account and send the appropriate funds to your creditor. In turn, your creditor uses the funds to pay down the debt you owe.

If the debtor does not show up at the hearing, the court may issue a bench warrant for the debtor's arrest. If the debtor shows up, you will have the chance to ask him or her questions about where he or she works and what bank accounts, property, belongings, stocks, or any other assets the debtor may have.

If a Company Goes Bankrupt and Owes Me Money, Can I Collect?Stop Collection Efforts.Review Bankruptcy Documents.Attend Debtor's Initial Examination.File a Proof of Claim.Attend Debtor's Bankruptcy Hearing.Let the Bankruptcy Proceed.07-Jan-2020

Try the following seven tips for getting what's owed you.Be mentally prepared.Follow up.Start by sending a reminder letter.Next, make a phone call.Don't threaten the client or get angry.Take legal action.Consider taking your customer to court or hiring a collection agency.25-Jun-2014

You can use a statutory demand to ask for money you're owed from a person or business. If they ignore the statutory demand or cannot repay the money, you can apply to a court to: make someone bankrupt - if you're owed £5000 or more by an individual, including a sole trader or a member of a partnership.

What follows are some more helpful hints for small business debt collection:Avoid harassing the people that owe you money.Keep phone calls short.Write letters.Get a collection agency to write demand letters.Offer to settle for less than is due.Hire a collection agency.Small claims court.File a lawsuit.15-Feb-2018

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

These 10 steps can help you collect money from late-paying clients:Send Polite Reminders.Pick up the Phone.Go Directly to the Payment Source.Cut off Future Work.Hire a Collection Agency.Take the Client to Small Claims Court.Sue the Client in Superior Court.Go to Arbitration.More items...?28-Mar-2019

The lender can file a civil suit for recovering the money he owed through promissory note or loan agreement. He can do so under Order 37 of CPC which allows the lender to file a summary suit. He can file this suit in any high court, City Civil Court, Magistrate Court, Small Causes Court.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.