New Hampshire Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

In case you require to compile, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the website's straightforward and user-friendly search to find the documents you need. Numerous templates for business and personal purposes are categorized by categories and states, or keywords.

Utilize US Legal Forms to obtain the New Hampshire Request for Evidence of Debt in just a few clicks.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the New Hampshire Request for Evidence of Debt. Each legal document template you obtain is yours forever. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Complete and download, and print the New Hampshire Request for Evidence of Debt with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to locate the New Hampshire Request for Evidence of Debt.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

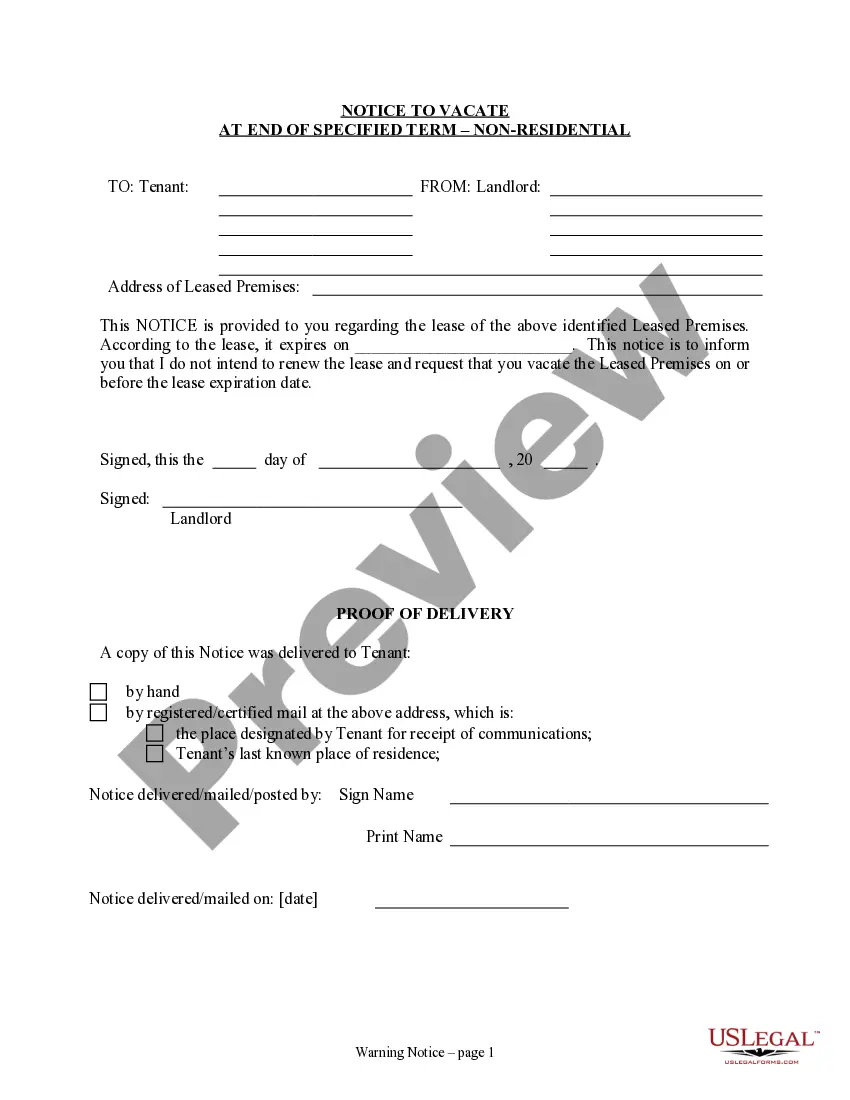

- Step 2. Use the Review option to check the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your credentials to sign up for an account.

Form popularity

FAQ

To write a letter requesting proof of debt, start with your name, address, and date at the top. Follow with the creditor's details and a clear statement requesting verification of the debt. Be sure to specify that this request is part of your New Hampshire Request for Proof of Debt. Using templates from US Legal Forms can simplify this process and help ensure you include all necessary information.

In New Hampshire, the statute of limitations for collecting most debts is typically three years. After this period, creditors can no longer legally enforce the debt, making it uncollectible. However, it's vital to understand that the debt may still impact your credit report. For more information on how this affects your situation, consider the resources available on US Legal Forms regarding your New Hampshire Request for Proof of Debt.

When asking for proof of debt, it's important to be direct and professional. Clearly state your request in writing, including relevant details such as your account number and the amount owed. Emphasizing your rights under the Fair Debt Collection Practices Act can strengthen your request. Utilizing resources from US Legal Forms can help you craft a well-structured letter for your New Hampshire Request for Proof of Debt.

To request proof of debt in New Hampshire, you can start by writing a formal request to the creditor. Include your account details and specify that you are seeking verification as part of your New Hampshire Request for Proof of Debt. Make sure to send the request via certified mail to ensure it is received. By using a clear template from platforms like US Legal Forms, you can streamline this process effectively.

How to Figure Out Your Total Debt BalanceObtain a free copy of your credit report at AnnualCreditReport.com.Make a list of all of the active accounts on your credit report.Call the creditors or sign into your online accounts to find out your current balance.Add up the total amount you owe on each loan.More items...?

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

At a minimum, it must produce: A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you. If the account has been sold to another creditor, then that creditor must prove that it has the right to sue to collect the debt.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter. If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days.