New Hampshire Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

If you want to thorough, obtain, or create valid document templates, utilize US Legal Forms, the leading assortment of legal forms, accessible online.

Employ the site’s straightforward and user-friendly search to discover the documents you need.

Various templates for commercial and personal purposes are categorized by categories and titles, or keywords.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the New Hampshire Demand for Collateral by Creditor. Each legal document template you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Visit the My documents section and choose a form to print or download again. Obtain and produce the New Hampshire Demand for Collateral by Creditor with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal requirements.

- Use US Legal Forms to locate the New Hampshire Demand for Collateral by Creditor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the New Hampshire Demand for Collateral by Creditor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

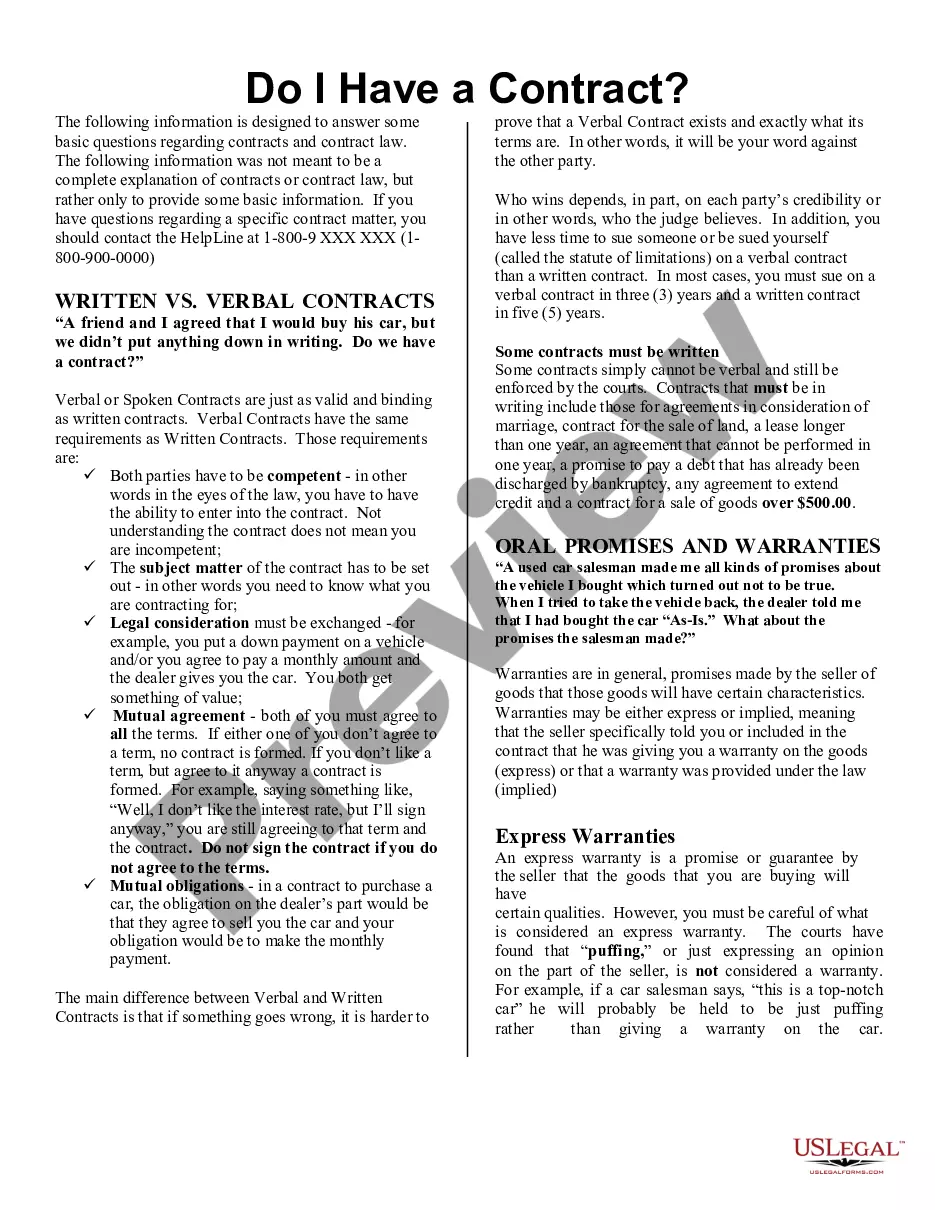

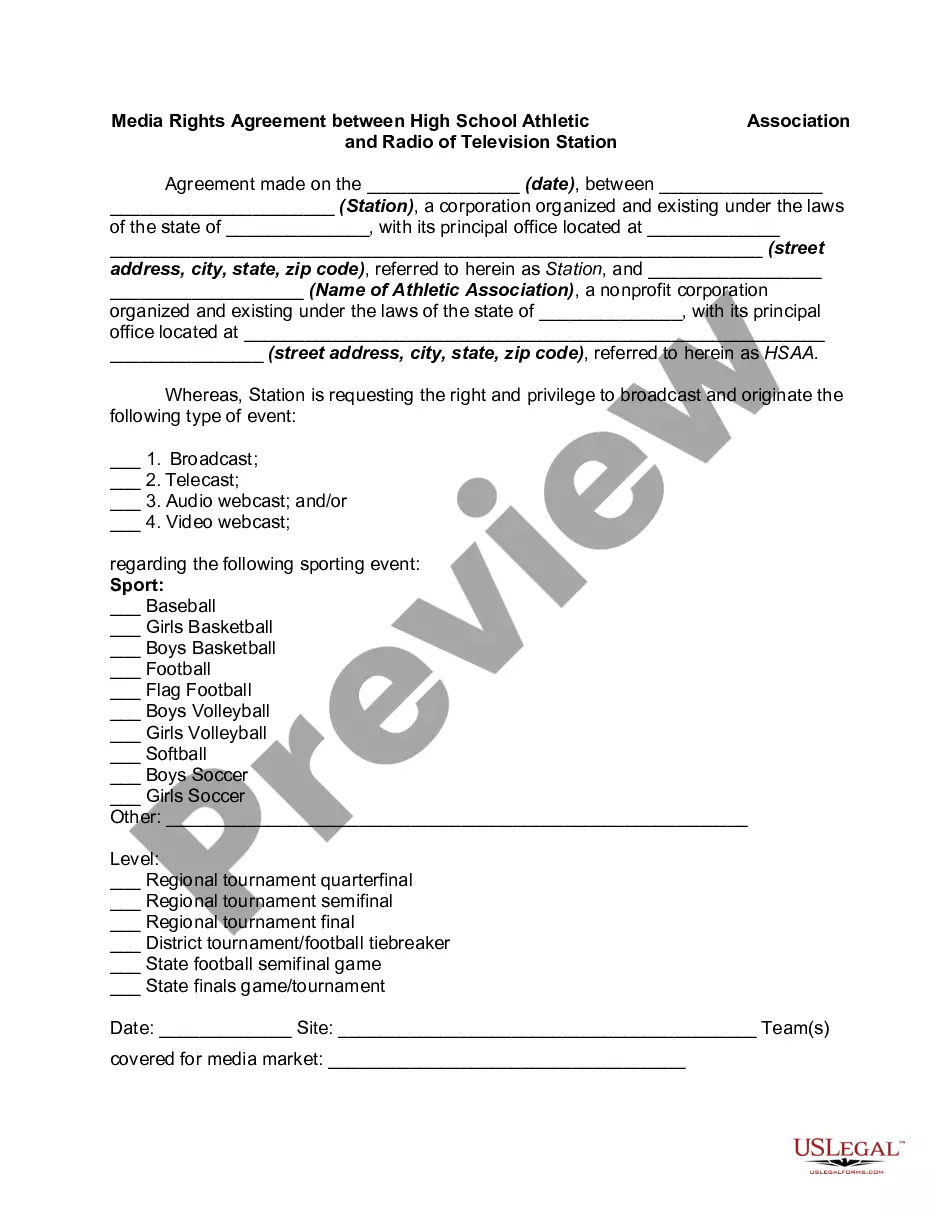

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other variations within the legal form template.

- Step 4. Once you have identified the form you need, click on the Buy now button. Choose the pricing plan you prefer and input your details to register for an account.

Form popularity

FAQ

The process where a creditor takes possession of collateral is known as repossession. This action typically occurs after the debtor has failed to meet the obligations outlined in the security agreement. In the context of a New Hampshire Demand for Collateral by Creditor, understanding the repossession process is crucial for both lenders and borrowers. Platforms like USLegalForms can provide guidance and templates to navigate these legalities effectively.

When a UCC is filed, it officially puts other creditors on notice regarding the secured interest in the collateral described in the filing. It establishes the creditor's right to the specified asset in case of default. In situations involving a New Hampshire Demand for Collateral by Creditor, filing a UCC can protect the creditor's interests in the collateral.

The duration of a UCC search can vary depending on the state’s resources and the search's complexity. In New Hampshire, a typical UCC search usually takes a few hours to a couple of days. By utilizing a service like USLegalForms, you can streamline the process and get timely results when dealing with a New Hampshire Demand for Collateral by Creditor.

A UCC search reveals the secured interests in personal property that creditors may have against a debtor. It provides details on any existing financing statements filed under the Uniform Commercial Code. If you are looking into a New Hampshire Demand for Collateral by Creditor, this search can help you identify any claims against assets before proceeding.

Debts in New Hampshire are typically uncollectible after a six-year period, as set by the statute of limitations. If you have fallen behind on payments, understanding this timeframe can ease some financial stress. Initiating communication with creditors before this time expires is vital. The New Hampshire Demand for Collateral by Creditor can clarify your options and help you negotiate better terms.

You can generally receive medical bills for services rendered within the last six years in New Hampshire. After this period, the provider may still request the payment, but enforcing it legally is more complicated. Regularly reviewing your financial records can help you stay on top of your health-related expenses. The New Hampshire Demand for Collateral by Creditor gives you insights into handling these situations effectively.

The statute of limitations on medical debt in New Hampshire is six years. This means creditors have six years to file a lawsuit to collect this type of debt. After this period, the debt becomes uncollectible, unless you make a payment or acknowledge the debt. Knowing about the New Hampshire Demand for Collateral by Creditor can assist you in understanding how this applies to your situation.

In New Hampshire, debt becomes uncollectible typically after a six-year period. This timeframe aligns with the statute of limitations set by state law. If creditors like you do not initiate the collection process during this period, you can no longer pursue the debt legally. Understanding the New Hampshire Demand for Collateral by Creditor can help you navigate your rights effectively.

Creditors typically have one year from the date of death to file claims against an estate in New Hampshire. This timeframe ensures creditors can recover debts while also protecting the beneficiaries' interests. If you're managing an estate, understanding how the New Hampshire Demand for Collateral by Creditor applies could provide insight into settling claims effectively and avoiding complications during this sensitive time.

In general, a 10-year-old debt may be too old to collect in New Hampshire due to the three-year statute of limitations. However, if a creditor can prove they made a payment or received acknowledgement from you within that time frame, they might still pursue the collection. It’s essential to review the circumstances surrounding any old debt and recognize the implications of the New Hampshire Demand for Collateral by Creditor for your situation. If in doubt, seeking legal advice could help clarify your rights.