New Hampshire Nonrecourse Assignment of Account Receivables

Description

How to fill out Nonrecourse Assignment Of Account Receivables?

If you want to full, acquire, or printing authorized document web templates, use US Legal Forms, the most important selection of authorized kinds, that can be found on-line. Use the site`s simple and handy look for to get the papers you need. Numerous web templates for enterprise and personal reasons are categorized by classes and states, or search phrases. Use US Legal Forms to get the New Hampshire Nonrecourse Assignment of Account Receivables in just a number of clicks.

When you are already a US Legal Forms client, log in to the bank account and click on the Down load button to find the New Hampshire Nonrecourse Assignment of Account Receivables. You may also gain access to kinds you formerly delivered electronically inside the My Forms tab of your own bank account.

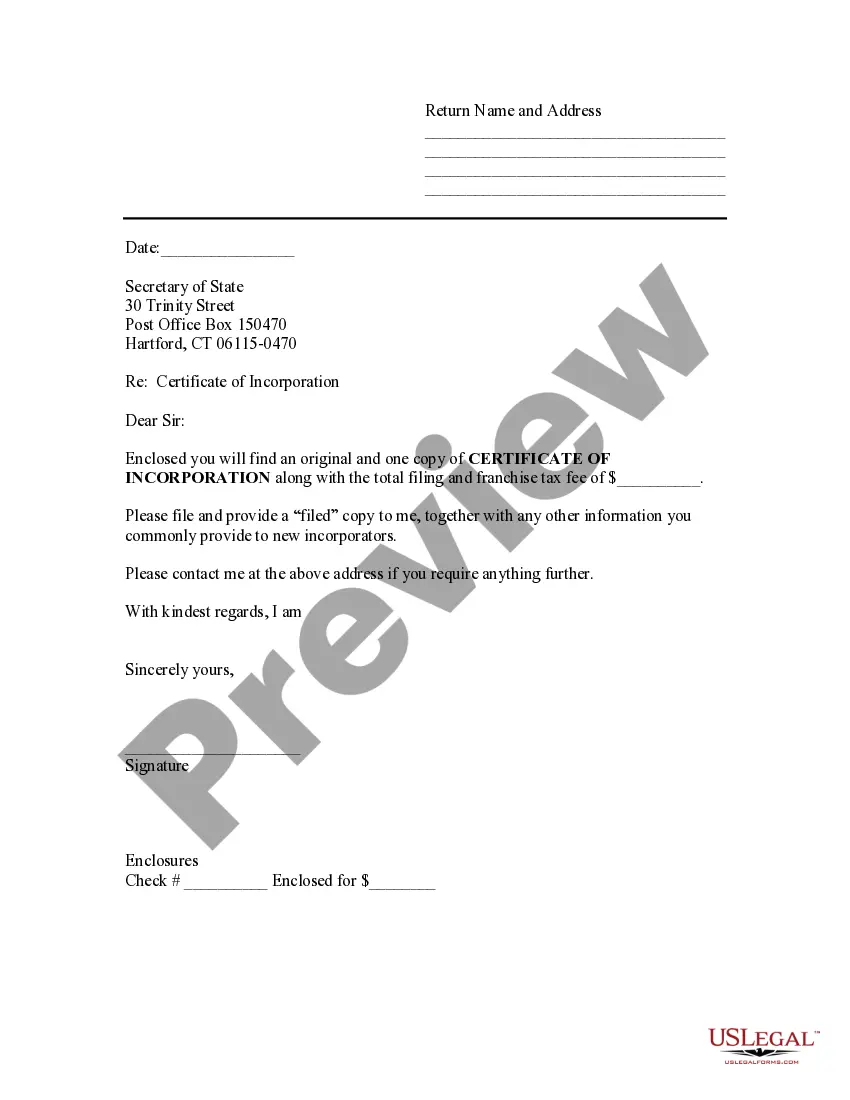

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for the proper town/country.

- Step 2. Use the Review option to look over the form`s information. Don`t forget to learn the description.

- Step 3. When you are not satisfied together with the kind, utilize the Look for discipline towards the top of the monitor to get other types of the authorized kind format.

- Step 4. Upon having identified the form you need, click the Acquire now button. Choose the costs strategy you like and include your references to register on an bank account.

- Step 5. Procedure the deal. You should use your bank card or PayPal bank account to finish the deal.

- Step 6. Pick the file format of the authorized kind and acquire it in your product.

- Step 7. Complete, revise and printing or sign the New Hampshire Nonrecourse Assignment of Account Receivables.

Each and every authorized document format you acquire is yours forever. You have acces to each and every kind you delivered electronically inside your acccount. Go through the My Forms area and select a kind to printing or acquire once again.

Remain competitive and acquire, and printing the New Hampshire Nonrecourse Assignment of Account Receivables with US Legal Forms. There are thousands of skilled and condition-certain kinds you may use to your enterprise or personal needs.

Form popularity

FAQ

Accounts receivable factoring is a source of debt financing available to businesses that sell on credit terms. The borrower assigns or sells its accounts receivable (or specific invoices) in exchange for cash today.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

What is the appropriate treatment for receivable assignment transaction? In a receivables financing transaction, the assignment of the debt by the seller to the financier is treated as a true sale: it does not secure payment or performance of an obligation.

However, pledging is general because all accounts receivable serve as collateral security for the loan. On the other hand, assignment is specific because specific accounts receivable serve as collateral security for the loan. Assignment may be done either on a nonnotification or notification basis.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.

In New Hampshire, the statute of limitations period for most types of debt is three years. That said, the statute of limitations period in New Hampshire for auto loan debt is four years, for credit card debt is three years, for medical debt is six years, and for mortgage debt is twenty years.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.