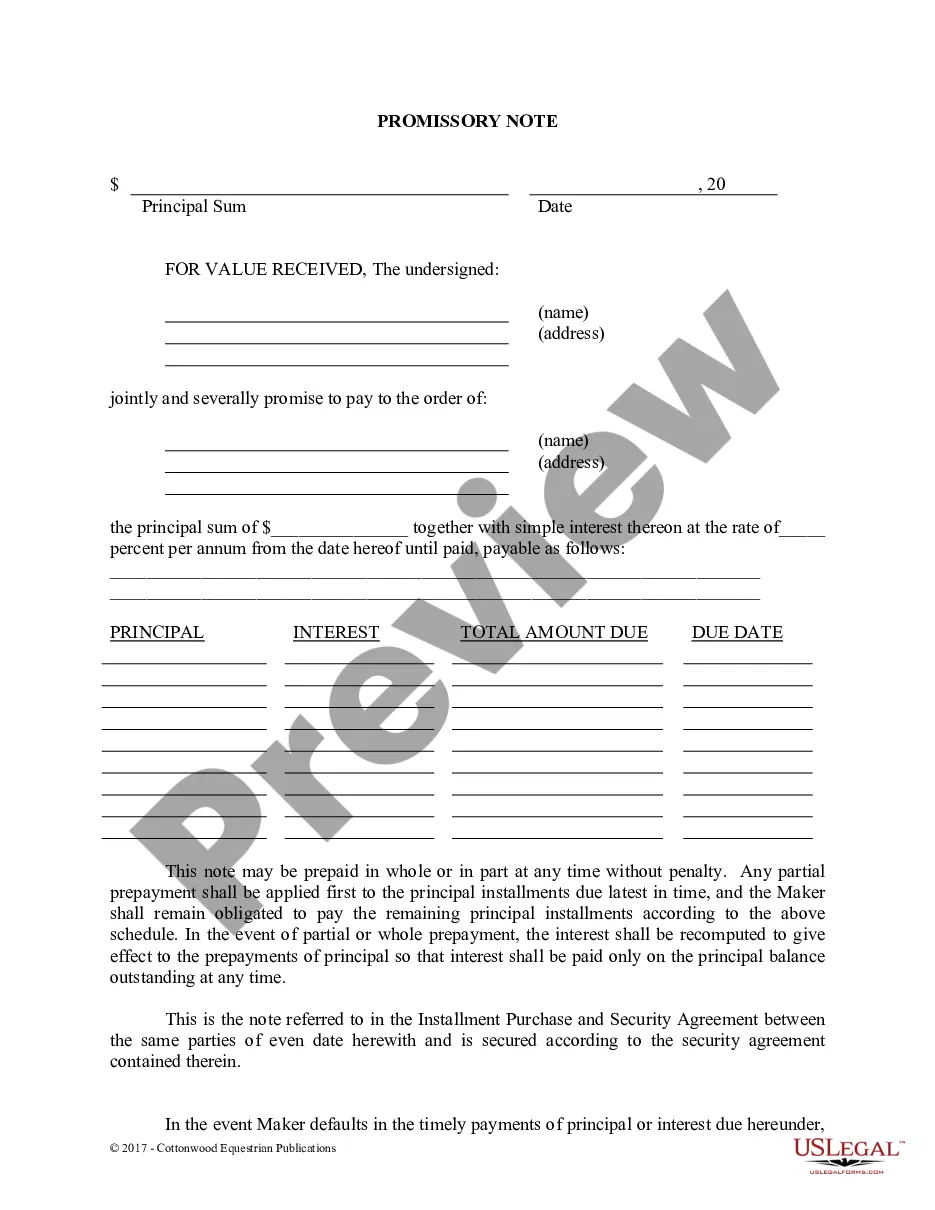

New Hampshire Promissory Note - Long Form

Description

How to fill out Promissory Note - Long Form?

If you seek to gather, acquire, or create valid document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Employ the site's straightforward and user-friendly search to find the documents you require.

An assortment of templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Select your preferred pricing plan and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the New Hampshire Promissory Note - Long Form in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Obtain button to access the New Hampshire Promissory Note - Long Form.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to review the content of the form. Don’t forget to look at the summary.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To get a copy of your promissory note, contact the lender and request a duplicate. If you created the note using US Legal Forms, you can log into your account for easy access to your documents. Always ensure you have identification ready to confirm your request when contacting the lender.

Recovering a promissory note involves gathering information about the transaction and reaching out to the lender. If the note was filed or recorded, you might be able to obtain a copy from the appropriate regulatory office. Platforms like US Legal Forms offer helpful templates and guidance to facilitate recovery and documentation.

Promissory notes are generally not public records unless they have been recorded with a government office. However, certain circumstances may require public disclosure, like foreclosure proceedings. To learn more about the implications of public records in your situation, consider resources available through US Legal Forms.

While you can create a promissory note without a lawyer, consulting one can provide added protection and clarity. A lawyer can ensure that your New Hampshire Promissory Note - Long Form complies with legal standards and addresses all necessary terms. Utilizing a platform like US Legal Forms may also simplify the process if you choose to draft the document independently.

If you lose the original promissory note, you can still enforce the agreement by providing proof of the transaction. It may be beneficial to consult with a legal professional to understand your options. Using a service like US Legal Forms can help you draft a new note or request a copy if applicable.

To obtain a copy of a promissory note, you typically need to contact the lender or financial institution that issued the note. If you used a legal service like US Legal Forms, you can easily access your documents through their platform. Additionally, keep your identification handy to verify your identity during this process.

Yes, promissory notes can certainly be long-term instruments. A New Hampshire Promissory Note - Long Form typically reflects this characteristic with repayment periods stretching over multiple years. Long-term notes can provide a more manageable payment approach for borrowers, while also offering lenders a steady return over time.

While a promissory note can be used as a short-term instrument, many are structured for longer durations. Specifically, a New Hampshire Promissory Note - Long Form often caters to longer repayment plans which benefit both the lender and the borrower. Understanding the intended use of the note helps in determining the proper classification of its term.

The duration of a promissory note can vary significantly based on the specific agreement between the lender and the borrower. When discussing a New Hampshire Promissory Note - Long Form, these documents often set repayment schedules that can range from a few months to several years. The length ultimately depends on the terms negotiated by both parties involved in the transaction.

Yes, a New Hampshire promissory note can still be valid without notarization, as long as it meets the state’s legal requirements. However, having a notarized note can strengthen its legitimacy and support enforcement in case of disputes. For extra security, consider utilizing a notary.