New Hampshire Installment Promissory Note with Bank Deposit as Collateral

Description

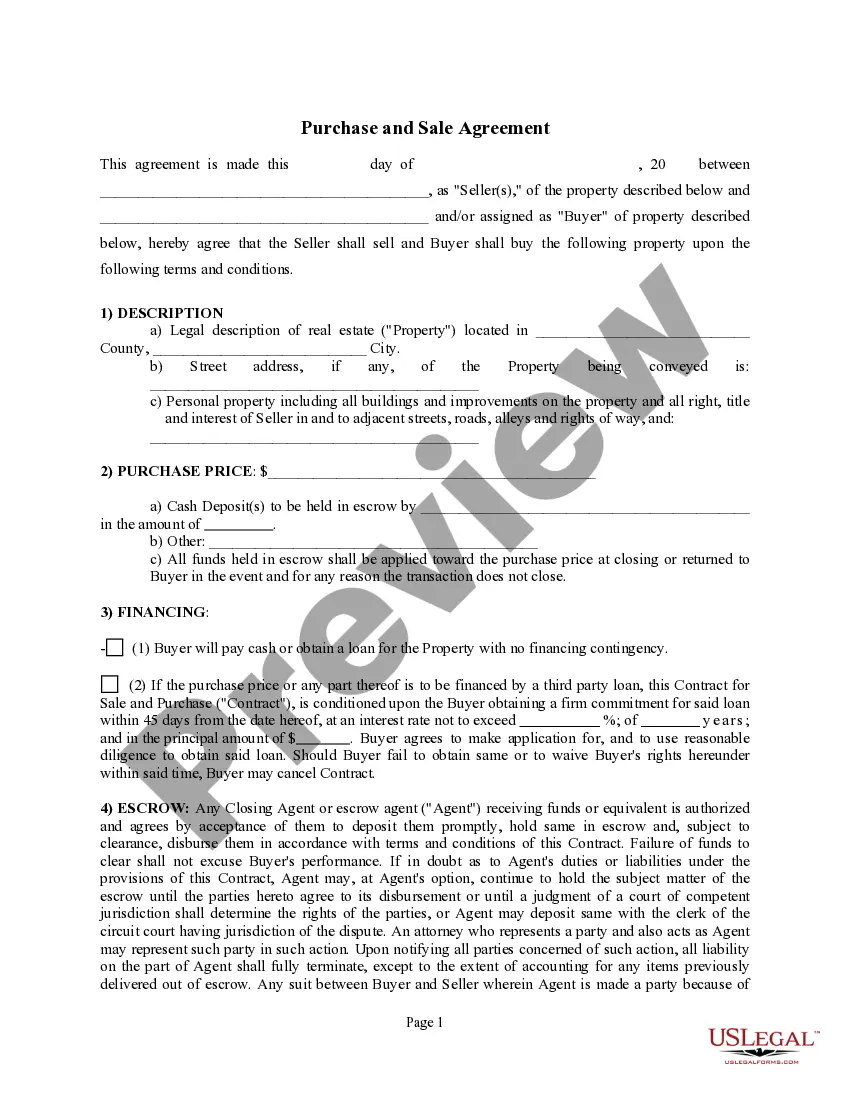

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

If you need to aggregate, download, or print official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's simple and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the New Hampshire Installment Promissory Note with Bank Deposit as Collateral in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Acquire and download, and print the New Hampshire Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- In case you are already a US Legal Forms customer, Log In to your account and click the Download button to access the New Hampshire Installment Promissory Note with Bank Deposit as Collateral.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific town/region.

- Step 2. Utilize the Preview feature to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search bar at the top of the screen to find other variations of the legal form template.

- Step 4. After discovering the form you require, click the Buy now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Installment Promissory Note with Bank Deposit as Collateral.

Form popularity

FAQ

Yes, a bank can issue a promissory note, which serves as a written promise to repay a specific amount over time. When dealing with a New Hampshire Installment Promissory Note with Bank Deposit as Collateral, banks often use such notes to secure the borrower’s obligation. This type of promissory note typically outlines the repayment terms and includes the bank deposit as security. Understanding these elements is important for anyone considering financing options offered by financial institutions.

Banks typically do not sell promissory notes directly to individuals. However, they may sell portfolios of notes to investors or other financial institutions. If you are interested in acquiring a promissory note, consider exploring a New Hampshire Installment Promissory Note with Bank Deposit as Collateral through specialized services like uslegalforms. This can guide you in creating valid notes for your financial transactions.

For a promissory note to be valid, it must include certain elements. These include the date of issuance, the amount owed, the payment terms, and the signatures of both parties. Additionally, a New Hampshire Installment Promissory Note with Bank Deposit as Collateral must clearly outline the collateral details to protect the lender. Ensuring all these components are present helps to avoid legal disputes.

Yes, banks do issue promissory notes as part of their lending processes. These notes serve as legal agreements between the bank and the borrower, detailing the terms of repayment. When using a New Hampshire Installment Promissory Note with Bank Deposit as Collateral, both parties are protected by the documented agreement. It is crucial to understand the note's conditions before signing.

One disadvantage of a promissory note is that if the borrower defaults, the lender may face challenges in recovering the funds. This can be especially true if there’s no collateral involved. Using a New Hampshire Installment Promissory Note with Bank Deposit as Collateral helps mitigate this risk, but it’s essential to understand the terms and conditions involved.

The document that connects a promissory note to collateral is typically a security agreement. This agreement outlines the specifics of the collateral, ensuring both parties understand their rights. In the case of a New Hampshire Installment Promissory Note with Bank Deposit as Collateral, the bank deposit functions as the backed item detailed in the security agreement.

Yes, promissory notes can be backed by collateral, which adds security for the lender. A New Hampshire Installment Promissory Note with Bank Deposit as Collateral is an excellent example of this type of arrangement. Collateral serves as an assurance that the lender will recover their funds if the borrower defaults.

Yes, many banks accept promissory notes as a form of financing. However, the acceptance often depends on the specific terms and the borrower’s creditworthiness. When using a New Hampshire Installment Promissory Note with Bank Deposit as Collateral, you may increase your chances of approval, as this collateral protects the lender.