New Hampshire Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Are you currently within a situation that you need paperwork for either organization or specific purposes virtually every day? There are a variety of authorized document layouts accessible on the Internet, but discovering ones you can rely on is not straightforward. US Legal Forms provides a large number of kind layouts, just like the New Hampshire Articles of Incorporation, Not for Profit Organization, with Tax Provisions, which can be created to meet state and federal specifications.

When you are currently familiar with US Legal Forms site and possess your account, just log in. After that, it is possible to obtain the New Hampshire Articles of Incorporation, Not for Profit Organization, with Tax Provisions format.

If you do not have an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for the proper town/county.

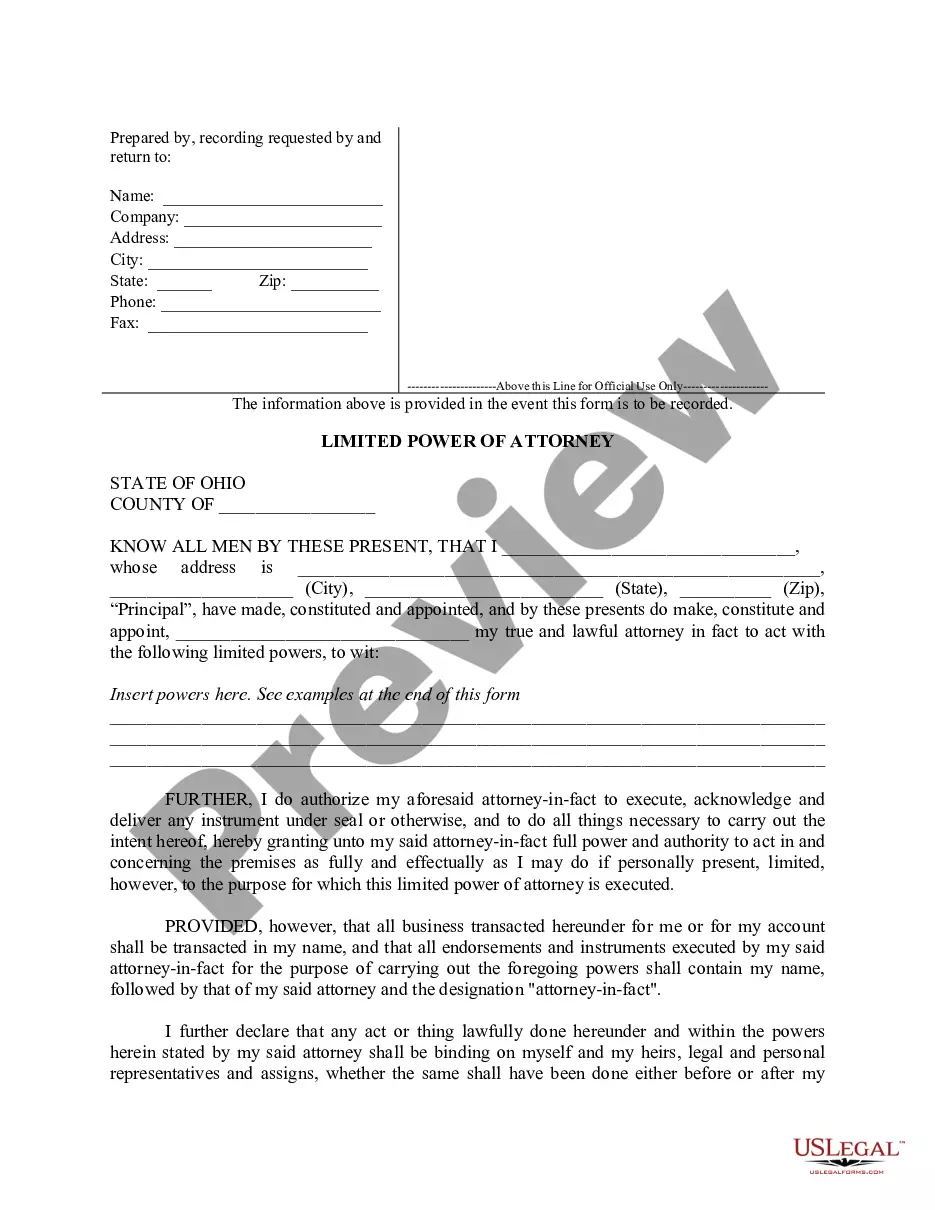

- Make use of the Review button to analyze the shape.

- See the information to actually have selected the correct kind.

- In the event the kind is not what you are looking for, take advantage of the Look for industry to obtain the kind that meets your requirements and specifications.

- Whenever you find the proper kind, click on Buy now.

- Pick the pricing program you would like, complete the specified information to make your bank account, and buy the transaction with your PayPal or credit card.

- Decide on a practical document formatting and obtain your version.

Discover all the document layouts you possess purchased in the My Forms food list. You can get a additional version of New Hampshire Articles of Incorporation, Not for Profit Organization, with Tax Provisions anytime, if required. Just click on the essential kind to obtain or print the document format.

Use US Legal Forms, one of the most considerable assortment of authorized kinds, to conserve time and prevent mistakes. The support provides appropriately manufactured authorized document layouts that you can use for a selection of purposes. Produce your account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

New Hampshire. The IRS lists 9,079 active tax-exempt organizations operating in New Hampshire, including 7,061 501(c)(3)s, to which you can make a tax-deductible donation.

8 Steps to Form a Nonprofit Organization: Choose a business name. Incorporate online or by phone with incorporate.com. Apply for your IRS tax exemption. Apply for a state tax exemption. Draft bylaws. Appoint directors. Hold a meeting of the board. Obtain any necessary licenses and permits.

benefit nonprofit corporation is a type of nonprofit corporation chartered by a state government, and organized primarily or exclusively for social, educational, recreational or charitable purposes by likeminded citizens.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

How To Start A Nonprofit In New Hampshire Choose your NH nonprofit filing option. File the NH nonprofit articles of agreement. Get a Federal EIN from the IRS. Adopt your NH nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required state licenses. Open a bank account for your NH nonprofit.

How to Start a Nonprofit in New Hampshire Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders. But nonprofit organizations do not issue stock or pay dividends.

Contents Conduct a needs assessment. Complete a market analysis. Choose from the 3 types of nonprofit organization structures. Create a business plan. Secure funding. Form your nonprofit. Apply for tax-exempt status. Keep your tax-exempt status.