New Hampshire Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

If you wish to gather, acquire, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Take advantage of the website's simple and user-friendly search to find the documents you need.

Numerous templates for professional and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to get the New Hampshire Sample Letter for Explanation of Insurance Rate Increase with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download option to obtain the New Hampshire Sample Letter for Explanation of Insurance Rate Increase.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

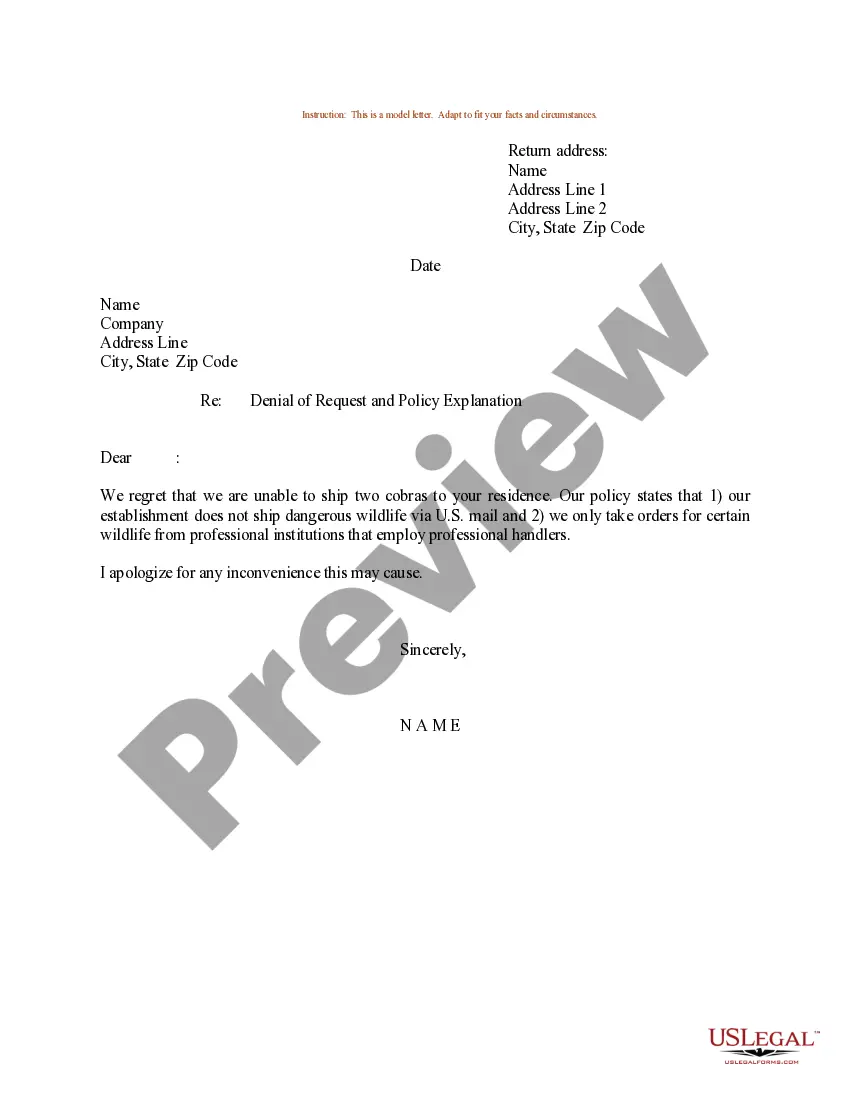

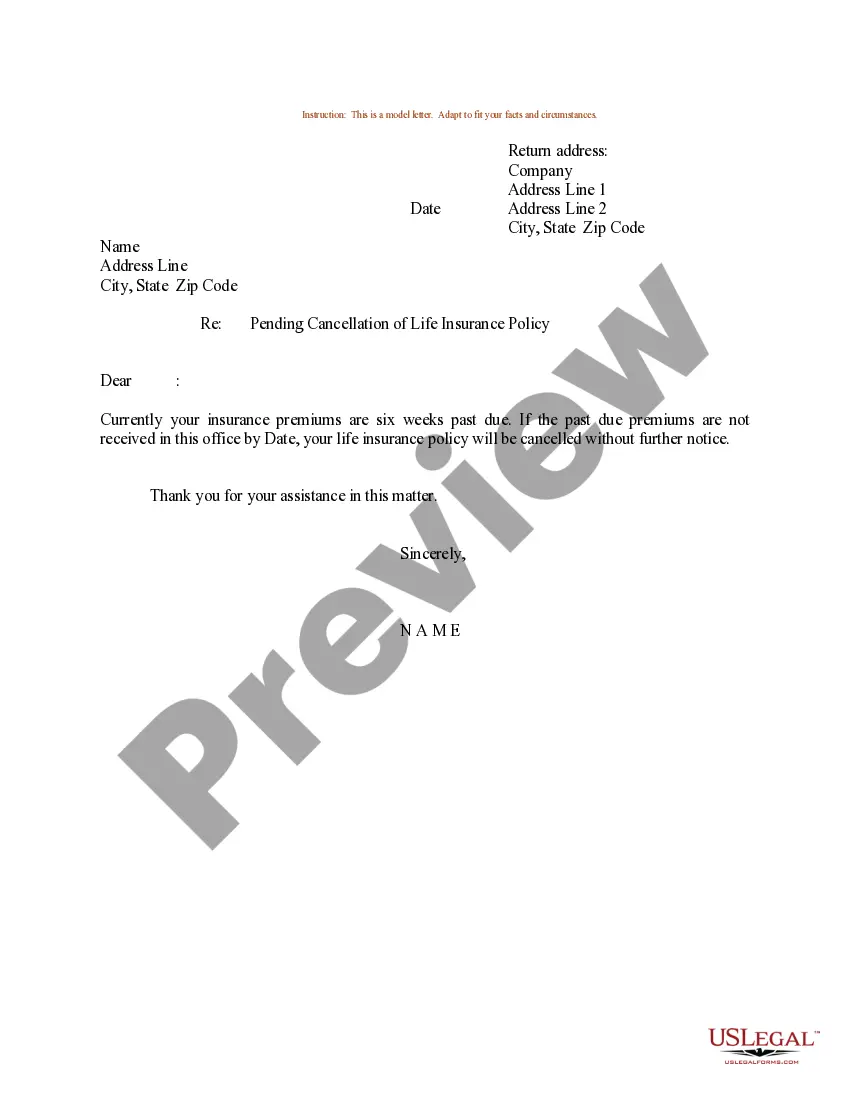

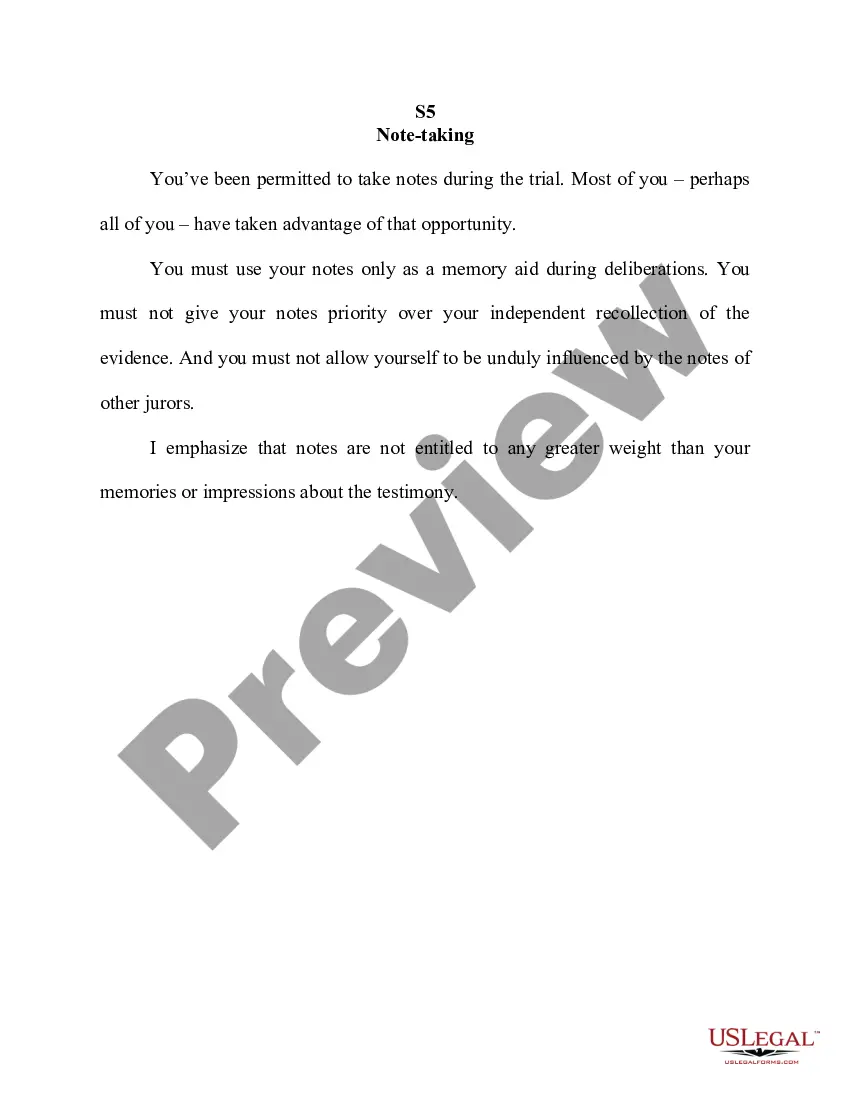

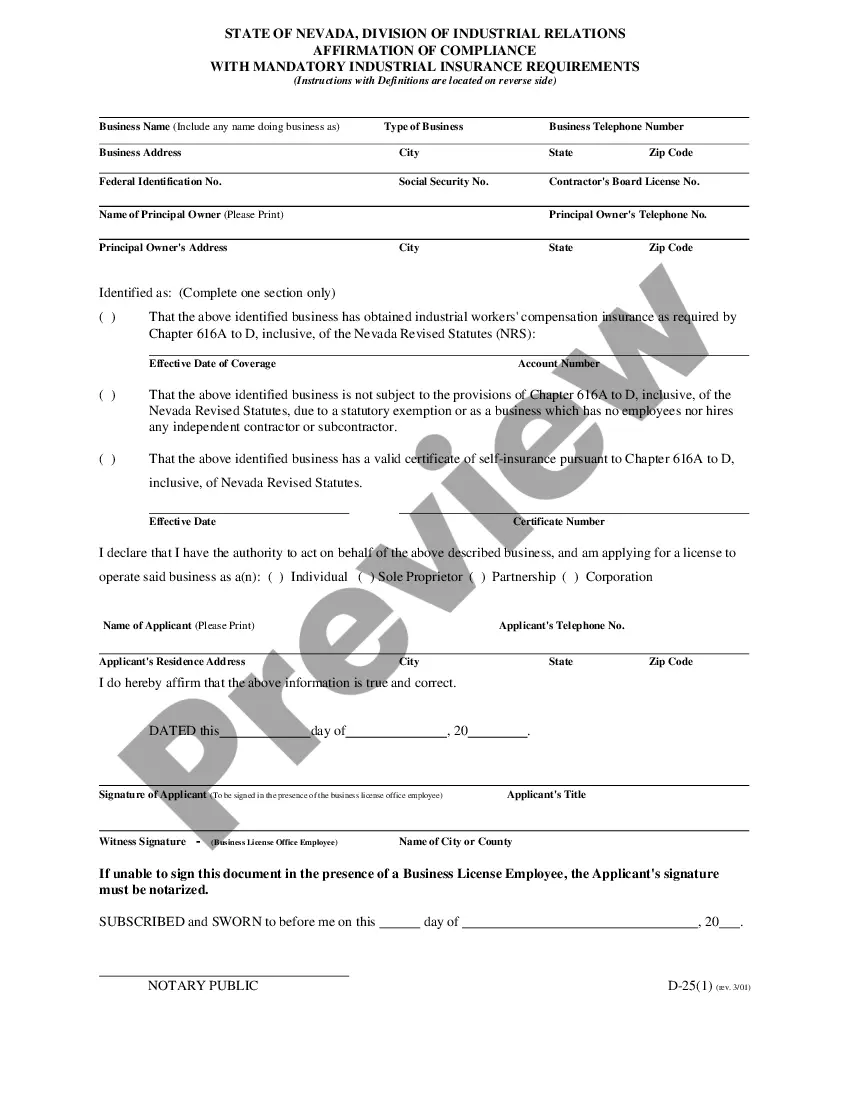

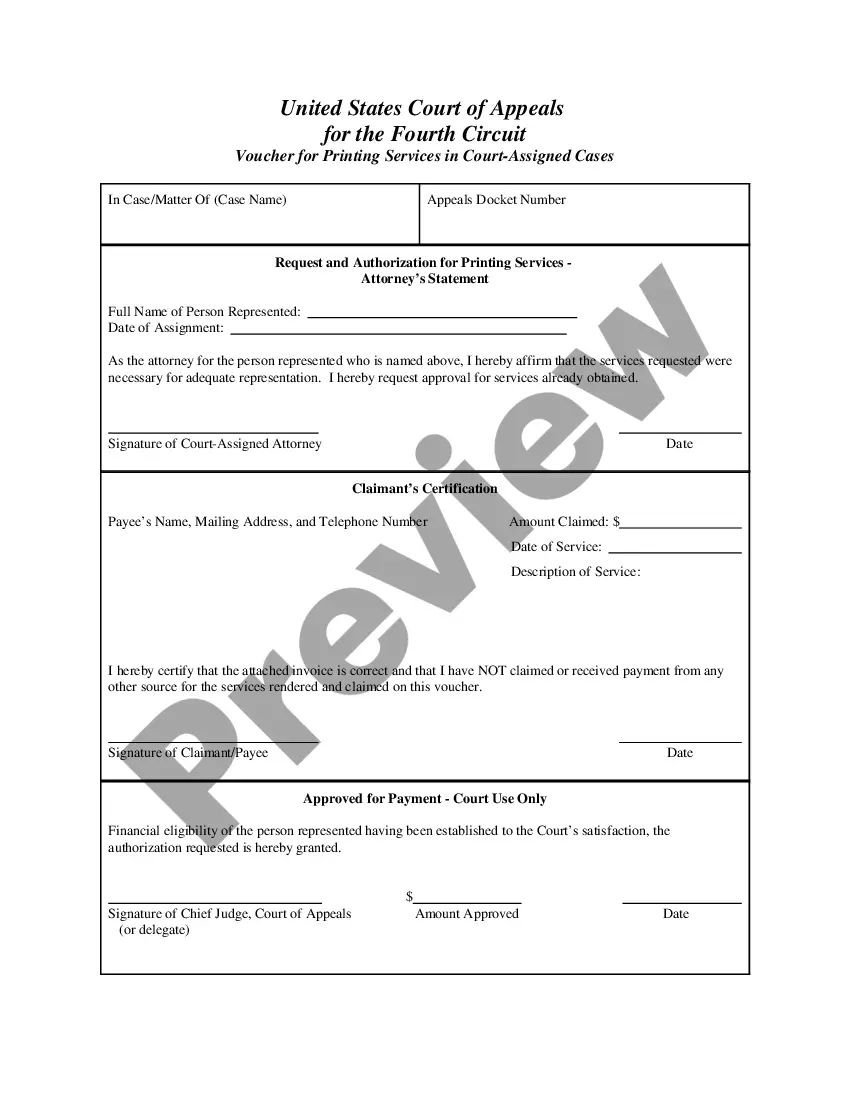

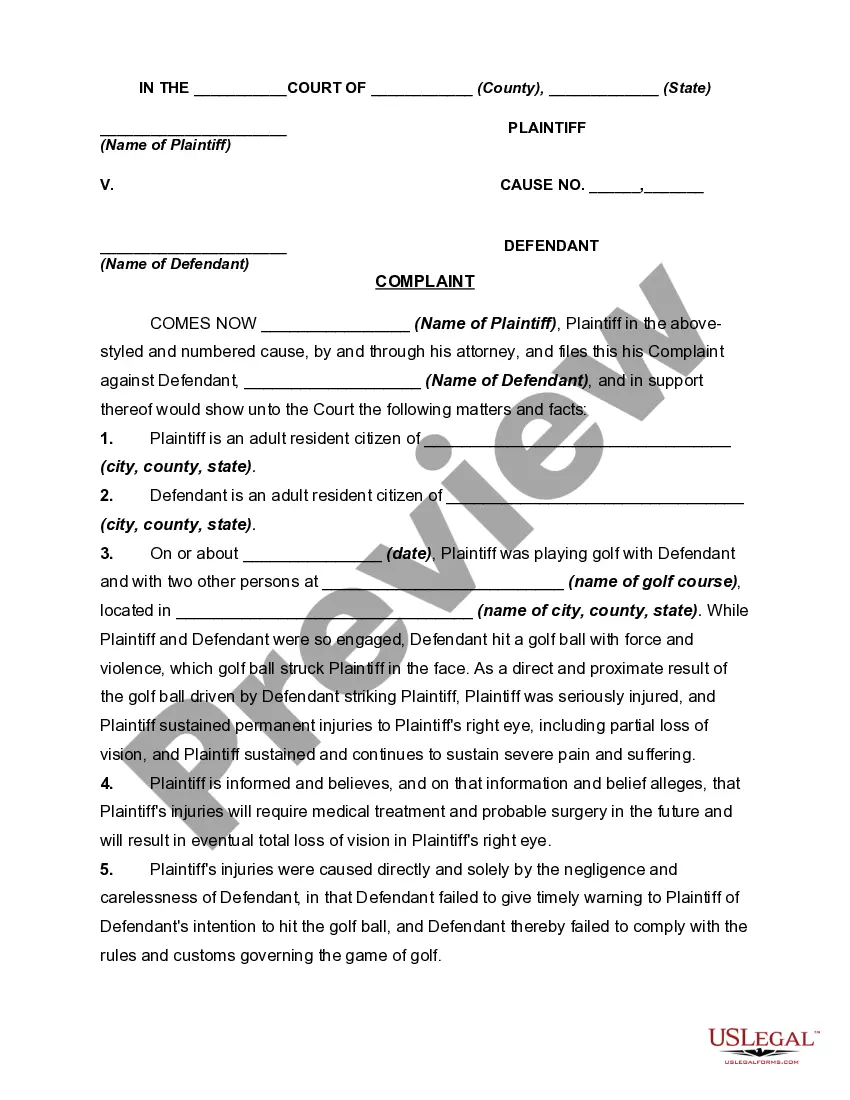

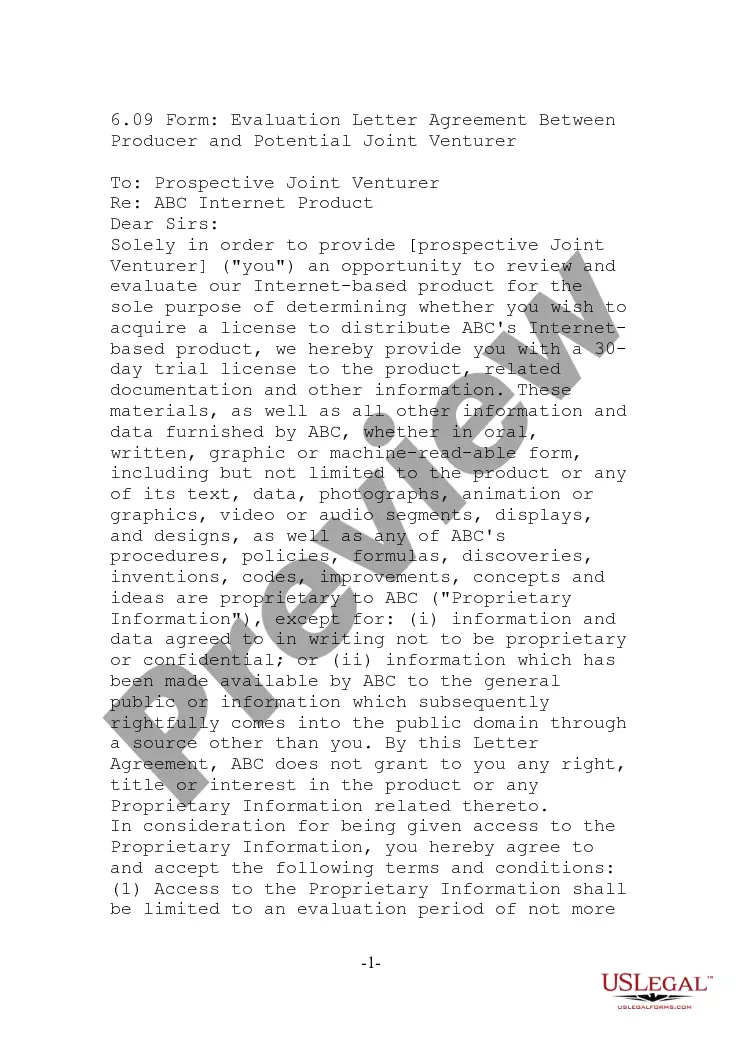

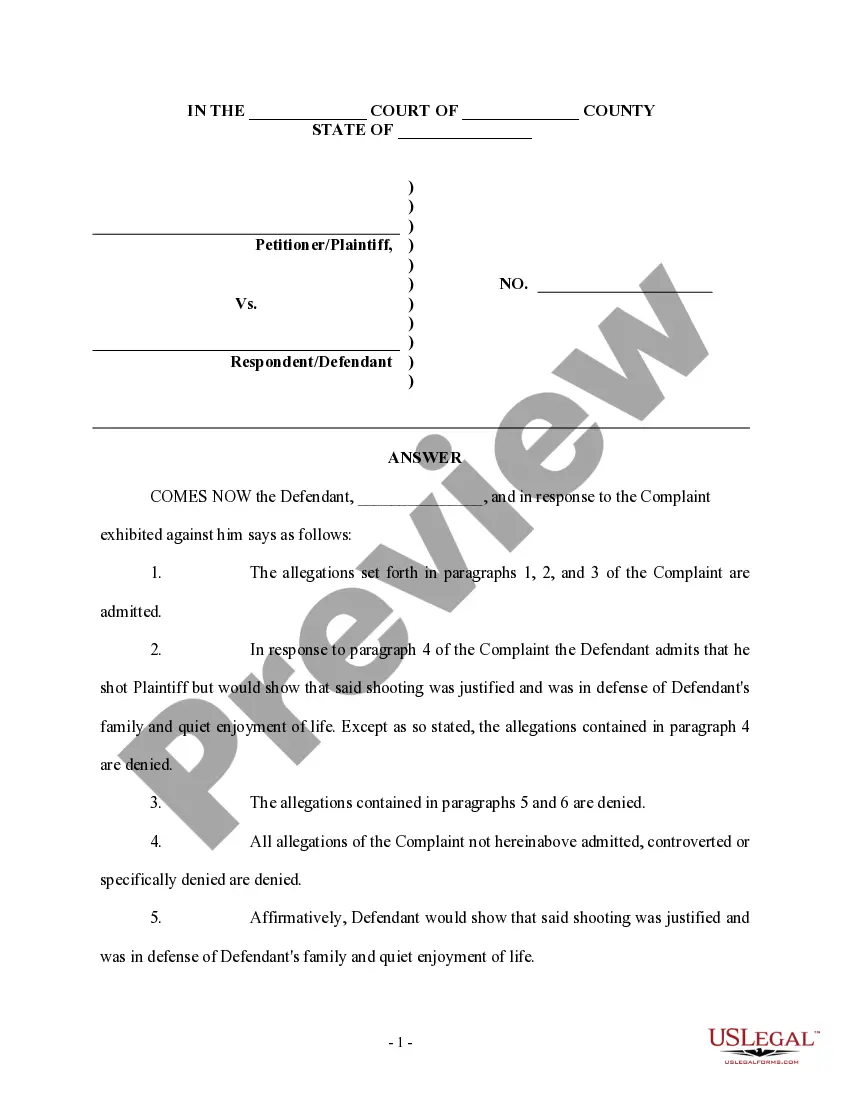

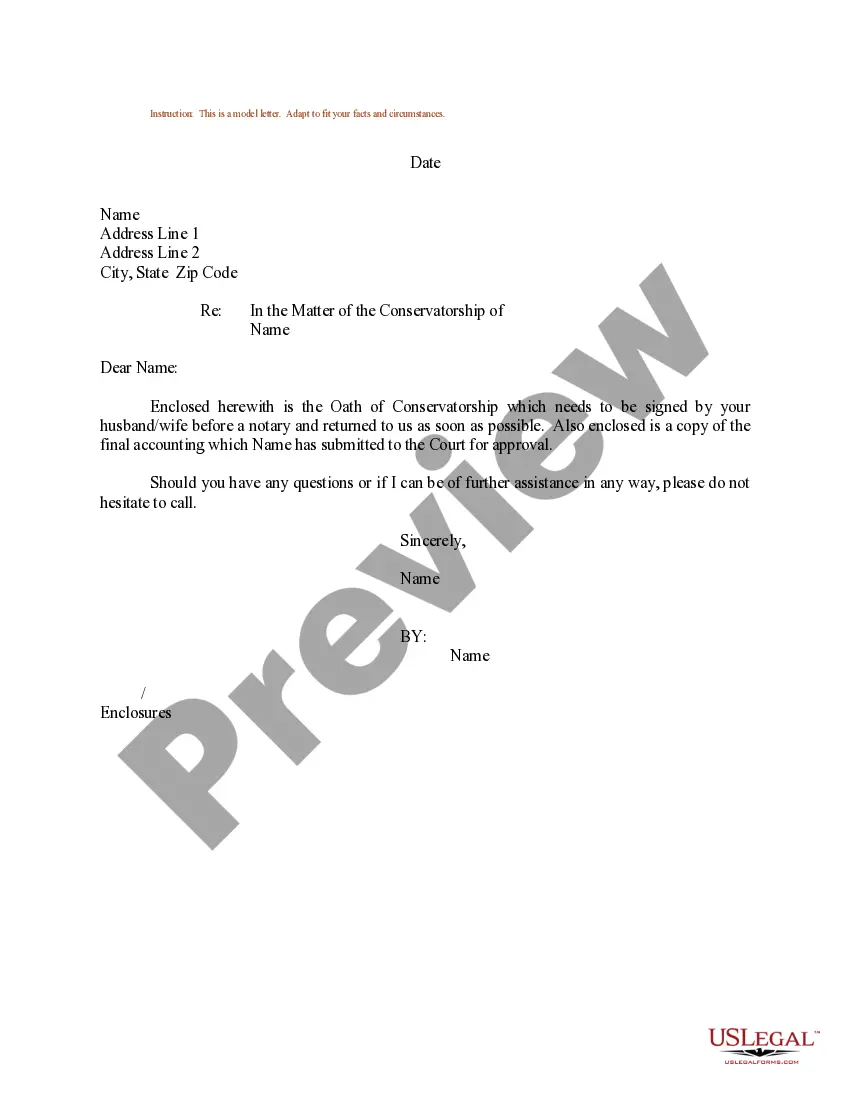

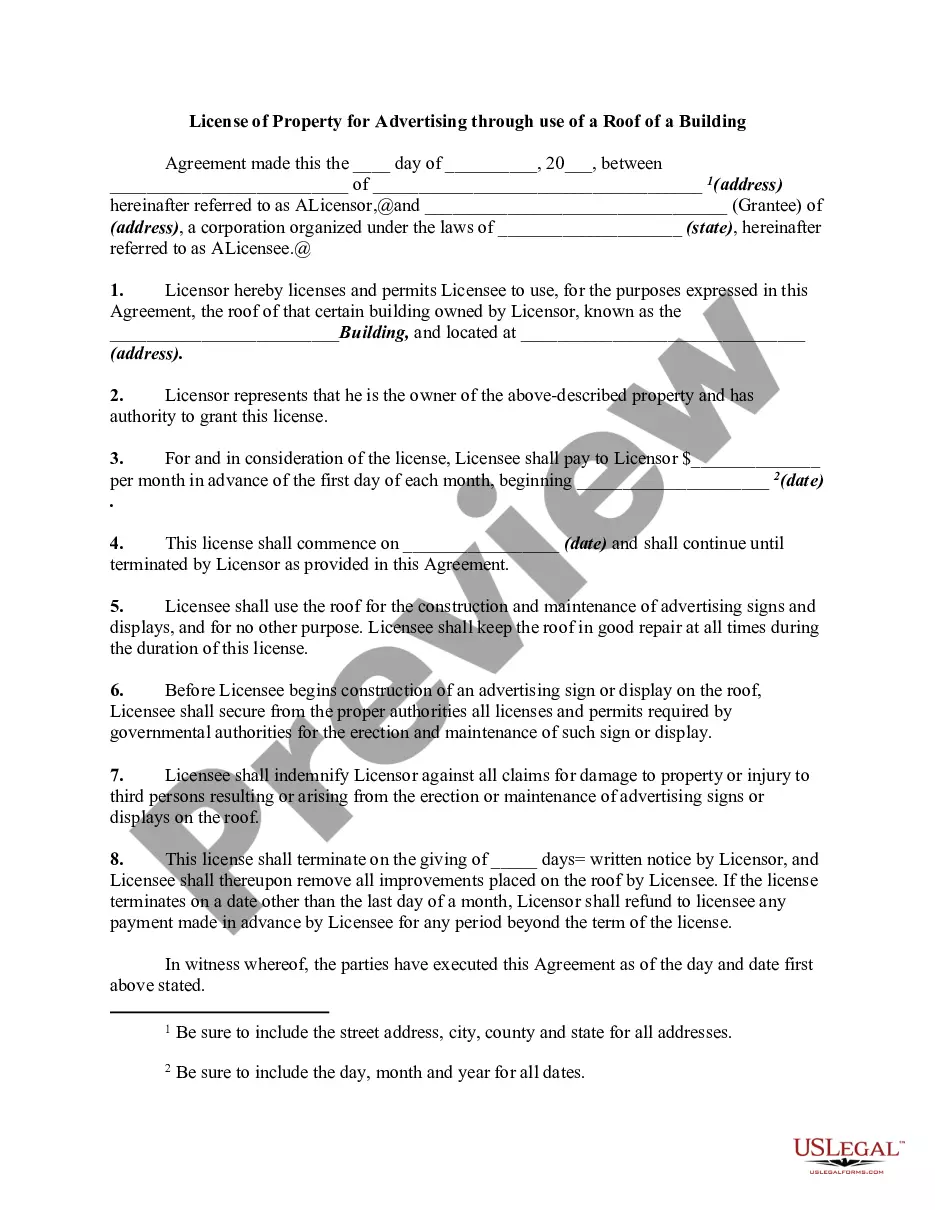

- Step 2. Use the Preview feature to review the form's content. Remember to read the information carefully.

Form popularity

FAQ

To write a successful appeal letter to an insurance company, start by clearly stating the purpose of your letter and providing all relevant details of your claim. Use the New Hampshire Sample Letter for Explanation of Insurance Rate Increase as a guide to structure your appeal, ensuring it is concise and addresses the issues at hand. By backing your case with documentation and expressing your key concerns, you not only enhance your chances for reconsideration but also foster open communication with your insurer. This approach shows that you are informed and proactive.

You can explain an insurance premium increase by detailing factors that affect rates, such as changes in risk assessment, claims history, and market trends. The New Hampshire Sample Letter for Explanation of Insurance Rate Increase can help you communicate these points clearly to your insurer. By outlining your circumstances and providing factual context, you can build a strong case for understanding your new premium. This proactive communication may help you address concerns or negotiate a better rate.

Insurance companies in New Hampshire are regulated by the New Hampshire Insurance Department. This department enforces state regulations that govern insurance practices and ensure consumer protection. If you find yourself facing unexpected rate increases, using a New Hampshire Sample Letter for Explanation of Insurance Rate Increase can clarify your concerns and help facilitate a resolution.

You should contact the insurance commissioner if you experience unresolved issues with your insurance provider or if you feel your rights are being violated. Additionally, if you have questions about coverage or rate increases, they can provide helpful guidance. In these situations, a New Hampshire Sample Letter for Explanation of Insurance Rate Increase can assist in presenting your case effectively.

In New Hampshire, the oversight of insurance companies is conducted by the New Hampshire Insurance Department. This department monitors the financial health and practices of insurers to ensure fair treatment of consumers. Should you need to address a rate increase issue, a New Hampshire Sample Letter for Explanation of Insurance Rate Increase is a practical tool to help you express your situation clearly.

The main responsibility of regulating insurance companies falls to state insurance departments. In New Hampshire, the New Hampshire Insurance Department ensures companies comply with state laws and protect consumer rights. If you need guidance or assistance with a rate increase, consider crafting a New Hampshire Sample Letter for Explanation of Insurance Rate Increase to formally communicate your concerns.

If you have a concern regarding the New Hampshire Insurance Commission, you can submit your complaint through their official website or contact them via phone. Make sure to provide detailed information regarding your issue. Incorporating a New Hampshire Sample Letter for Explanation of Insurance Rate Increase can help convey your situation in an organized manner.

To file a complaint about insurance in New Hampshire, start by contacting your insurance company directly. If unresolved, you can escalate the issue to the New Hampshire Insurance Department. Utilizing a New Hampshire Sample Letter for Explanation of Insurance Rate Increase may assist you in outlining your concerns clearly and formally.

Insurance companies determine rate increases based on a variety of factors, including claims history, market trends, and individual risk profiles. They analyze statistical data and assess how likely you are to file a claim in the future. By leveraging tools like a New Hampshire Sample Letter for Explanation of Insurance Rate Increase, you can better understand these calculations and advocate for fair treatment from your insurer.

Writing a successful insurance appeal letter requires a clear structure and persuasive arguments. Start by stating your purpose, provide supporting evidence, and reference any relevant laws or policies. For examples, a New Hampshire Sample Letter for Explanation of Insurance Rate Increase can guide you in crafting a compelling appeal that effectively communicates your concerns and expectations.