New Hampshire Sample Letter for Request for Information - Increase in Bill Amount

Description

How to fill out Sample Letter For Request For Information - Increase In Bill Amount?

Are you presently engaged in a position where you need documentation for both business or personal purposes every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms provides a vast array of form templates, including the New Hampshire Sample Letter for Request for Information - Increase in Bill Amount, which can be drafted to meet state and federal regulations.

Once you locate the appropriate form, click Buy now.

Select the pricing plan you desire, enter the required information to create your account, and complete your purchase using PayPal or a Visa or Mastercard.

- If you are currently acquainted with the US Legal Forms website and possess your account, simply Log In.

- Afterwards, you can download the New Hampshire Sample Letter for Request for Information - Increase in Bill Amount template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/region.

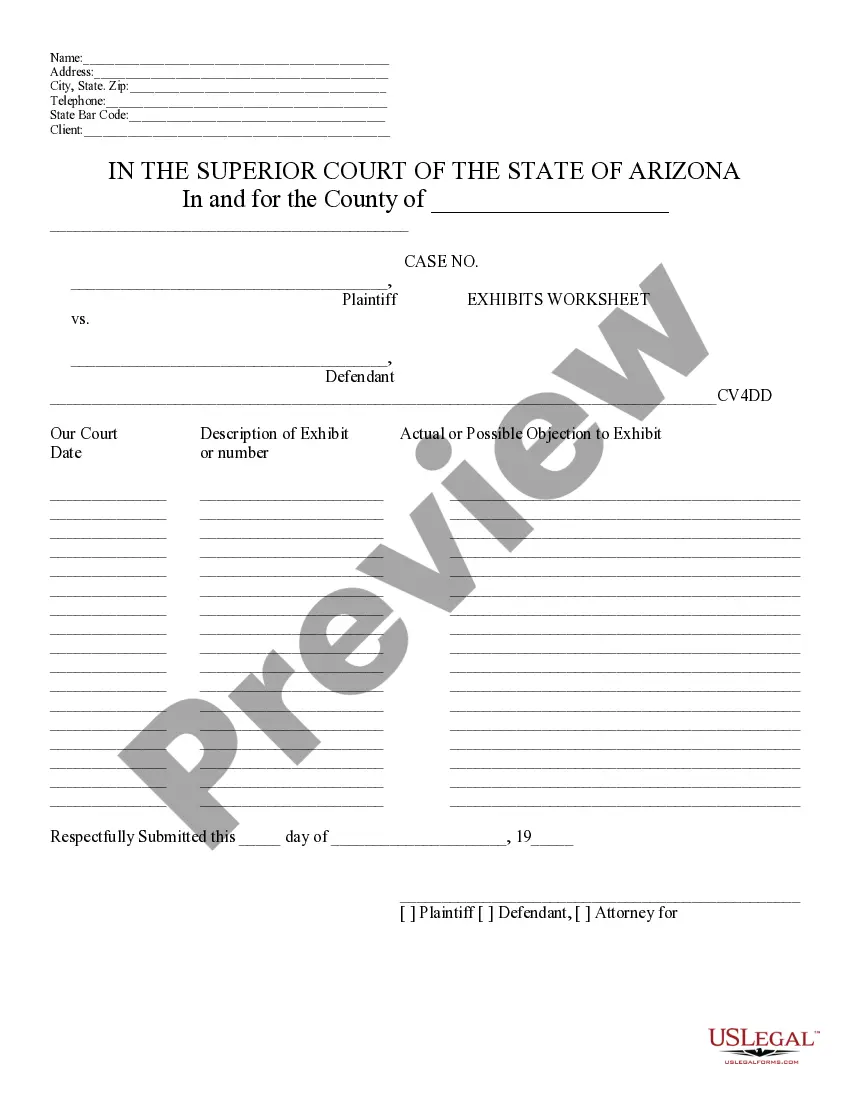

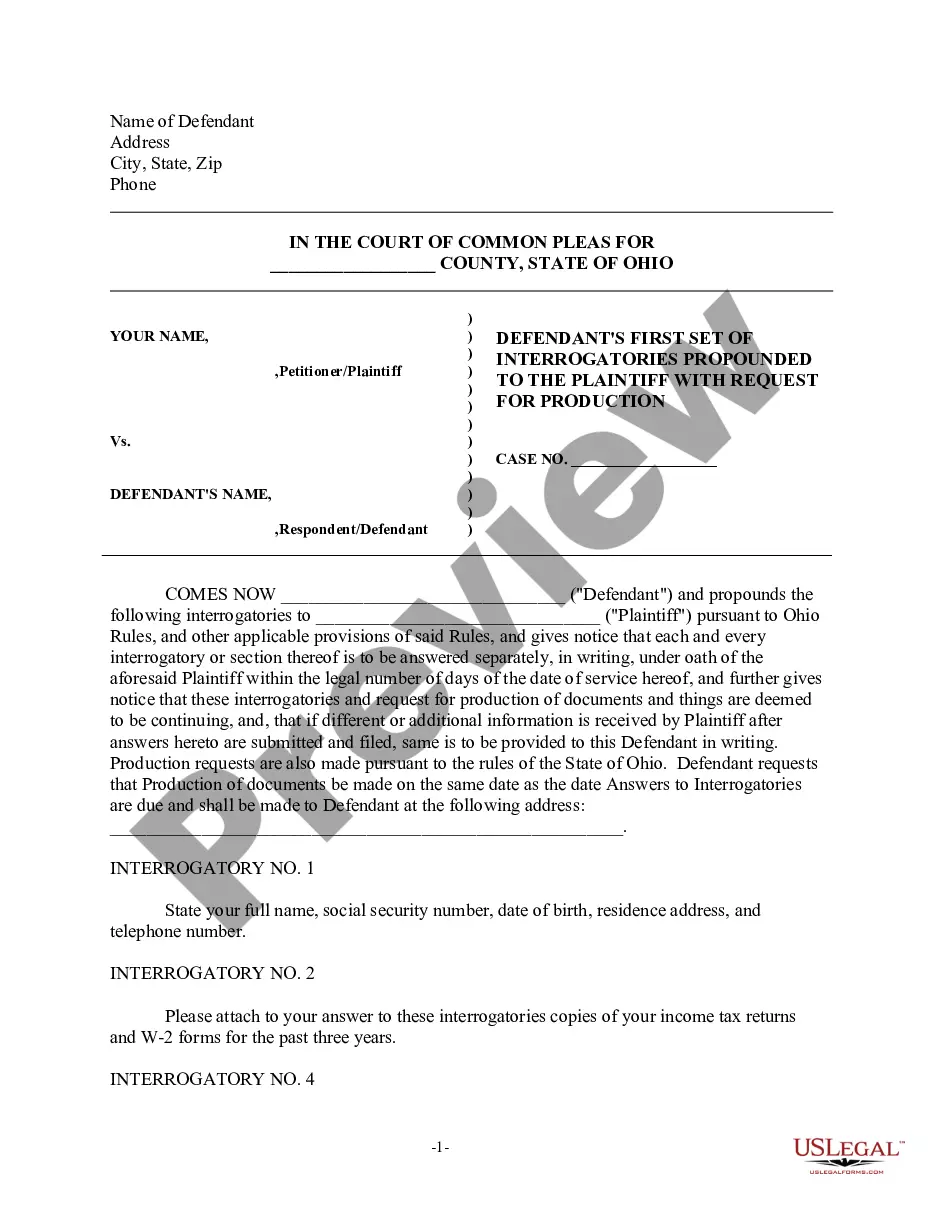

- Utilize the Preview option to review the form.

- Examine the description to ensure you have selected the appropriate document.

- If the document is not what you are looking for, use the Search field to find the form that meets your criteria and needs.

Form popularity

FAQ

Anyone who receives interest and dividends exceeding the state’s set threshold must file the NH DP 10 form. This includes individuals with investment income from sources such as bank accounts and stocks. Understanding your filing requirements can prevent surprises, such as an increase in bill amounts.

In New Hampshire, dividends and interest are taxed at a rate of 5%. It is important to report this income accurately, as failure to do so may lead to penalties or increases in tax liabilities. For clarity, one might utilize a New Hampshire Sample Letter for Request for Information regarding any tax concerns.

As of now, New Hampshire has not explicitly stated plans to phase out the interest and dividend tax. However, discussions continue about potential reforms in taxation policy. Stay informed about changes that could affect your financial responsibilities, especially concerning increases in bill amounts.

Yes, New Hampshire Medicaid does accept paper claims, in addition to electronic submissions. However, using electronic claims can expedite the processing time. If you experience an increase in bill amounts related to Medicaid, you might consider reaching out through a New Hampshire Sample Letter for Request for Information.

The DP10 form in New Hampshire is used to report interest and dividends earned by individuals. Especially for those concerned about their tax liabilities, understanding this form is essential. If you encounter issues, refer to a New Hampshire Sample Letter for Request for Information to seek clarification.

The form for interest and dividends in New Hampshire is called the DP-10. It is essential for taxpayers to report their income from financial investments accurately. This ensures that unexpected increases in bill amounts do not arise from misreported income.

The form used for reporting interest and dividends in New Hampshire is known as the DP-10. This form collects information regarding your interest and dividend income, impacting your taxation. Keeping it accurate ensures you avoid unexpected changes in your financial obligations, like an increase in bill amounts.

The NH 1120 is the corporate income tax return form for businesses operating in New Hampshire. Corporations must file this return to report their income and calculate the applicable taxes. If your business encounters an increase in bill amounts, reviewing your tax obligations with forms like the NH 1120 can provide clarity.

The tax form for reporting interest and dividends in New Hampshire is the DP-10. This form is required for individuals receiving interest or dividend income exceeding the state threshold. As you assess this income, consider how it may relate to your overall financial situation, especially if you suspect an increase in bill amounts.

A DP10, or the 'Interest and Dividends Tax Return,' is a tax form used in New Hampshire for reporting interest and dividend income. If you receive income from sources like stocks or bonds, you must file this form. Always stay informed about your financial obligations to avoid surprises, such as an increase in bill amounts.