In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm

Description

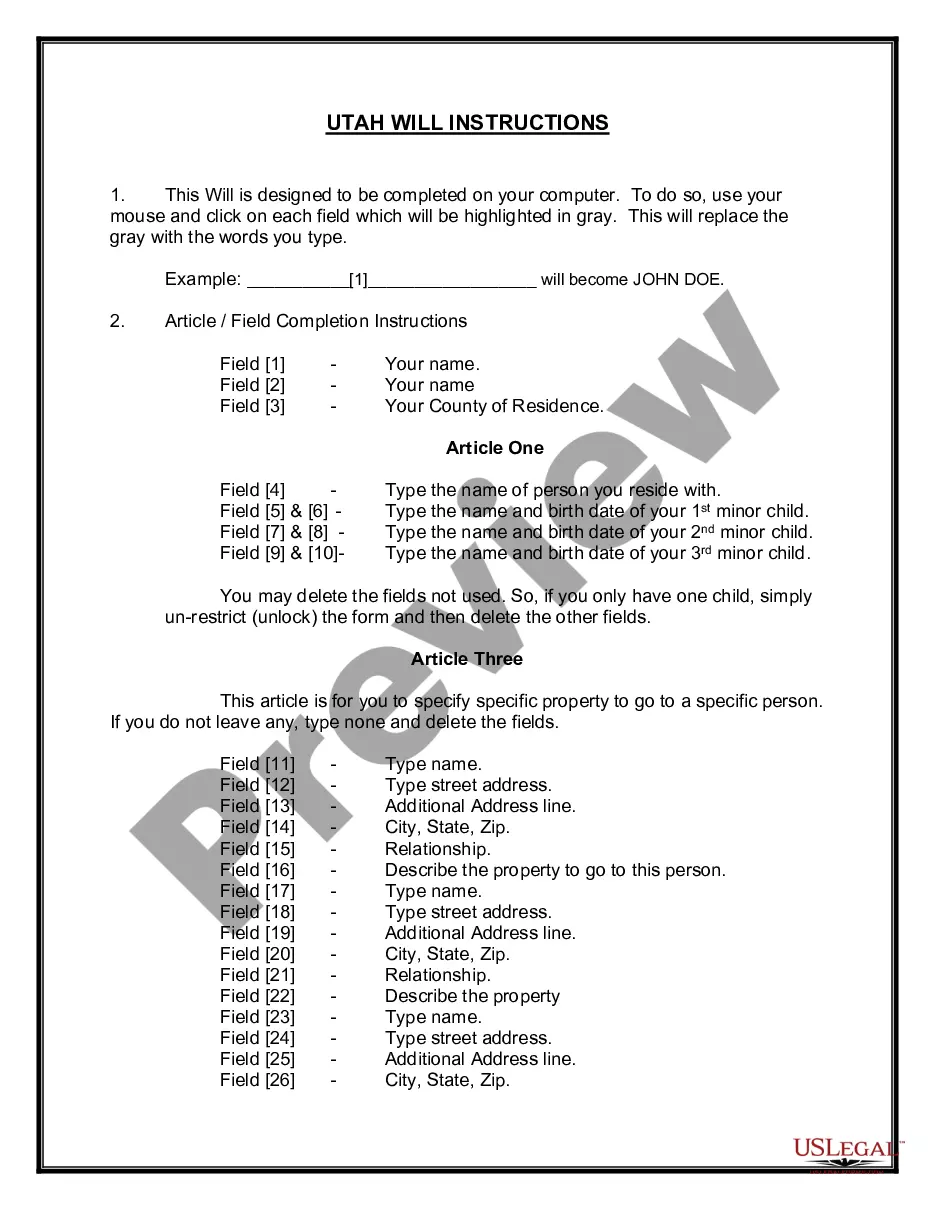

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

It is feasible to spend hours on the web attempting to locate the legal documents template that meets the federal and state requirements you require.

US Legal Forms offers a wide array of legal documents that can be examined by professionals.

It is easy to obtain or print the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm from our assistance.

In order to acquire another version of the form, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm.

- Each legal documents template you purchase is yours for a long time.

- To obtain another copy of a purchased form, go to the My documents section and click the respective button.

- If you use the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Review the form overview to confirm you have chosen the appropriate form.

Form popularity

FAQ

The primary difference between compilation and review of financial statements lies in the level of assurance provided. Compilation involves presenting financial information without in-depth evaluation, often based solely on the information provided by management. In contrast, a review offers a moderate level of assurance through analytical procedures and inquiries. This is captured in the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm, emphasizing the importance of choosing the right service for your financial reporting needs.

The review of a company's financial statements by a CPA firm involves an assessment of the statements to provide a level of assurance about their reliability. During this process, the CPA examines key financial metrics and conducts inquiries with management. The end result is the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm, which informs users about the financial health of the business while not requiring the extensive procedures of an audit.

Yes, you can look up a company's financial statements using various online resources and databases. Many companies, especially publicly traded ones, publish their financial reports on their websites or submit them to regulatory agencies. For more tailored information, the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm can provide comprehensive insights directly related to a company's financial health.

A financial statement review typically takes a few weeks to complete, depending on the availability of necessary documents and the firm's workload. It involves analyzing financial data and ensuring it meets accounting standards. By utilizing the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm, you can expedite this process with professionalism and efficiency.

Audited financial statements provide a higher level of assurance compared to reviewed financial statements. An audit involves extensive testing and verification by the accounting firm, while a review primarily consists of analytical procedures and inquiries. In essence, the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm offers a valuable assessment without the exhaustive procedures of an audit.

Filing business documents in New Hampshire typically involves submitting forms through the Secretary of State’s office. You'll need to gather required documentation and ensure everything is complete and accurate. Utilizing the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm can assist you in presenting a precise overview of your finances. For an easier experience, consider using ulegalforms, which simplifies document filing and compliance for your business.

Corporations and limited liability companies (LLCs) are legally required to file an annual report in New Hampshire. This requirement ensures that these entities maintain good standing with the state. If your firm falls under these categories, your annual report should include the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm to validate your financial position. Consulting with an accounting firm can streamline this process and help ensure compliance.

To file a BOI report in New Hampshire, you should gather all necessary financial statements and ensure you have the correct form from the state. It’s essential to accurately compile your financial data, as this is crucial for the New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm. Once you have completed your report, you can submit it through the official state website or via mail. For additional assistance, consider using ulegalforms, which guides you through the filing process with ease.

Writing a compiled report requires you to focus on the client's financial data and how it is structured. This includes drafting the report according to established accounting principles while ensuring clarity and accuracy. Ultimately, the goal is to produce a summary in the form of a New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm.

To write a compilation report, begin by collecting all necessary financial information from your client. Organize the data into financial statements and follow the guidelines set forth by accounting standards. This process leads you to create a professional New Hampshire Report from Review of Financial Statements and Compilation by Accounting Firm that clients and stakeholders can trust.