New Hampshire Community Property Disclaimer

Description

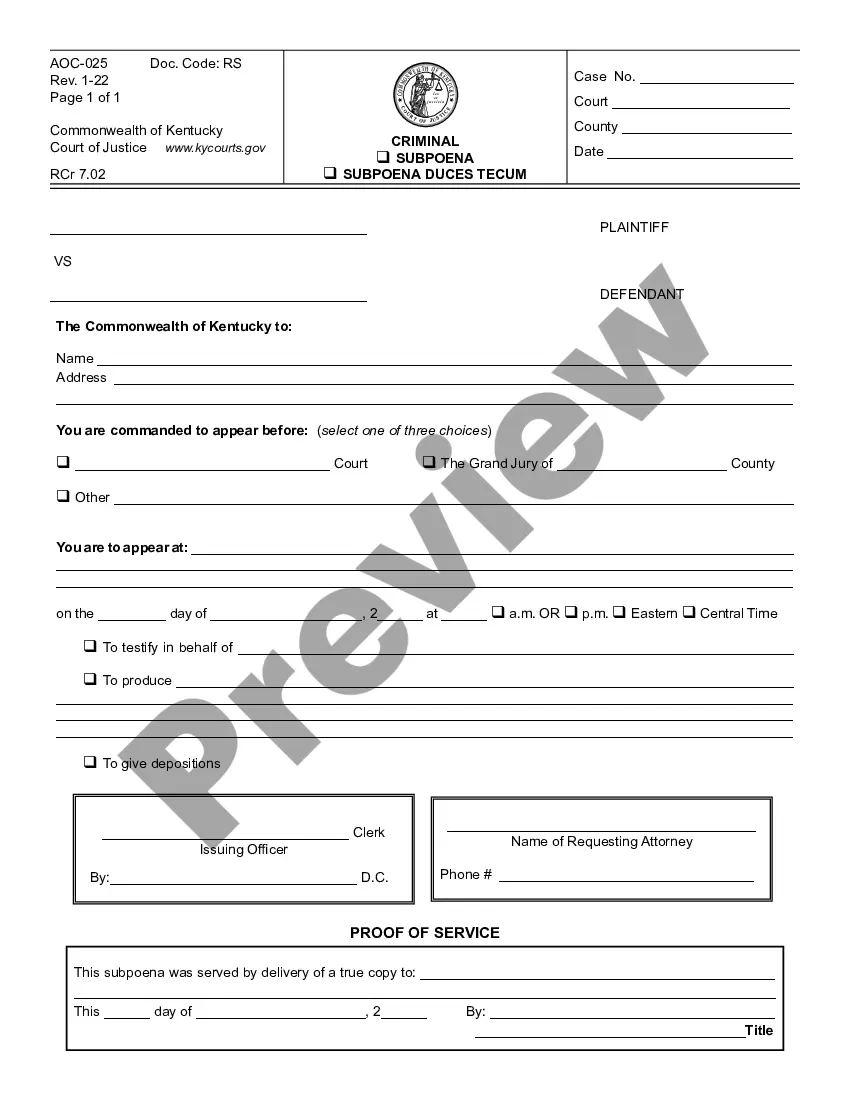

How to fill out Community Property Disclaimer?

Selecting the appropriate legal document template can be a significant challenge.

Of course, there is an assortment of designs accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm it suits your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired New Hampshire Community Property Disclaimer. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain well-crafted documents that comply with state regulations.

- The service offers thousands of templates, including the New Hampshire Community Property Disclaimer, suitable for both business and personal use.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the New Hampshire Community Property Disclaimer.

- Use your account to review the legal forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

New Hampshire is not classified as a community property state. Instead, it follows the principle of equitable distribution, meaning assets are divided fairly but not necessarily equally. If you need clarity on how this affects your situation, utilizing resources like the New Hampshire Community Property Disclaimer can guide you on the best approach to protect your rights and interests.

Marital property in New Hampshire includes any assets acquired during the marriage, regardless of whose name is on the title. This encompasses real estate, income, and personal belongings obtained while you were married. Understanding the distinction of marital property is essential, especially when dealing with a New Hampshire Community Property Disclaimer, as it directly affects division in divorce settlements.

In New Hampshire, adultery can influence divorce proceedings, but it is not a sole determining factor. The courts consider various elements, such as the impact of the adultery on the marriage and the overall circumstances of the divorce. If you are navigating a divorce, understanding how factors like the New Hampshire Community Property Disclaimer apply can help clarify the situation and ensure your rights are protected.

A qualified disclaimer must meet specific legal requirements to be valid. First, you must refuse the property, which means you do not accept any interest in it. Additionally, this disclaimer must be made within nine months of the transfer. It's important to understand these details, especially in relation to the New Hampshire Community Property Disclaimer, to ensure compliance and protect your interests.

Yes, it is possible to disclaim jointly held property in certain circumstances, but this process can be intricate. Generally, both parties must agree on the disclaimer, and it must be executed in accordance with state laws. By understanding the New Hampshire Community Property Disclaimer, individuals can better evaluate their rights and options in jointly held properties, ensuring proper handling of their interests.

A spouse might choose to disclaim assets for various reasons, including tax implications, finances, or unwanted responsibilities associated with the assets. Disclaiming assets can help protect one’s financial interests, especially in complicated estate situations. Utilizing the New Hampshire Community Property Disclaimer can provide legal clarity, ensuring that any disclaimed assets are appropriately handled according to state laws.

In New Hampshire, the time limit for disclaiming an inheritance is typically nine months from the date of death of the decedent. A proper disclaimer must be filed with the court, and it should comply with the requirements outlined in the New Hampshire Community Property Disclaimer laws. Understanding this timeline is vital for individuals who wish to decline inherited assets, as it ensures they make informed choices within the legal framework.

In New Hampshire, adverse possession laws allow individuals to claim ownership of land if they meet certain conditions, such as open and notorious use for a specified period. This often involves a continuous and exclusive claim to the property, which can complicate estate matters. If you're dealing with property disputes, understanding these laws in the context of a New Hampshire Community Property Disclaimer can guide you in making informed decisions.

When a spouse dies, community property usually divides between the surviving spouse and the deceased spouse’s heirs, based on state laws. In New Hampshire, the concept of community property is different from common law, so applying a New Hampshire Community Property Disclaimer is crucial for clarity in asset distribution. It is advisable to consult with a legal expert to navigate this process effectively.

Non-marital assets are properties acquired before marriage or through inheritance, gifts, or separate ownership. In New Hampshire, these assets typically remain with the owner when dividing property during divorce. Understanding how non-marital assets relate to a New Hampshire Community Property Disclaimer can clarify your rights.