The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

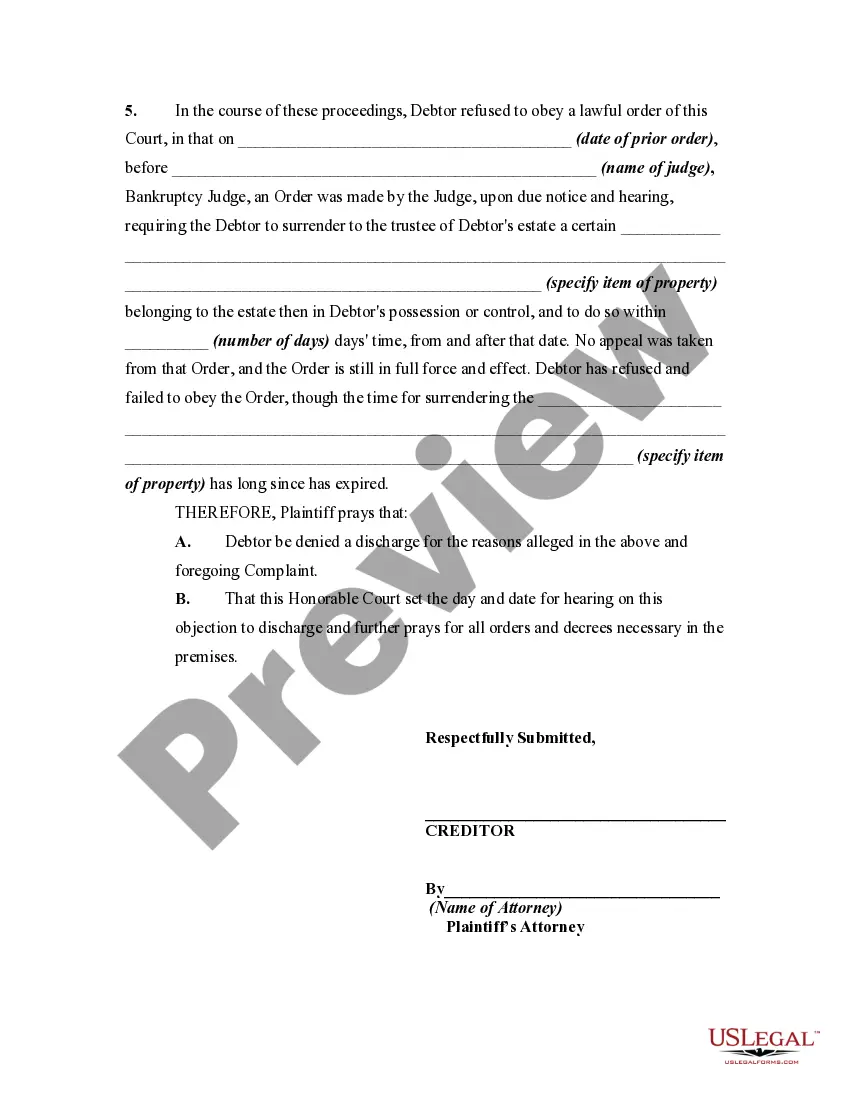

New Hampshire Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

Discovering the right legal record web template might be a have a problem. Obviously, there are tons of layouts available on the net, but how can you find the legal kind you require? Take advantage of the US Legal Forms internet site. The assistance delivers thousands of layouts, such as the New Hampshire Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the, which can be used for business and private needs. All of the forms are checked by specialists and fulfill federal and state requirements.

In case you are previously signed up, log in in your accounts and click the Obtain key to have the New Hampshire Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the. Make use of accounts to appear with the legal forms you might have purchased previously. Go to the My Forms tab of your own accounts and obtain another backup in the record you require.

In case you are a new end user of US Legal Forms, here are basic guidelines for you to adhere to:

- Very first, be sure you have chosen the appropriate kind for the metropolis/region. You can check out the shape making use of the Review key and study the shape information to guarantee it is the best for you.

- When the kind fails to fulfill your needs, take advantage of the Seach industry to get the appropriate kind.

- Once you are sure that the shape is proper, go through the Purchase now key to have the kind.

- Opt for the prices plan you desire and enter in the necessary information and facts. Build your accounts and pay money for the order utilizing your PayPal accounts or bank card.

- Select the file format and download the legal record web template in your product.

- Full, change and printing and signal the attained New Hampshire Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

US Legal Forms is the largest local library of legal forms where you can see various record layouts. Take advantage of the company to download professionally-produced papers that adhere to condition requirements.

Form popularity

FAQ

If you had a Chapter 7 that resulted in discharge of your debts, you must wait at least eight years from the date you filed it before filing Chapter 7 bankruptcy again. While Chapter 7 is typically the quickest form of debt relief, the eight-year period to refile is the longest waiting time between cases.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

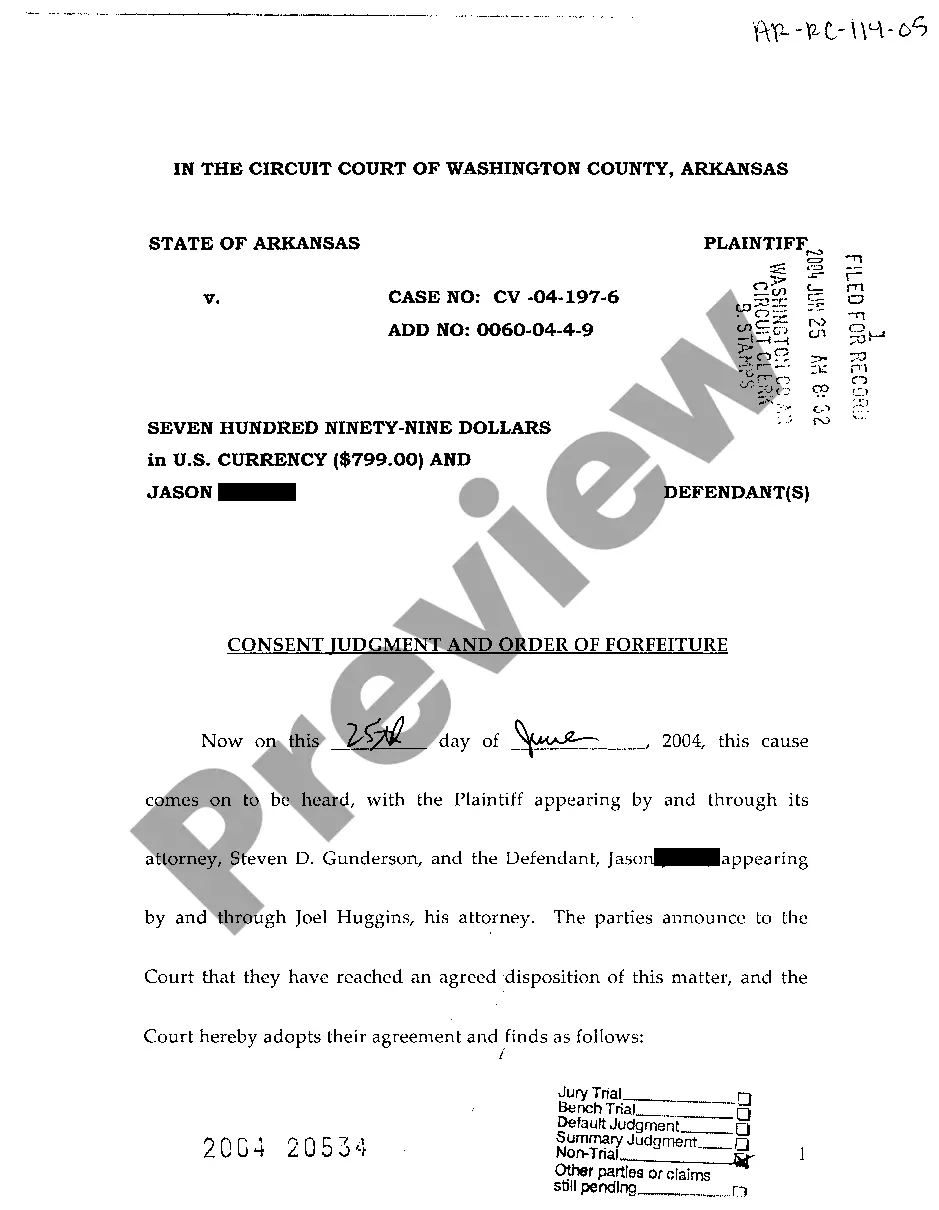

Section 523 complaints focus on specific debts to a single creditor. A Section 727 complaint may be filed if the creditor or bankruptcy trustee believes that the debtor has not met the requirements for a discharge under Section 727. Section 727 complaints address the discharge of a debtor's entire debt obligations.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Article I, Section 8, of the United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies." Under this grant of authority, Congress enacted the "Bankruptcy Code" in 1978.