The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

New Hampshire Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding Debtor's Financial Condition

Description

How to fill out Complaint Objecting To Discharge By Bankruptcy Court On The Grounds That Transaction Was Induced By Fraud Regarding Debtor's Financial Condition?

US Legal Forms - one of the largest libraries of authorized forms in the United States - gives a variety of authorized file templates you may download or print out. Using the site, you may get 1000s of forms for company and individual uses, categorized by types, suggests, or keywords and phrases.You will find the newest variations of forms such as the New Hampshire Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding in seconds.

If you already possess a monthly subscription, log in and download New Hampshire Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding from the US Legal Forms collection. The Acquire option can look on each kind you see. You have access to all earlier acquired forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, listed here are simple guidelines to help you began:

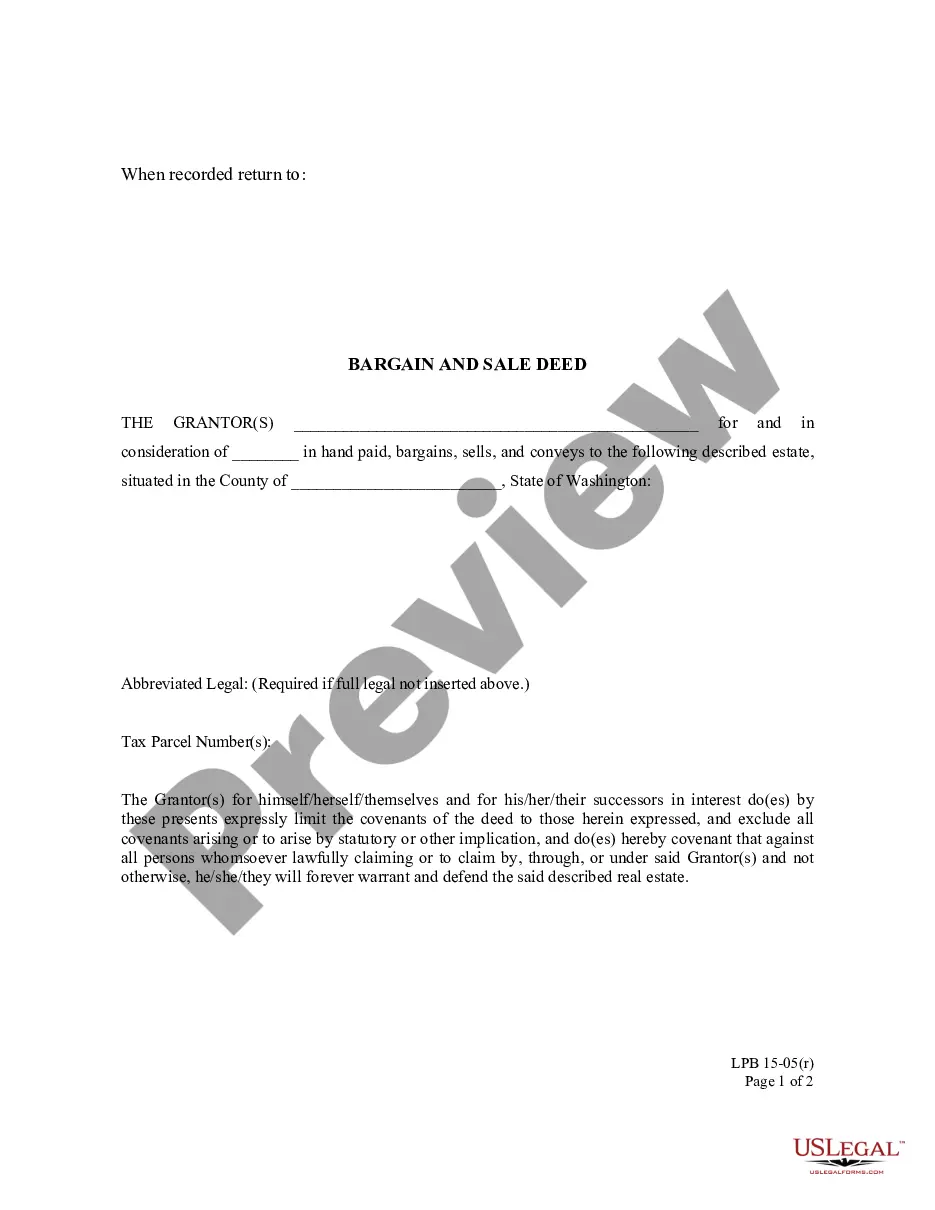

- Be sure you have chosen the proper kind to your metropolis/area. Click the Preview option to review the form`s content material. Browse the kind outline to actually have selected the correct kind.

- In case the kind does not fit your requirements, utilize the Lookup field near the top of the display to find the the one that does.

- Should you be happy with the shape, verify your choice by clicking on the Get now option. Then, pick the pricing plan you want and supply your qualifications to register for an accounts.

- Method the transaction. Use your bank card or PayPal accounts to finish the transaction.

- Find the formatting and download the shape in your gadget.

- Make adjustments. Load, edit and print out and sign the acquired New Hampshire Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding.

Every template you included in your money lacks an expiry particular date and is the one you have forever. So, if you wish to download or print out an additional copy, just check out the My Forms section and then click around the kind you want.

Gain access to the New Hampshire Complaint Objecting to Discharge by Bankruptcy Court on the Grounds that Transaction was Induced by Fraud Regarding with US Legal Forms, one of the most comprehensive collection of authorized file templates. Use 1000s of skilled and state-certain templates that satisfy your business or individual requirements and requirements.

Form popularity

FAQ

Conditions for Denial of Discharge You've hidden, destroyed, or failed to keep adequate records of your assets and financial affairs. You lied or tried to defraud the court or your creditors. You failed to explain any loss of assets. You refused to obey a lawful order of the court.

In a decision handed down on February 22, 2023, Bartenwerfer v. Buckley, the United States Supreme Court ruled that the bankruptcy process cannot be used to discharge debts incurred through fraud, even when the debtor was not the individual that defrauded creditors.

In a unanimous decision, the Supreme Court held that § 523(a)(2)(A) of the Bankruptcy Code precludes a debtor from discharging a debt obtained by fraud, regardless of the debtor's own culpability.

Debts Never Discharged in Bankruptcy Alimony and child support. Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years. Debts for willful and malicious injury to another person or property.

The Supreme Court recently ruled that debtors cannot get out of paying creditors whom they have defrauded, even when they aren't directly involved in the fraud. This means a debtor can't escape the consequences of fraudulent activity by filing for bankruptcy.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

In a unanimous decision, the Supreme Court held that § 523(a)(2)(A) of the Bankruptcy Code precludes a debtor from discharging a debt obtained by fraud, regardless of the debtor's own culpability.

Section 523(a)(2) provides in substance that an individual Chapter 7 debtor does not receive a discharge from any debt for money obtained by fraud.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.