New Hampshire Promissory Note - Payable on Demand

Description

How to fill out Promissory Note - Payable On Demand?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous authentic document templates available online, but finding forms you can trust is not easy.

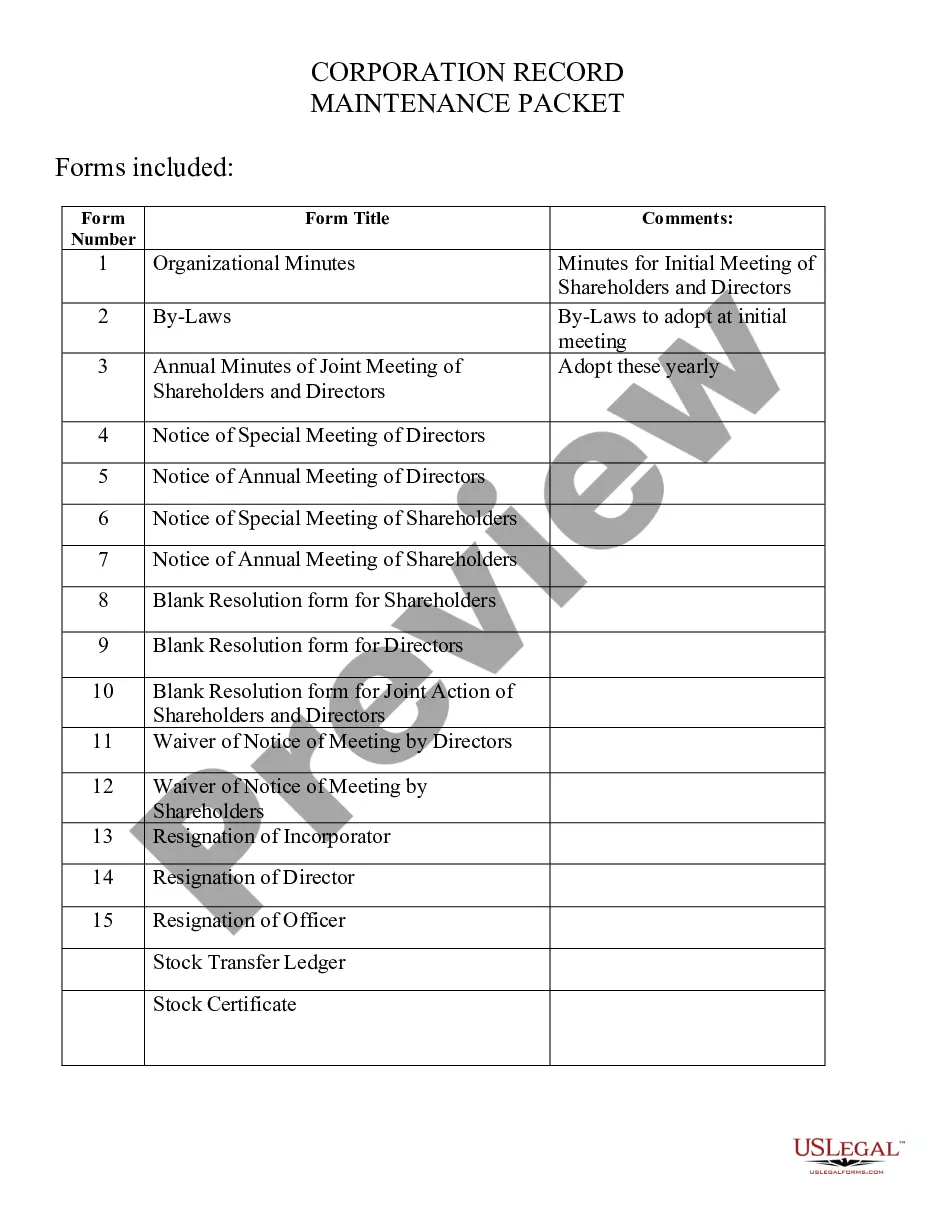

US Legal Forms offers thousands of document templates, such as the New Hampshire Promissory Note - Payable on Demand, designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, complete the required information to create your account, and finalize your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Promissory Note - Payable on Demand template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is appropriate for the correct city/region.

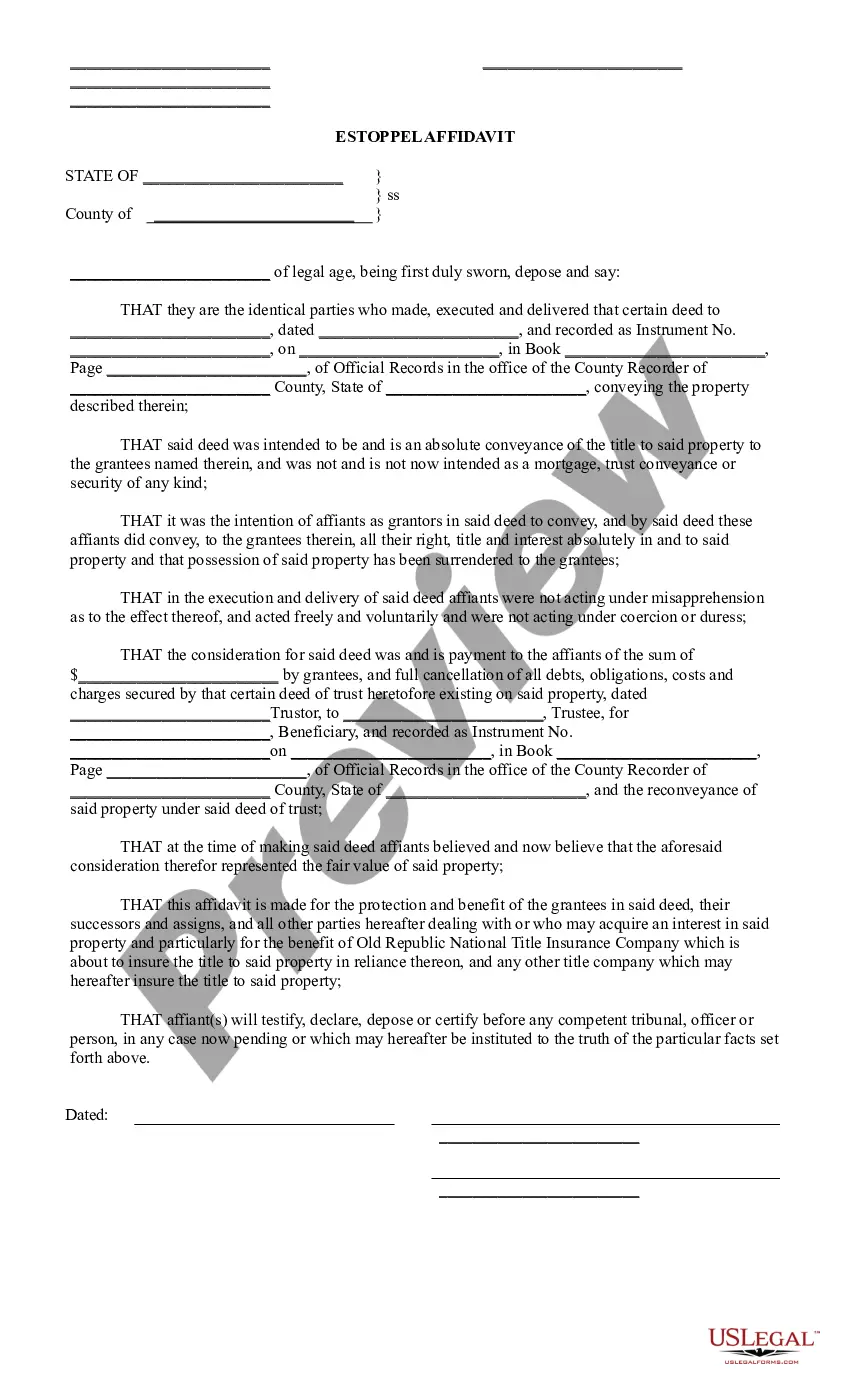

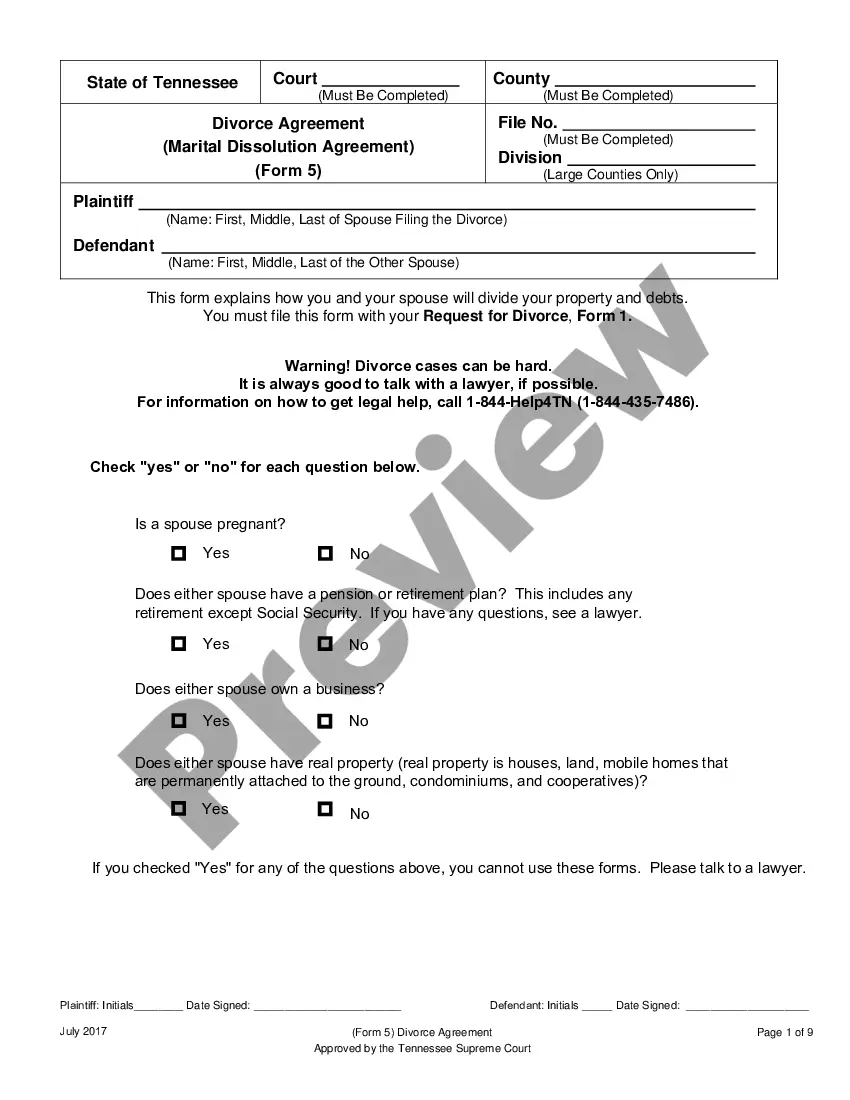

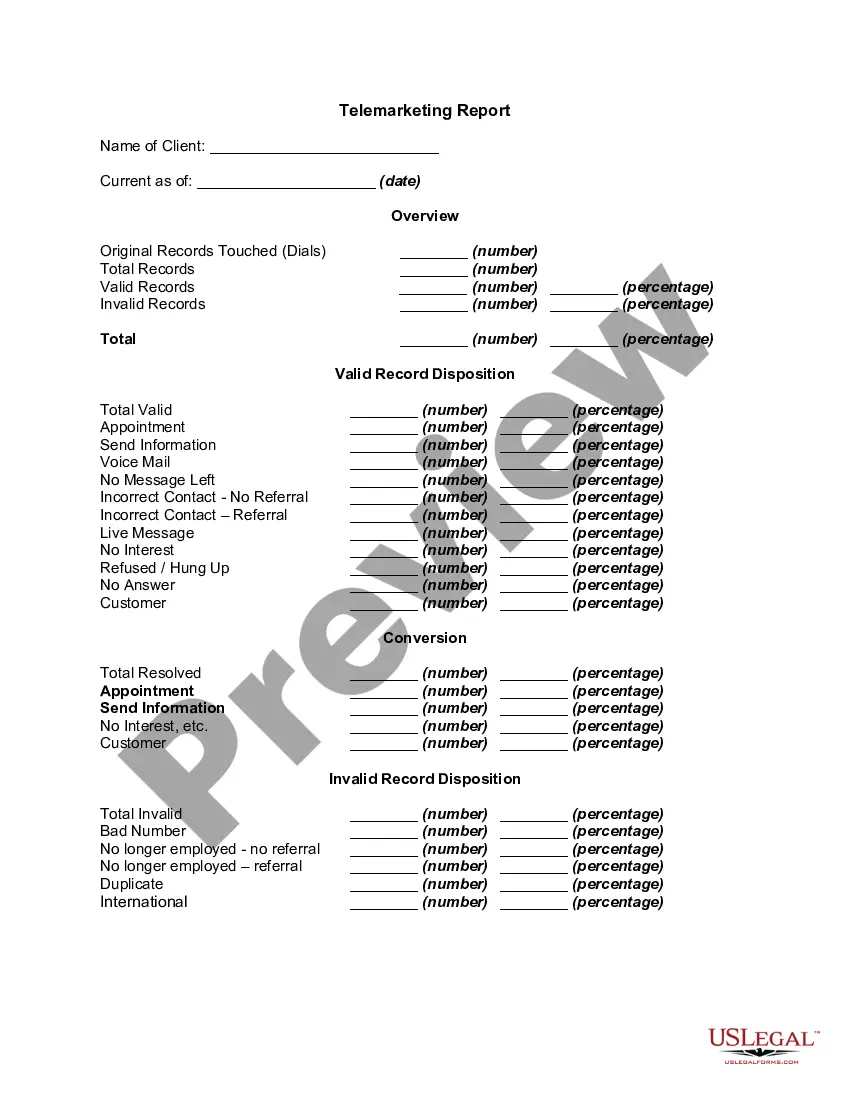

- Utilize the Preview feature to review the document.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the document that fits your needs.

Form popularity

FAQ

A note payable on demand, such as a New Hampshire promissory note - payable on demand, is a financial instrument that requires repayment whenever the lender demands it. This type of note provides significant advantages, including immediate repayment options for the lender. It establishes a clear agreement between the borrower and lender. If you are new to creating these notes, uslegalforms can guide you through the steps.

Yes, you can demand a promissory note if it is structured as payable on demand. This means the lender has the right to request repayment at any time, according to the stipulations laid out in the note. Using platforms like USLegalForms can simplify the process of creating and managing a New Hampshire Promissory Note - Payable on Demand, ensuring all legal requirements are met for successful transactions.

Examples of promissory notes include personal loans from friends, family, or financial institutions. A New Hampshire Promissory Note - Payable on Demand can also be issued for business purposes, like short-term loans or financing agreements. Each example typically outlines the repayment conditions, whether secured or unsecured.

Writing a simple promissory note involves several key components. Include the details of both the borrower and lender, the principal amount, interest rate, and repayment terms. For a New Hampshire Promissory Note - Payable on Demand, specify that the payment is due upon request and ensure both parties sign and date the document for legal validity.

A promissory note is not typically payable to bearer on demand to ensure the identity of the payee. The term 'payable on demand' signifies that the lender can request payment, but the note is specifically tied to a named individual rather than anyone holding the document. This creates a stronger legal framework under New Hampshire law, as it helps prevent fraud and ensures secure transactions.

You can easily obtain your New Hampshire Promissory Note - Payable on Demand by drafting the document yourself or finding a reputable service. US Legal Forms offers templates that simplify the process. Select a suitable template, fill in the necessary details, and ensure both parties sign it. This ensures you have an enforceable note that protects your rights as a lender or borrower.

Payable to the bearer on demand refers to financial instruments that allow the holder to request payment at any time. These agreements typically offer great flexibility and immediate access to funds. However, a New Hampshire Promissory Note - Payable on Demand retains an advantage by defining clear repayment conditions that safeguard both the lender's and borrower's interests.

In the context of financial instruments, instruments that are not payable to bearers often come with specific conditions or must be endorsed. Unlike a New Hampshire Promissory Note - Payable on Demand, which obligates the borrower to repay when requested, other notes might restrict direct transfer to anyone holding the document. Such conditions are set to ensure certain legal protections.

A promissory note can indeed be payable on demand, which allows the lender to request repayment at any moment. This feature is particularly beneficial in a New Hampshire Promissory Note - Payable on Demand scenario. It offers a safety net for lenders, as they can ensure prompt repayment as needed.

Certainly, both a promissory note and a bill of exchange can be designated as payable on demand. This type of arrangement ensures immediate repayment based on the lender's request, offering flexibility. Utilizing a New Hampshire Promissory Note - Payable on Demand is an effective way to structure your financial agreements for quick liquidity.