New Hampshire Acknowledgment by Debtor of Correctness of Account Stated

Description

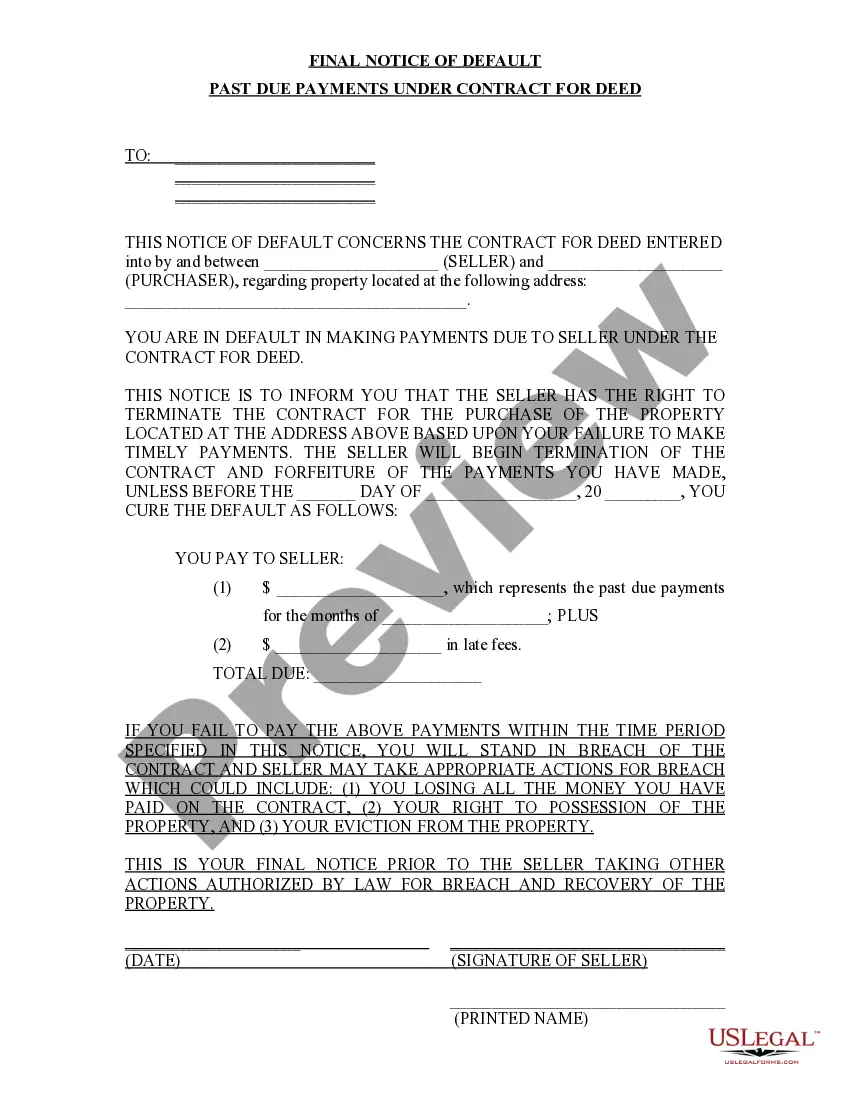

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms like the New Hampshire Acknowledgment by Debtor of Correctness of Account Stated within minutes.

Check the form description to confirm you have chosen the appropriate form.

If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

- If you already have a monthly subscription, Log In and access the New Hampshire Acknowledgment by Debtor of Correctness of Account Stated from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are easy steps to help you get started.

- Make sure you have selected the correct form for your city/region.

- Read the Preview button to review the form's details.

Form popularity

FAQ

The notarization process is typically simple. You present a document to a notary public and sign it in their presence. After that, the notary officially notarizes the document using an official stamp, writes in the date, and adds their own signature.

Each document must have an original New Hampshire Notary Public or Justice of the Peace signature witnessing the signature of the author of the document. If signed by a notary, the notary's seal must be included in order to be certified by this office.

The Creditor's claim will only prescribe after the period of three years have lapsed from the date of the acknowledgement of debt, even if the debt was admitted without prejudice.

Acknowledgement of Debt. Section 18 of the limitation act covers acknowledgement of debt and thus the fresh start of the limitation period. It is a tool which always plaintiff uses to say that his suit is within the limitation period as there is an acknowledgement as per s.

An Acknowledgment of Debt is a contract which both a debtor and creditor sign acknowledging that a debtor is indebted to the creditor and for how much as well as setting out the payment terms of paying off the debt owed.

There's no time limit for the creditor to enforce the order. If the court order was made more than 6 years ago, the creditor has to get court permission before they can use bailiffs.

A Debt Acknowledgment Letter is a document signed by one primary party, the debtor, as an acknowledgment of a specific amount of money owed to another party, the creditor.

Do hereby acknowledge that I am truly and lawfully indebted to 202620262026202620262026202620262026202620262026202620262026202620262026202620262026 I hereby bind myself to pay the full amount of the said capital by not later than 202620262026202620262026202620262026202620262026202620262026202620262026202620262026202620262026 (insert final date of repayment) Interest will be charged should payment not be received on the due date.

An acknowledgment of a debt or liability by a debtor in writing or a partial payment of the outstanding dues, during the subsisting period of limitation, extends the period of limitation. There are several cases pending before the Supreme Court in which these issues have cone up for consideration.

Contracts and open accounts: 3 years, (RSA 5). Notes secured by a mortgage: 20 years and applies even if the mortgage has been foreclosed, (RSA 5).