New Hampshire Receipt for Payment of Account

Description

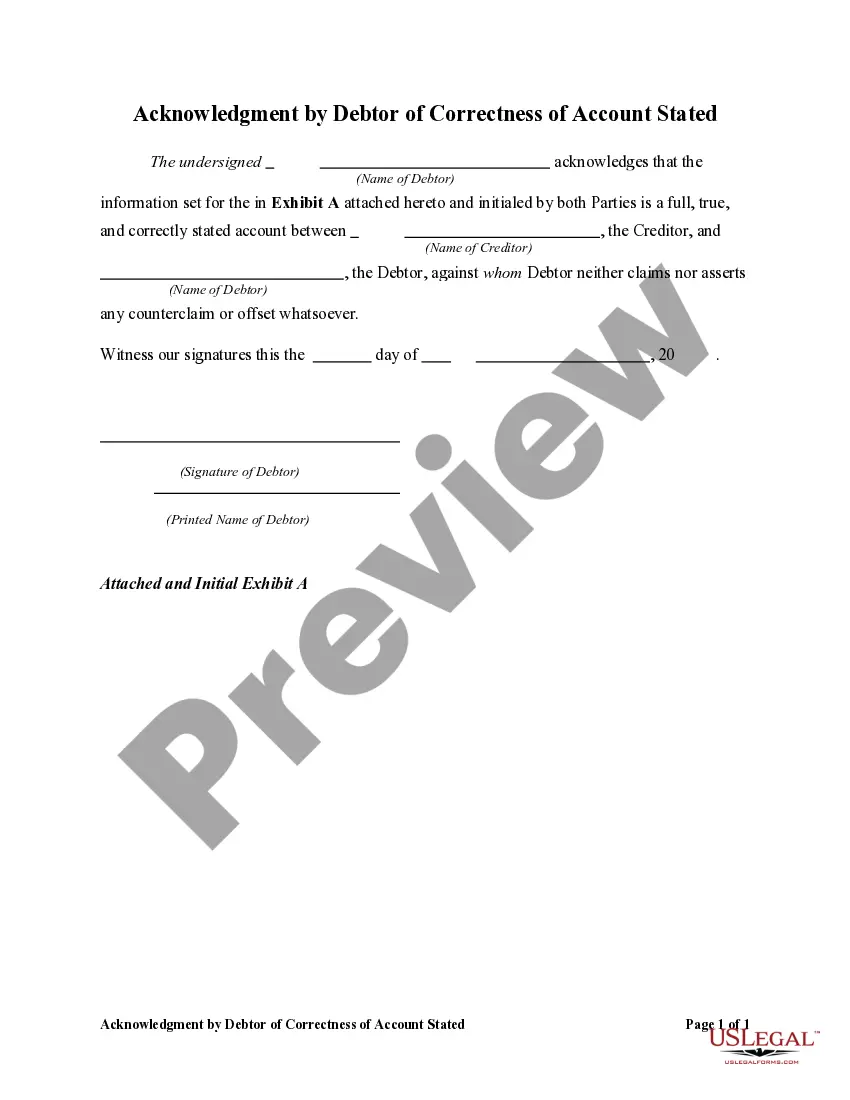

How to fill out Receipt For Payment Of Account?

US Legal Forms - one of many most significant libraries of authorized forms in the United States - offers a variety of authorized file themes you can download or print out. Utilizing the web site, you will get a large number of forms for organization and personal purposes, sorted by groups, states, or keywords and phrases.You will discover the most recent versions of forms such as the New Hampshire Receipt for Payment of Account in seconds.

If you have a monthly subscription, log in and download New Hampshire Receipt for Payment of Account through the US Legal Forms catalogue. The Down load key can look on each and every type you perspective. You have accessibility to all previously acquired forms from the My Forms tab of your accounts.

If you wish to use US Legal Forms the first time, allow me to share straightforward instructions to help you get began:

- Ensure you have chosen the correct type for your personal city/area. Select the Review key to analyze the form`s articles. See the type outline to ensure that you have selected the right type.

- When the type does not satisfy your specifications, make use of the Lookup discipline on top of the monitor to obtain the one who does.

- Should you be content with the form, verify your selection by clicking the Buy now key. Then, pick the costs program you favor and give your accreditations to register to have an accounts.

- Method the purchase. Use your bank card or PayPal accounts to perform the purchase.

- Choose the format and download the form on your gadget.

- Make modifications. Complete, modify and print out and indicator the acquired New Hampshire Receipt for Payment of Account.

Each and every template you added to your bank account lacks an expiration day and it is yours eternally. So, if you want to download or print out another duplicate, just visit the My Forms section and then click in the type you require.

Gain access to the New Hampshire Receipt for Payment of Account with US Legal Forms, by far the most comprehensive catalogue of authorized file themes. Use a large number of expert and status-certain themes that fulfill your small business or personal needs and specifications.

Form popularity

FAQ

Under the state Constitution, all revenues in excess of the necessary cost of collection and administration accruing to the state from motor vehicle registration fees, operators' licenses, gasoline road toll, or any other special charges or taxes with respect to the operation of motor vehicles or the sale or ...

New Hampshire Annual Report Fee: $100 Due every year by April 1st, your LLC's New Hampshire Annual Report costs $100 to file. If you're late for the filing deadline, the Corporations Division will charge an additional $50 late fee.

New Hampshire does not levy a general sales tax or individual income tax. (New Hampshire reports some income tax revenue because it levies a tax on interest and dividend income.) New Hampshire's largest sources of per capita revenue were property taxes ($3,329) and federal transfers ($2,772).

County revenues rely on property taxes, Medicaid and limited Medicare payments, fees, and other locally-generated revenues to fund these services. State government provides the widest variety of services in New Hampshire.

You need to file an Annual Report in order to keep your New Hampshire LLC in compliance and in good standing with the state. You must complete your New Hampshire Annual Report online (using the New Hampshire QuickStart filing system). And then you can either submit it online or print it and submit it by mail.

New Hampshire Income Taxes New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

Estimated FY 2024 Restricted and Unrestricted RevenueFund TypeAmountPercentFederal Funds$2,359,066,54931.7%General Funds$1,821,375,79524.5%Other Funds$1,487,584,98820.0%11 more rows

NH QuickStart, is an online platform for business registration with the Corporation Division of the Secretary of State's Office. Application for Registration of Trade Name: Anyone doing business under any name except his or her own is required to register that trade name with the Secretary of State's Office.