New Hampshire Receipt of Payment for Obligation

Description

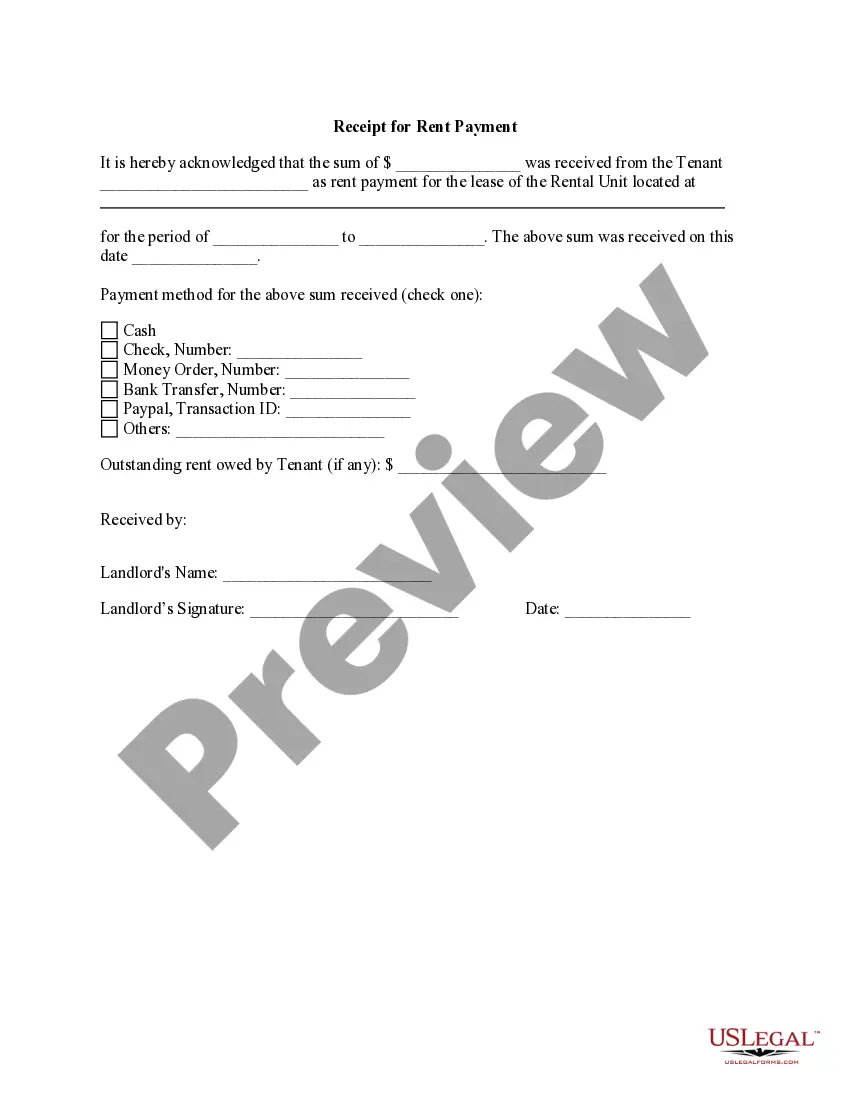

How to fill out Receipt Of Payment For Obligation?

If you want to total, down load, or print lawful record layouts, use US Legal Forms, the most important variety of lawful varieties, that can be found on the web. Make use of the site`s basic and hassle-free lookup to obtain the files you will need. Different layouts for organization and person functions are sorted by groups and claims, or keywords. Use US Legal Forms to obtain the New Hampshire Receipt of Payment for Obligation in a few clicks.

If you are presently a US Legal Forms buyer, log in in your account and then click the Obtain button to obtain the New Hampshire Receipt of Payment for Obligation. Also you can accessibility varieties you in the past delivered electronically within the My Forms tab of your respective account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape for that right metropolis/nation.

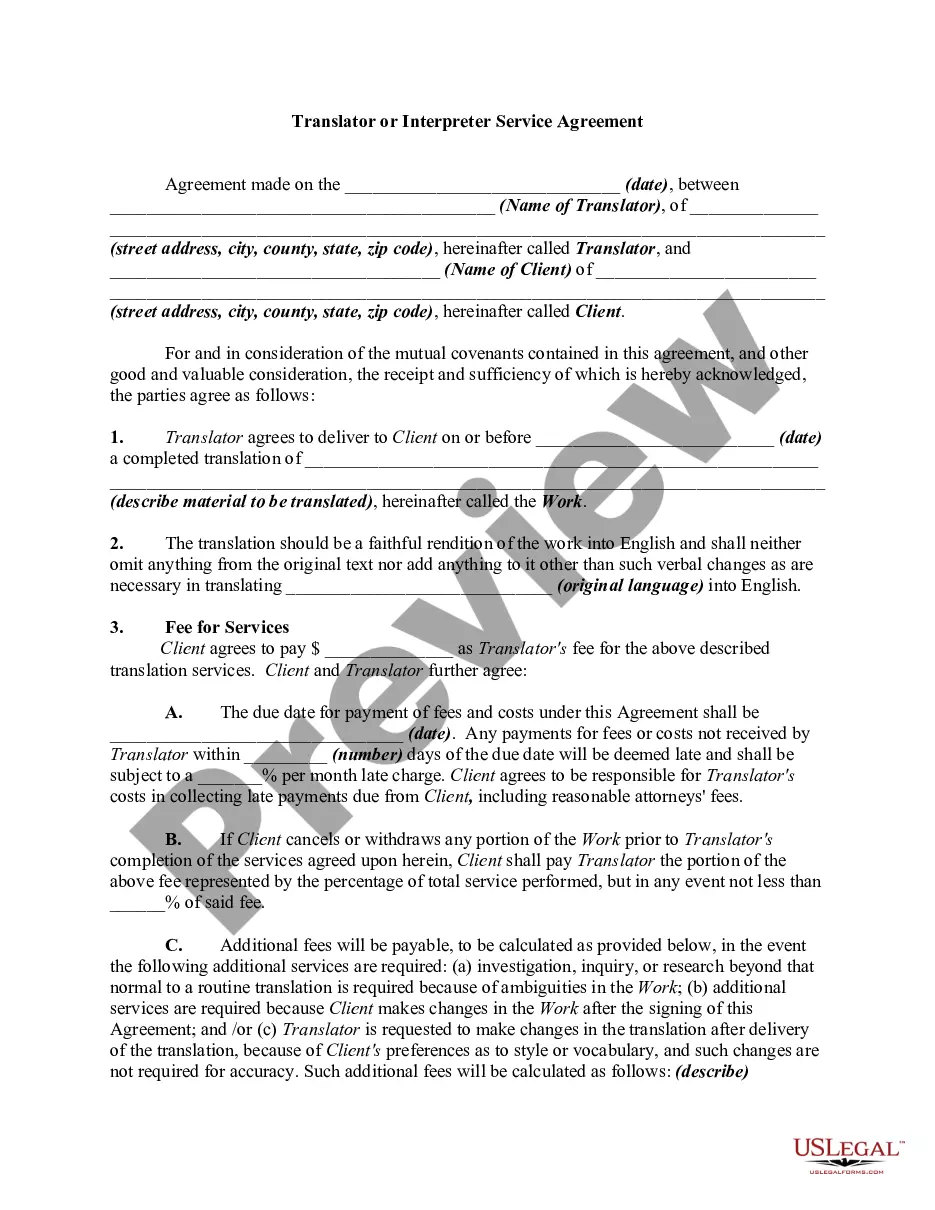

- Step 2. Use the Review choice to check out the form`s content material. Don`t overlook to learn the explanation.

- Step 3. If you are not happy with all the develop, make use of the Look for area on top of the screen to find other models in the lawful develop design.

- Step 4. After you have identified the shape you will need, click the Buy now button. Select the prices strategy you choose and include your credentials to sign up for an account.

- Step 5. Approach the transaction. You can utilize your charge card or PayPal account to accomplish the transaction.

- Step 6. Find the structure in the lawful develop and down load it on your product.

- Step 7. Complete, revise and print or indicator the New Hampshire Receipt of Payment for Obligation.

Each and every lawful record design you purchase is your own forever. You possess acces to every develop you delivered electronically with your acccount. Click the My Forms area and pick a develop to print or down load once more.

Compete and down load, and print the New Hampshire Receipt of Payment for Obligation with US Legal Forms. There are many specialist and state-certain varieties you may use for the organization or person needs.

Form popularity

FAQ

A 540-A Petition is a request for court assistance to protect the rights of a tenant or landlord and stop actions prohibited by law under RSA 540-A. The law provides for quick relief from prohibited actions by the other party.

Within 30 days from when your tenancy ends, your landlord must return your full security deposit, or the portion left after deductions for unpaid rent and/or the cost of repairs. You can sue your landlord in small claims court if you do not get your security deposit back within 30 days.

A 540-A Petition is a request for court assistance to protect the rights of a tenant or landlord and stop actions prohibited by law under RSA 540-A. The law provides for quick relief from prohibited actions by the other party.

If your landlord gives you a valid 30-day rent increase notice which you do not pay, you will not have the right to cure by paying the increased amount after the landlord issues the 30-day notice to quit. There is no New Hampshire statute limiting how much a landlord can raise the rent.

Judgments. This includes actions of debt upon judgments, whether domestic or foreign, recognizances, and contracts under seal. In these cases, the creditor can file a lawsuit within 20 years after the cause of action accrued. Mortgage.

It is against the law RSA 540-A for a landlord to: Enter your residence without permission, except to make emergency repairs. (You should not refuse your landlord's reasonable request to enter with enough notice); Take any other action to force you out of your home without going through the eviction process.

A person who rents or leases a single-family residence and owns no other rental property or who rents or leases rental units in an owner-occupied building of 5 units or less shall not be considered a "landlord'' for the purposes of this subdivision, except for any individual unit in such building which is occupied by a ...