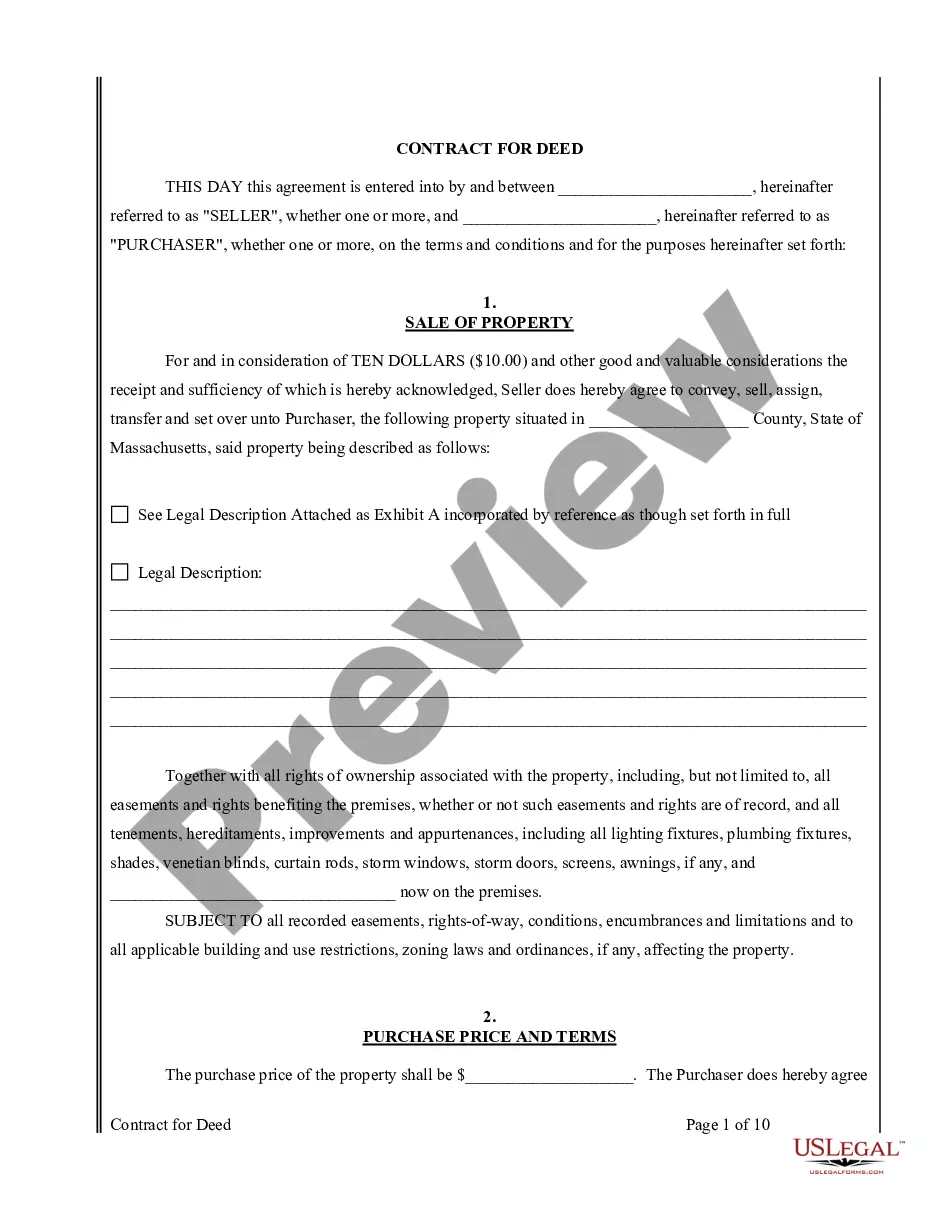

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

New Hampshire Change or Modification Agreement of Deed of Trust

Description

How to fill out Change Or Modification Agreement Of Deed Of Trust?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing option you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the New Hampshire Change or Modification Agreement of Deed of Trust. Each legal document format you purchase is yours permanently. You have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again. Compete and acquire, and print the New Hampshire Change or Modification Agreement of Deed of Trust with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to quickly find the New Hampshire Change or Modification Agreement of Deed of Trust with just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to access the New Hampshire Change or Modification Agreement of Deed of Trust.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Utilize the Preview feature to review the form's details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal document format.

Form popularity

FAQ

Yes, a trust can be edited, but the process depends on the type of trust you have. Revocable trusts are easier to modify compared to irrevocable trusts, which often require more legal steps. If you need to make changes to your trust, you might also want to consider a New Hampshire Change or Modification Agreement of Deed of Trust to align your trust with your current wishes. USLegalForms offers resources to help you navigate these modifications smoothly.

Yes, you can write your own will in New Hampshire, and having it notarized adds an extra layer of validity. However, to ensure that your will meets all legal requirements, consider using a New Hampshire Change or Modification Agreement of Deed of Trust. This agreement can help clarify any modifications you wish to make in your estate planning. Platforms like USLegalForms provide templates and guidance to assist you in creating a legally sound document.

A modification of a deed of trust is a legal process that allows for changes to the obligations and terms of the original deed. This can involve adjusting payment amounts, interest rates, or other conditions to better fit the needs of the parties involved. For a clear understanding and implementation of these changes, the New Hampshire Change or Modification Agreement of Deed of Trust from US Legal Forms can be a valuable tool.

A trust agreement can be changed, but the process depends on the type of trust and its specific terms. Modifications usually require consent from all parties involved and must comply with state law. To effectively navigate this process, consider using the New Hampshire Change or Modification Agreement of Deed of Trust available from US Legal Forms.

Yes, New Hampshire permits transfer-on-death (TOD) deeds, which allow property to pass directly to beneficiaries without going through probate. This option simplifies the transfer process and can provide peace of mind. If you're interested in setting up a TOD deed in New Hampshire, explore the resources available through US Legal Forms for guidance.

Modification of a deed of trust refers to changes made to the original terms and conditions of the deed. This process can adjust payment terms, interest rates, or borrower obligations. Understanding the nuances of a New Hampshire Change or Modification Agreement of Deed of Trust is crucial for ensuring that all legal requirements are met.

Yes, you can alter a trust deed, but the process must adhere to legal guidelines. In New Hampshire, any alterations should be documented through a modification agreement, ensuring all parties are in agreement. Using a reliable resource like US Legal Forms can simplify this process and help you create a proper New Hampshire Change or Modification Agreement of Deed of Trust.

To modify a trust deed, you typically need to draft a formal amendment that outlines the changes you wish to make. This document must be signed by the necessary parties and recorded with the appropriate government office. When creating a New Hampshire Change or Modification Agreement of Deed of Trust, make sure to comply with local regulations to ensure validity.

Yes, a trustee can amend a trust deed under specific conditions. In New Hampshire, the trustee must follow the terms outlined in the original deed of trust or state law. It's essential to ensure that the amendment aligns with the intent of the original agreement. For assistance, consider utilizing the New Hampshire Change or Modification Agreement of Deed of Trust from US Legal Forms.