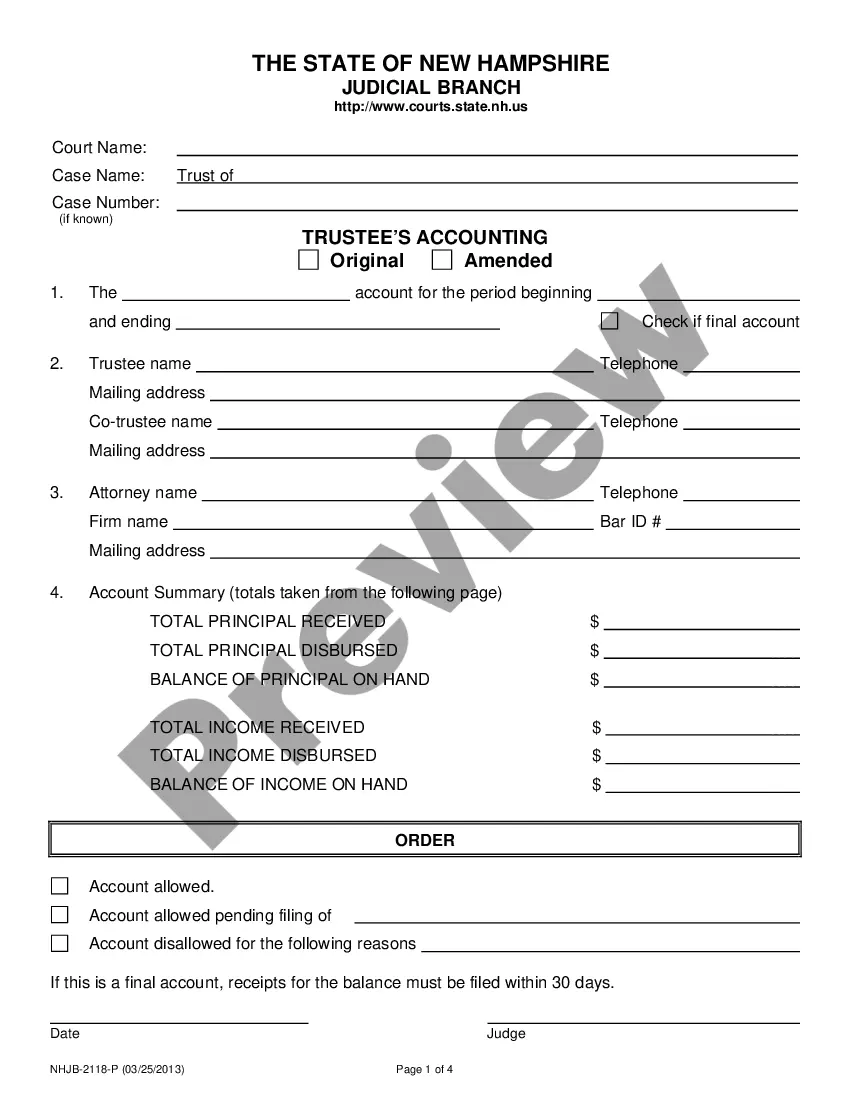

This form, along with the required attachments, is a report of all the transactions that have taken place during the accounting period specified on the form. Basically, it is used to show the court the details of how the principal and income of a trust have been managed. It will summarize monies received and disbursed out of the trust.

New Hampshire Trustee Accounting

Description

How to fill out New Hampshire Trustee Accounting?

US Legal Forms is really a special platform where you can find any legal or tax document for filling out, including New Hampshire Trustee Accounting. If you’re tired with wasting time seeking suitable examples and spending money on document preparation/legal professional service fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s advantages, you don't need to install any software but just pick a subscription plan and register an account. If you have one, just log in and look for an appropriate template, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Trustee Accounting, have a look at the instructions below:

- make sure that the form you’re checking out applies in the state you want it in.

- Preview the example and read its description.

- Click on Buy Now button to get to the register webpage.

- Select a pricing plan and carry on signing up by entering some info.

- Select a payment method to complete the sign up.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain about your New Hampshire Trustee Accounting sample, speak to a attorney to analyze it before you send out or file it. Get started without hassles!

Form popularity

FAQ

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

If the trustee fails to account, he or she is in violation of the statute and his or her fiduciary duty. If the beneficiaries are harmed by the lack of accounting, the trustee may be liable. Further, the court may become involved, may levy sanctions and could even remove the trustee.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

Taxes paid, disbursements made to trust beneficiaries, and gains and losses on trust assets. Fees and expenses paid to advisors of the trustee, such as attorneys, CPAs, and financial advisors.

Generally, the trustee only has to provide the annual accounting to each beneficiary to whom income or principal is required or authorized in the trustee's discretion to be currently distributed. The trust document has to be read and interpreted to determine who is entitled to accountings.

To familiarise itself with the terms of the trust especially beneficiaries and trust property; to act honestly, reasonably and in good faith; to preserve and not waste the value of the trust assets; to accumulate or pay income as directed by the trust instrument;