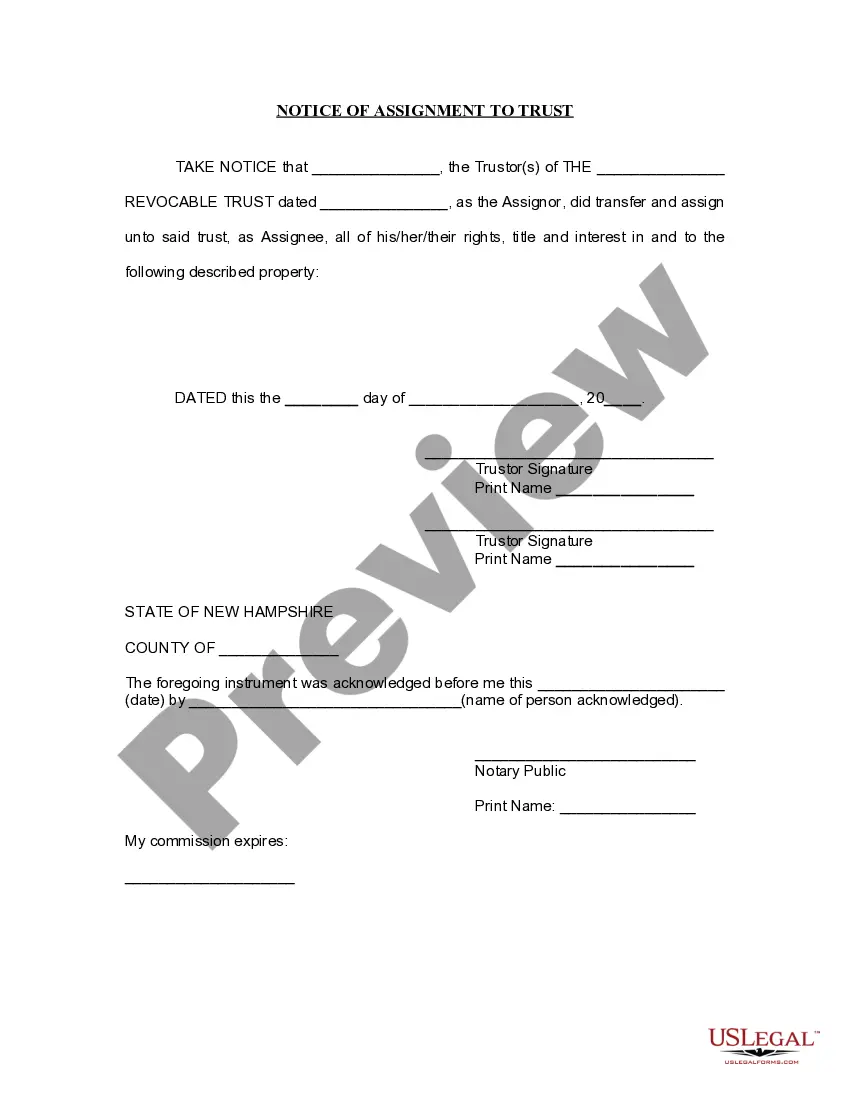

New Hampshire Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out New Hampshire Notice Of Assignment To Living Trust?

US Legal Forms is actually a unique platform where you can find any legal or tax document for submitting, such as New Hampshire Notice of Assignment to Living Trust. If you’re tired with wasting time seeking suitable samples and spending money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re trying to find.

To experience all the service’s advantages, you don't have to download any software but simply pick a subscription plan and create an account. If you have one, just log in and find a suitable sample, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need New Hampshire Notice of Assignment to Living Trust, take a look at the guidelines listed below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the example and look at its description.

- Click Buy Now to reach the register page.

- Pick a pricing plan and keep on signing up by entering some info.

- Select a payment method to complete the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure regarding your New Hampshire Notice of Assignment to Living Trust sample, contact a attorney to examine it before you send or file it. Get started without hassles!

Form popularity

FAQ

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

If you have a revocable living trust, it should still be valid in your new state, or in any state for that matter. The main consideration with your trust when you move is to make sure it is funded with all of the assets you want to pass directly to a beneficiary.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

Trusts are transferrable from state to state, but it always makes sense to have your estate plan reviewed when you move.