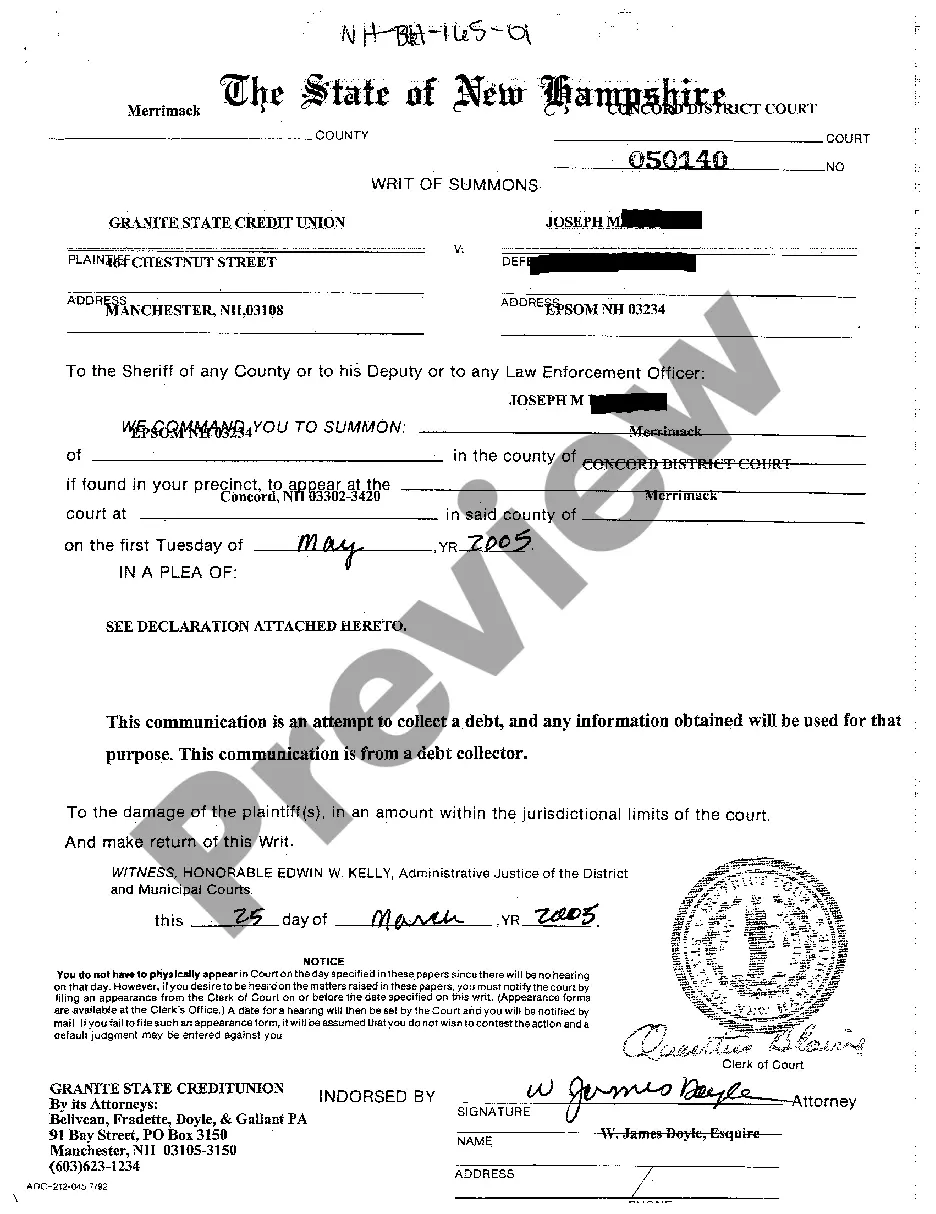

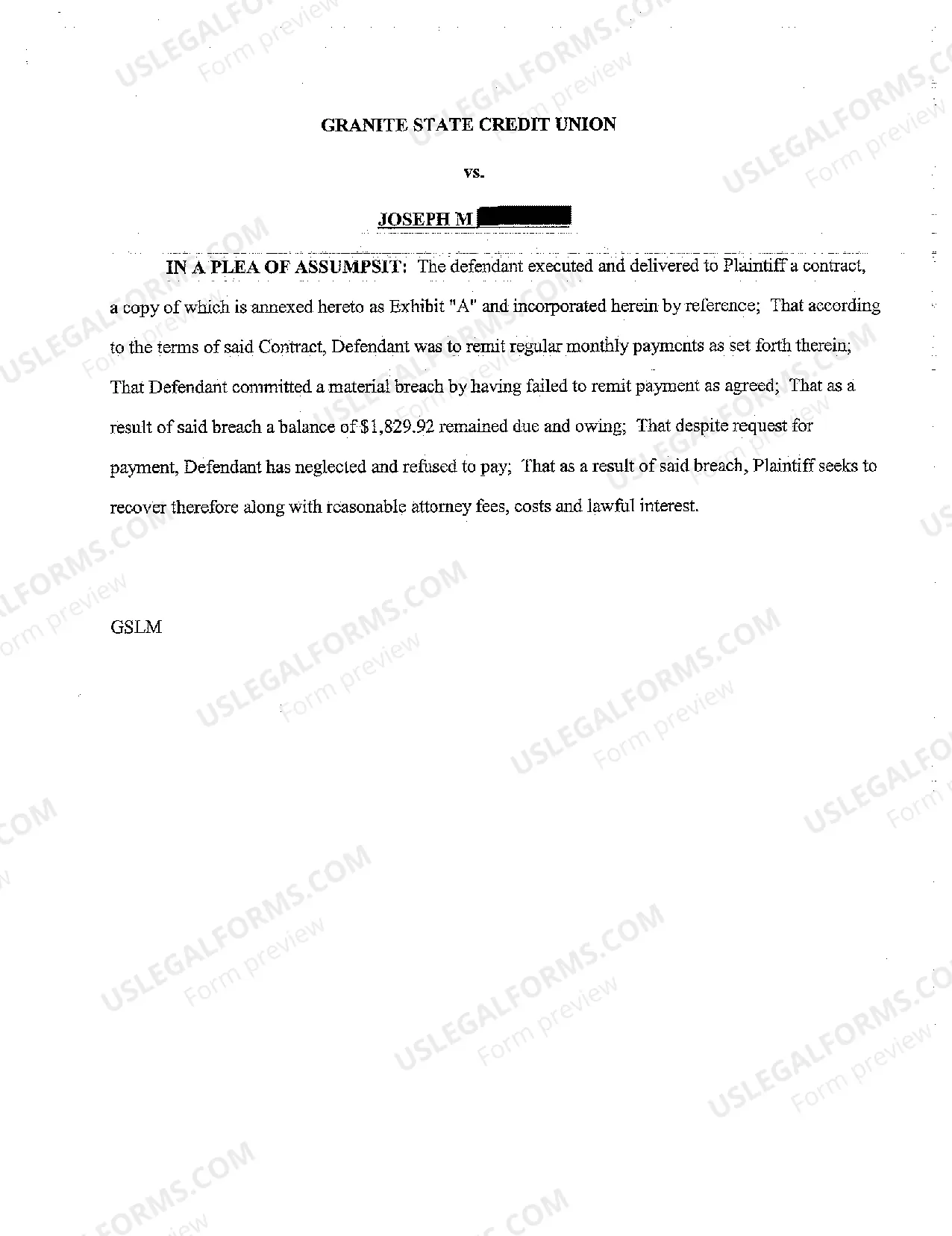

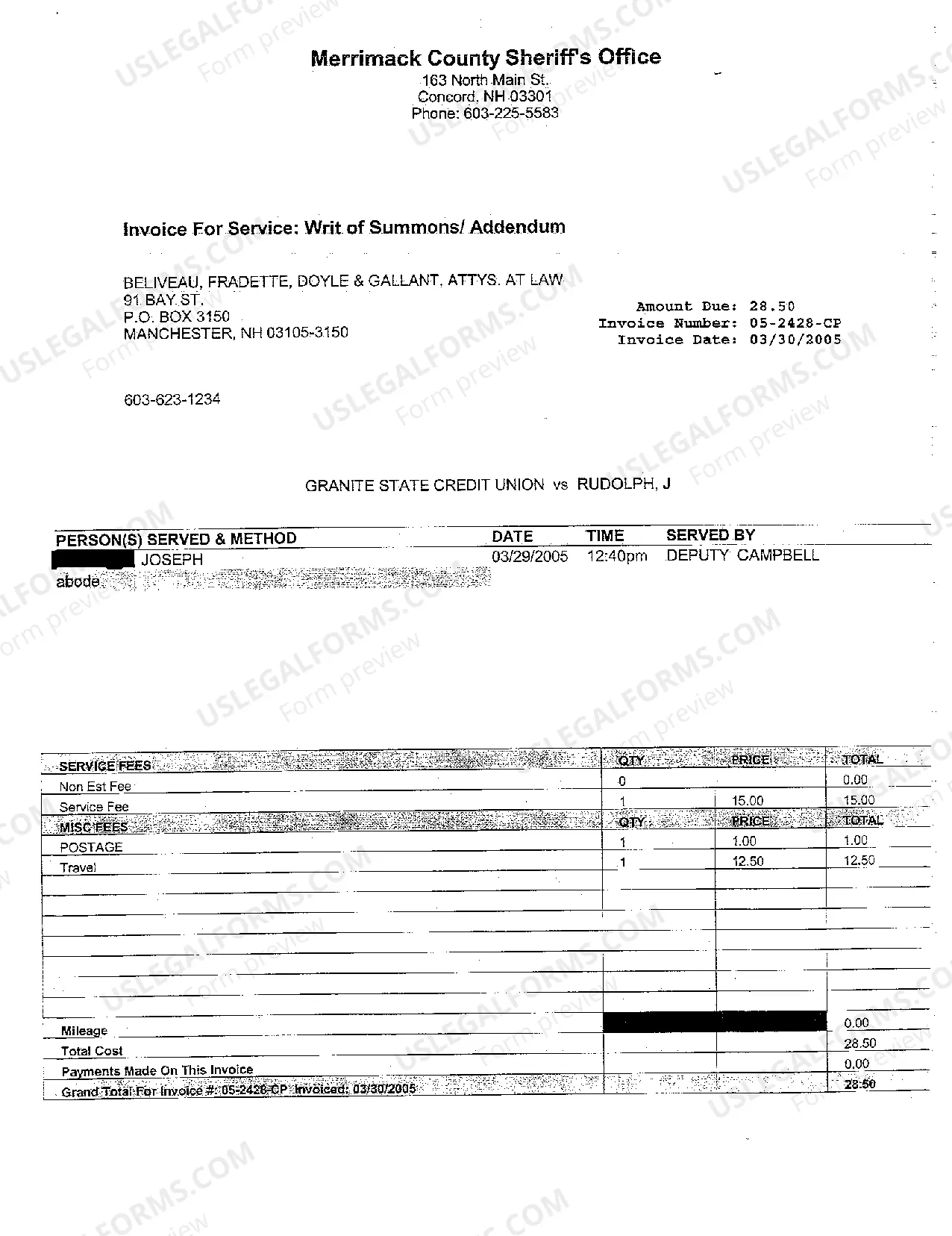

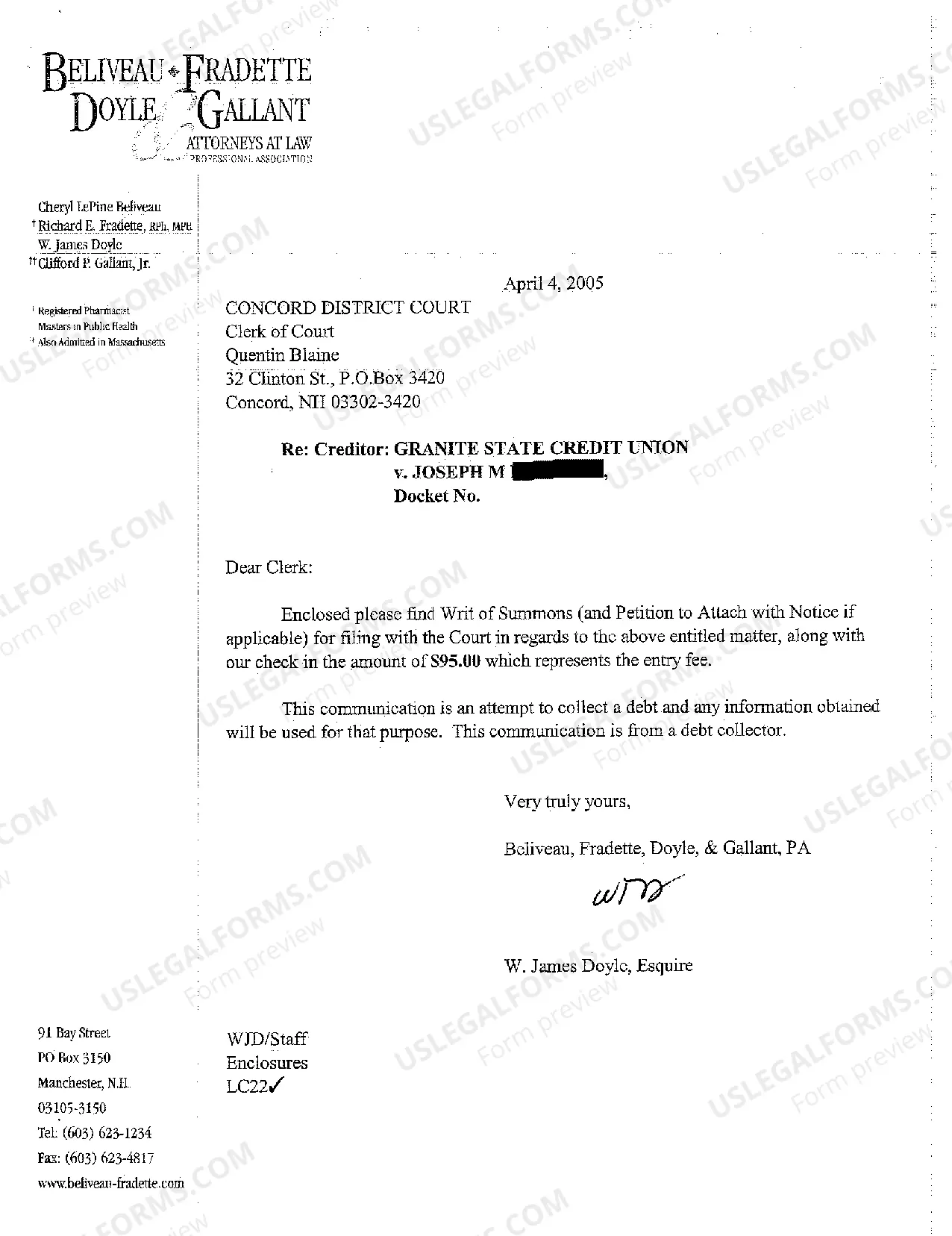

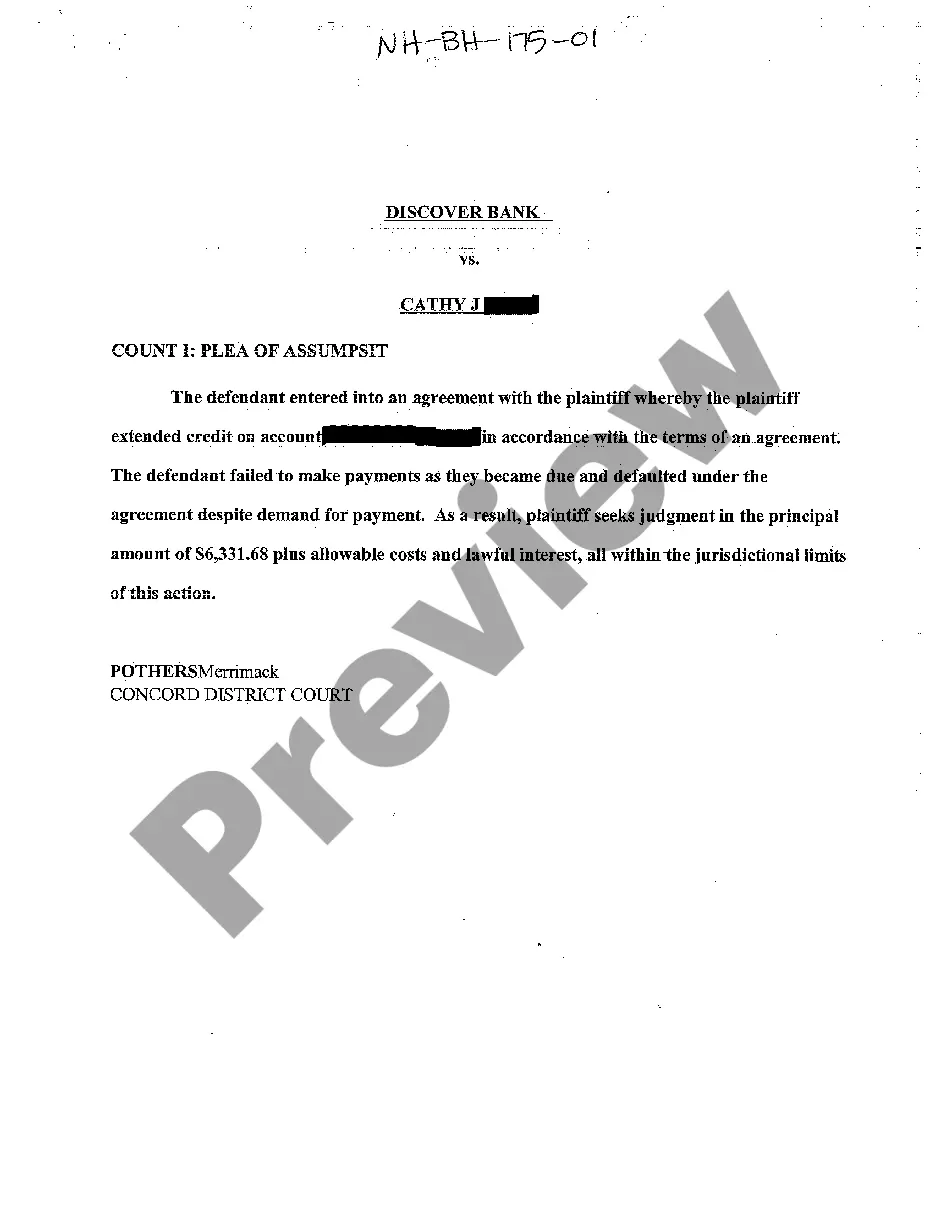

New Hampshire Writ of Summons Collection of Debt for Breach of Credit Card Agreement

Description

How to fill out New Hampshire Writ Of Summons Collection Of Debt For Breach Of Credit Card Agreement?

Avoid costly lawyers and find the New Hampshire Writ of Summons Collection of Debt for Breach of Credit Card Agreement you want at a affordable price on the US Legal Forms website. Use our simple categories function to search for and download legal and tax documents. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to obtain and complete each and every form.

US Legal Forms clients simply need to log in and obtain the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet must stick to the tips below:

- Ensure the New Hampshire Writ of Summons Collection of Debt for Breach of Credit Card Agreement is eligible for use where you live.

- If available, look through the description and make use of the Preview option before downloading the sample.

- If you’re sure the template fits your needs, click on Buy Now.

- In case the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you may fill out the New Hampshire Writ of Summons Collection of Debt for Breach of Credit Card Agreement by hand or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Typically, a credit card company will write off a debt when it considers it uncollectable. In most cases, this happens after you have not made any payments for at least six months.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

Contracts and open accounts: 3 years, (RSA 508:4). Notes secured by a mortgage: 20 years and applies even if the mortgage has been foreclosed, (RSA 508:6).

Can I Be Chased for Debt After 10 Years? In most cases, the statute of limitations for a debt will have passed after 10 years. This means that a debt collector may still attempt to pursue it, but they can't typically take legal action against you.

1Pull the header information from the plaintiff's petition.2Title your Answer Answer to Plaintiff's Petition/Complaint. Center this title and make it bold.3Introduce yourself.4Admit, deny, or claim that you lack sufficient knowledge to admit or deny each of the plaintiff's numbered allegations.How to Respond to a Court Petition (with Pictures) - wikiHow\nwww.wikihow.com > Respond-to-a-Court-Petition

When you file your answer with the court, you tell the court, in writing, the statements in the complaint that: you agree with, you disagree with, and. you do not know about.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising.If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau.

Respond to the Lawsuit or Debt Claim. Challenge the Company's Legal Right to Sue. Push Back on Burden of Proof. Point to the Statute of Limitations. Hire Your Own Attorney. File a Countersuit if the Creditor Overstepped Regulations. File a Petition of Bankruptcy.

Most debts have a statute of limitations that runs between four to six years. However, it's still possible for a debt to be within the statute of limitations at seven years, depending on the debt, when the last payment was made and where you live.