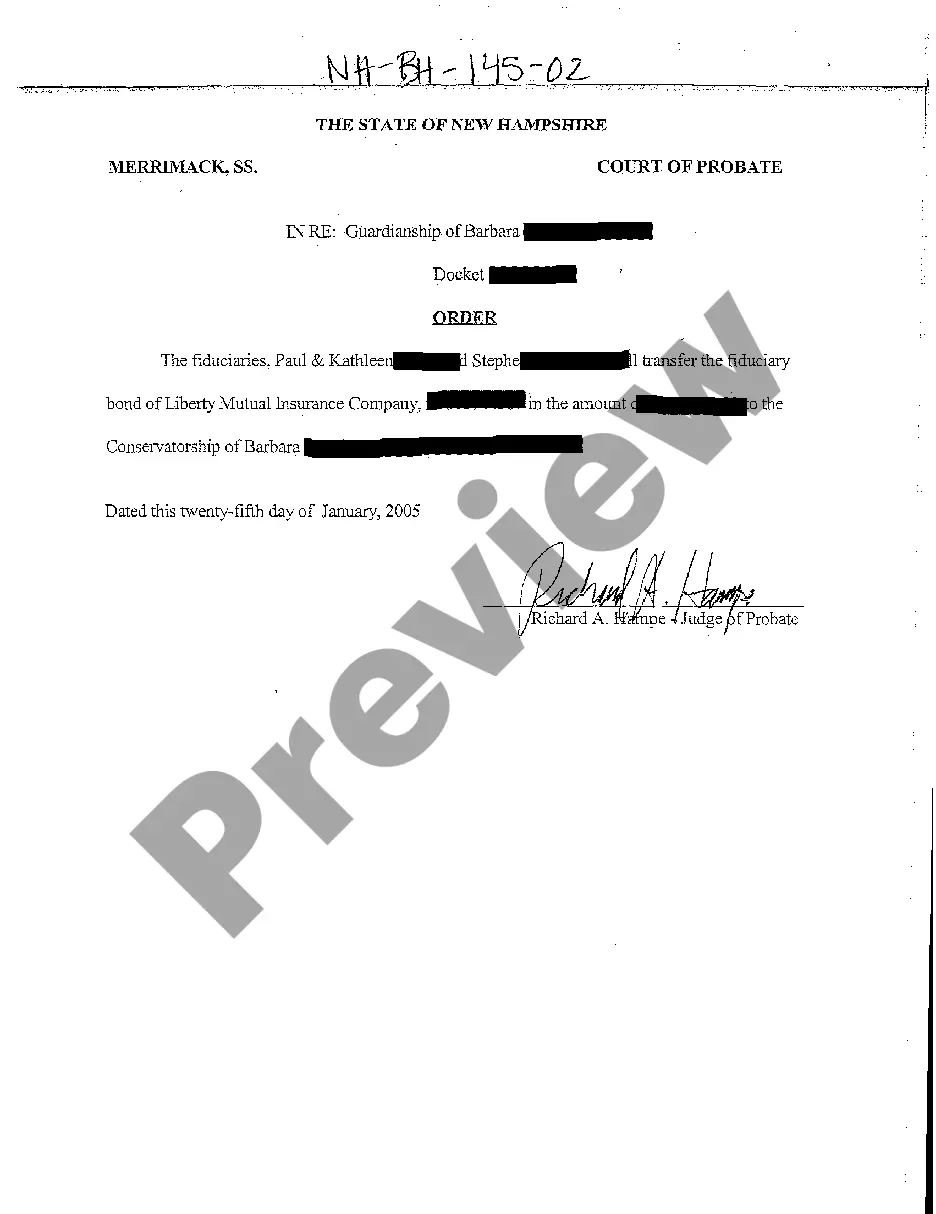

New Hampshire Order Transferring Fiduciary Bond to Conservator ship

Description

How to fill out New Hampshire Order Transferring Fiduciary Bond To Conservator Ship?

Avoid pricey attorneys and find the New Hampshire Order Transferring Fiduciary Bond to Conservator ship you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to look for and download legal and tax documents. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to obtain and fill out each template.

US Legal Forms subscribers merely have to log in and download the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should stick to the tips below:

- Ensure the New Hampshire Order Transferring Fiduciary Bond to Conservator ship is eligible for use in your state.

- If available, read the description and make use of the Preview option before downloading the templates.

- If you are confident the document fits your needs, click on Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you may fill out the New Hampshire Order Transferring Fiduciary Bond to Conservator ship by hand or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Yes. The owner can transfer EE and I Bonds to another person with a TreasuryDirect account; however, you must wait five business days after the purchase date to transfer the bonds. Are there any fees for transferring EE and I Bonds?

A savings bond isn't transferable, so signing it doesn't allow someone else to cash it. As protection against fraud, financial institutions require more than a signature to cash savings bonds. If you're unable to cash a bond yourself, a registered co-owner can do it, or you can give someone power of attorney.

Yes. The owner can transfer EE and I Bonds to another person with a TreasuryDirect account; however, you must wait five business days after the purchase date to transfer the bonds.

When you buy savings bonds as gifts, you must hold them in your TreasuryDirect account for at least five business days before you can deliver them to the gift recipient. The five-day hold protects Treasury against loss by ensuring the ACH debit has been successfully completed before the funds can be moved.

A U.S. savings bond will have the name of a single owner or two co-owners printed on the bond. Only a listed owner can cash in the savings bond. To change an owner on a savings bond, a reissue request must be sent in along with the bond to the U.S. Treasury.

If there are two listed owners on a savings bond, the Treasury refers to the owners as co-owners. Each co-owner of the bond has equal ownership rights, including the right to cash the bond at any time. One co-owner can redeem the bond without the signature of the other co-owner.

Do nothing. The bond will continue to earn interest until the bond matures. Cash (redeem) the bond. Reissue: Have the bond reissued in the survivor's name. Submit a certified copy of the owner's death certificate, along with FS Form 5396 (download or order).

If you own a bond solely in your name and want to add a co-owner or beneficiary or change the beneficiary to a co-owner, you must have the bond reissued. To do this, fill out FS Form 4000, available online from TreasuryDirect.

Go to www.treasurydirect.gov. Log into your TreasuryDirect account (or open one in your name). Purchase the type of savings bond you wish (Series EE or Series I), in the desired denomination ($25 to $10,000). Deliver the savings bond gift to the recipient's TreasuryDirect account.