Nebraska Affidavit of Heirship for House

Description

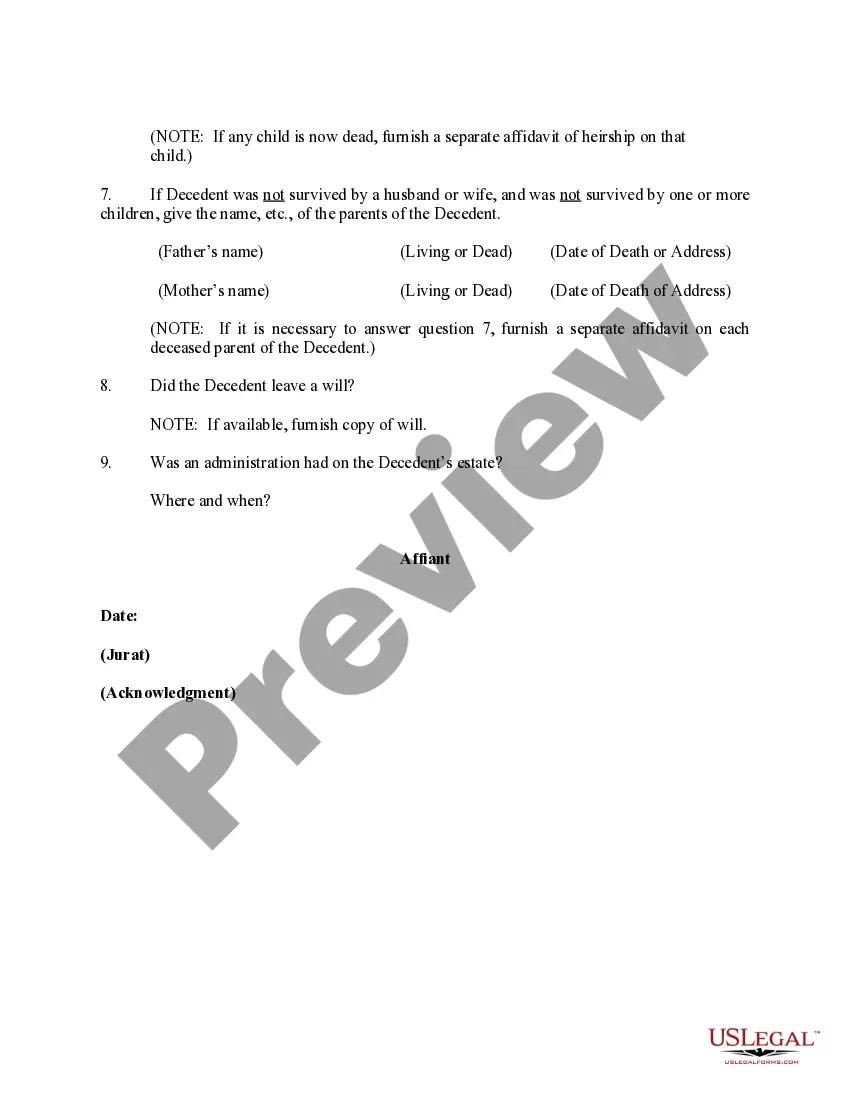

How to fill out Affidavit Of Heirship For House?

Have you been within a situation where you require paperwork for both enterprise or personal purposes almost every day? There are tons of legitimate file layouts accessible on the Internet, but discovering versions you can trust isn`t simple. US Legal Forms gives a huge number of type layouts, such as the Nebraska Affidavit of Heirship for House, which can be composed to meet federal and state needs.

In case you are already informed about US Legal Forms web site and have a free account, basically log in. After that, it is possible to down load the Nebraska Affidavit of Heirship for House template.

If you do not come with an profile and would like to begin to use US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for your right area/county.

- Utilize the Review key to analyze the form.

- See the explanation to ensure that you have chosen the proper type.

- In the event the type isn`t what you are seeking, utilize the Lookup area to find the type that meets your needs and needs.

- If you get the right type, click Acquire now.

- Select the rates program you desire, fill in the specified details to produce your account, and pay money for the transaction making use of your PayPal or bank card.

- Decide on a convenient document structure and down load your copy.

Locate all the file layouts you have purchased in the My Forms menus. You can aquire a additional copy of Nebraska Affidavit of Heirship for House whenever, if possible. Just click on the needed type to down load or produce the file template.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to save time and stay away from blunders. The support gives expertly created legitimate file layouts that you can use for a variety of purposes. Create a free account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

You must file the affidavit with the register of deeds office of the county in which the real property of the deceased is located and also file, in any other county in Nebraska in which the real property of the deceased that is subject to the affidavit is located, the recorded affidavit and a certified or authenticated ... Affidavit for Transfer of Real Property without Probate nebraska.gov ? self-help ? estates nebraska.gov ? self-help ? estates

Trusts: If the deceased had a trust, you will not need to go through probate. Trusts are created to allow the deceased's family and friends to inherit without having to go through the long and expensive probate process.

In Nebraska, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

Living trusts A living trust is often the best choice for a large estate or if there are many beneficiaries. To avoid probate, most people create a living trust commonly called a revocable living trust.

The fair market value of the entire estate of the deceased, less liens and encumbrances (everything the deceased owned minus everything the deceased owes) is $100,000.00 or less. Affidavit for Transfer of Personal Property without Probate nebraska.gov ? self-help ? estates nebraska.gov ? self-help ? estates

Establish a living trust: This is a common way for people with high-value estates to avoid probate. With a living trust, the person writing the trust decides which assets to put into the trust and who will act as trustee. When the trust owner dies, the trustee will divide the assets outside of probate.

You may be able to avoid probate in Nebraska if you: Establish a Living Trust. Title assets in Joint Tenancy. Probate Fees in Nebraska [Updated 2021] | Trust & Will trustandwill.com ? learn ? nebraska-probate-fees trustandwill.com ? learn ? nebraska-probate-fees

The Nebraska Probate Code provides two methods of presenting a claim against a decedent's estate: A claim can be presented by filing a written statement thereof with the clerk of the probate court or by commencing a proceeding against the personal representative in any court which has jurisdiction. 1. Presenting or filing claim - Nebraska Legislature nebraskalegislature.gov ? laws ? statutes nebraskalegislature.gov ? laws ? statutes