Nebraska Material Storage Lease (For Pipe and Equipment)

Description

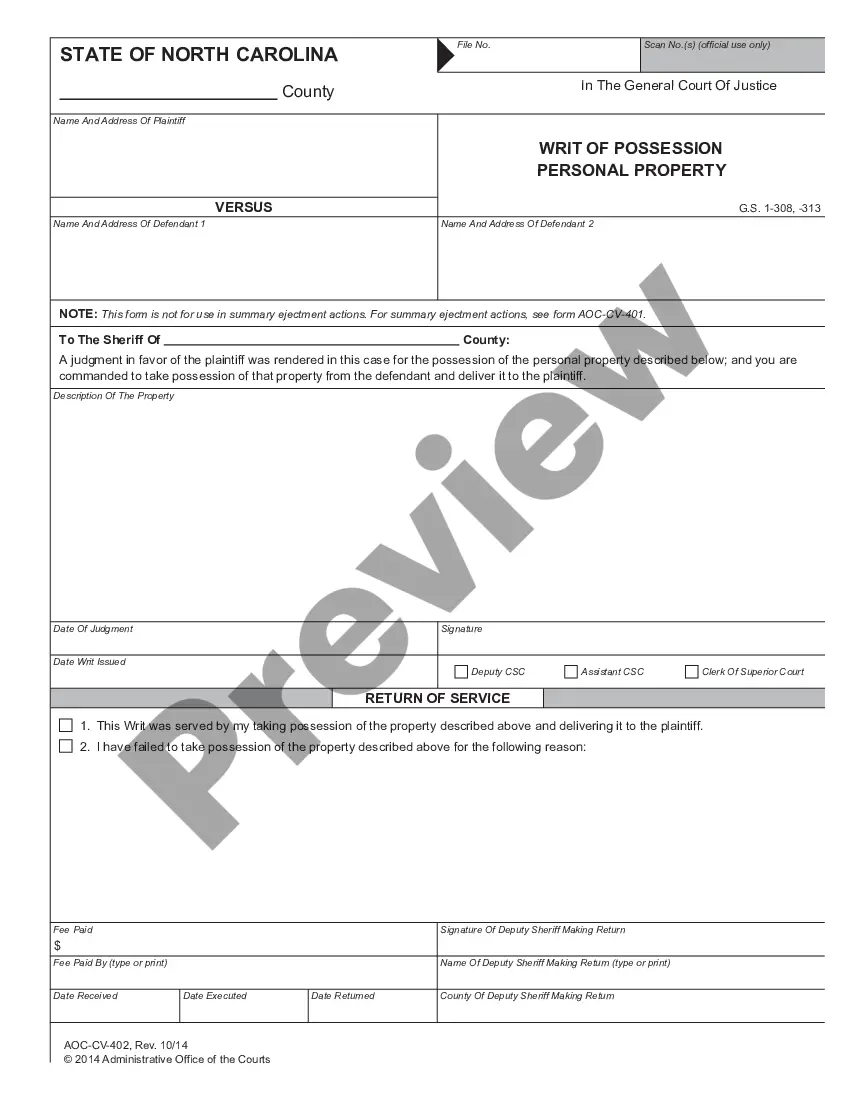

How to fill out Material Storage Lease (For Pipe And Equipment)?

If you need to complete, download, or print authorized document layouts, use US Legal Forms, the biggest variety of authorized kinds, that can be found on the Internet. Take advantage of the site`s easy and convenient look for to find the papers you will need. A variety of layouts for company and individual purposes are sorted by groups and states, or search phrases. Use US Legal Forms to find the Nebraska Material Storage Lease (For Pipe and Equipment) with a few clicks.

If you are presently a US Legal Forms buyer, log in to your profile and click the Acquire switch to get the Nebraska Material Storage Lease (For Pipe and Equipment). You can even accessibility kinds you earlier acquired in the My Forms tab of the profile.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form to the appropriate metropolis/land.

- Step 2. Utilize the Preview solution to examine the form`s information. Never neglect to read through the outline.

- Step 3. If you are unsatisfied together with the develop, take advantage of the Look for discipline at the top of the display screen to discover other models of the authorized develop template.

- Step 4. Once you have found the form you will need, select the Acquire now switch. Pick the rates program you like and include your accreditations to sign up on an profile.

- Step 5. Process the deal. You should use your credit card or PayPal profile to accomplish the deal.

- Step 6. Find the file format of the authorized develop and download it on the gadget.

- Step 7. Comprehensive, edit and print or indicator the Nebraska Material Storage Lease (For Pipe and Equipment).

Every single authorized document template you purchase is your own property eternally. You might have acces to each develop you acquired in your acccount. Go through the My Forms section and select a develop to print or download again.

Be competitive and download, and print the Nebraska Material Storage Lease (For Pipe and Equipment) with US Legal Forms. There are many professional and state-distinct kinds you can utilize for your company or individual requires.

Form popularity

FAQ

Hear this out loud PauseSales Tax¹ Nebraska sales tax is imposed upon the gross receipts from: all sales, leases, rentals, installation, application, and repair of tangible personal property; ? every person providing or installing utility services; retailers of intellectual or entertainment property; the sale of admissions, bundled ... Nebraska and Local Sales and Use Taxes nebraskalegislature.gov ? select_special ? taxmod nebraskalegislature.gov ? select_special ? taxmod

Tips and Gratuities. Discretionary tips or gratuities given by customers are not taxable even if they are charged to the customer's bill instead of the customer giving the tip directly to the server.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

If you own rental real estate, you should be aware of your federal tax responsibilities. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

Motor vehicles leased for periods of one year or more are subject to sales tax in Nebraska when the location indicated on the application for registration of the vehicle is in this state, regardless of the location of the lessor.

Hear this out loud PauseA net lease involves payment of additional costs associated with the property, which is in contrast to a gross lease where only a flat fee is paid, and all other costs are covered by the lessor. The costs include several items, such as: Taxes. Insurance. Maintenance. Net Lease - Overview, How It Works, Types and Uses corporatefinanceinstitute.com ? accounting ? net-l... corporatefinanceinstitute.com ? accounting ? net-l...