Nebraska Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

Are you presently in a location that you need to have documents for sometimes business or specific reasons almost every working day.

There are numerous genuine document templates available online, but acquiring forms you can trust is not easy.

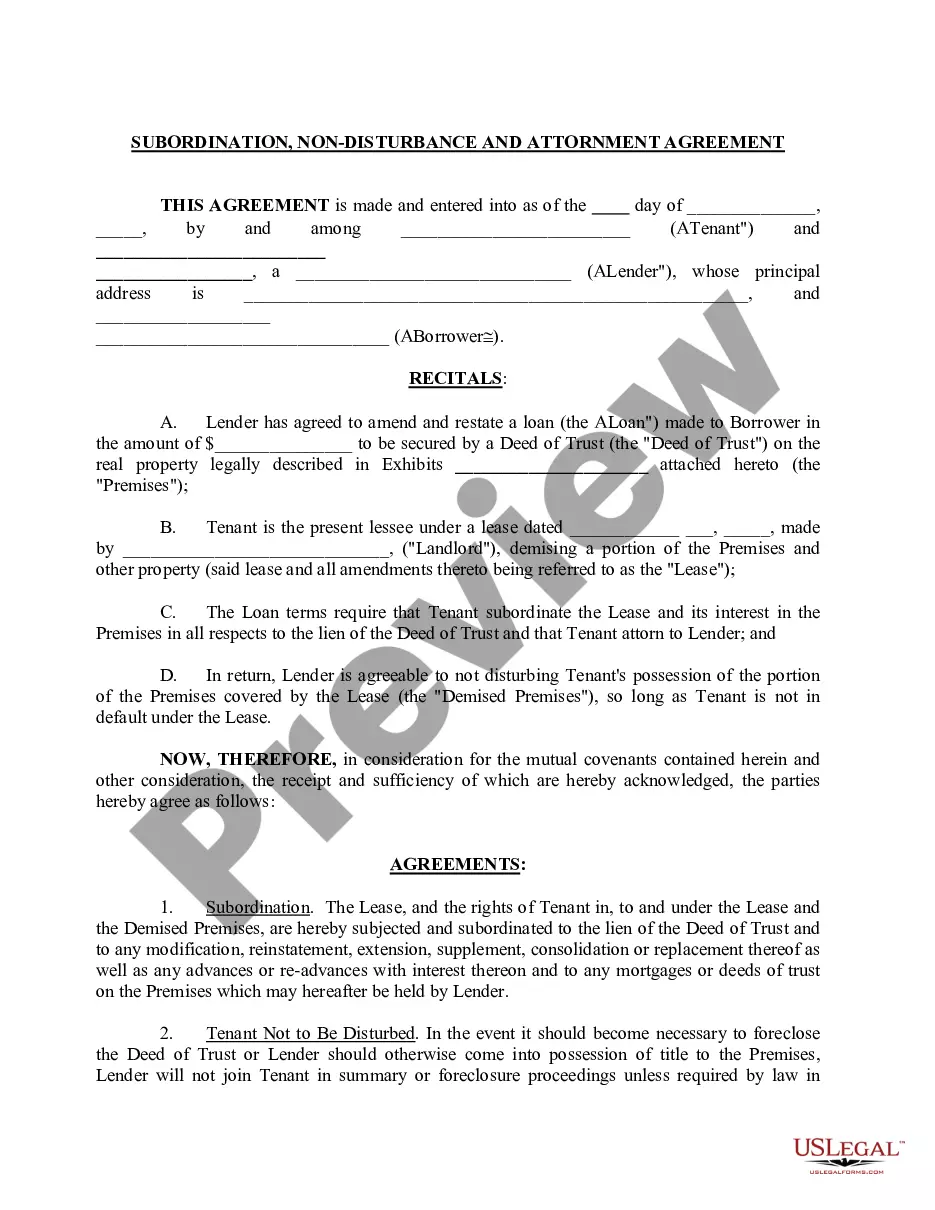

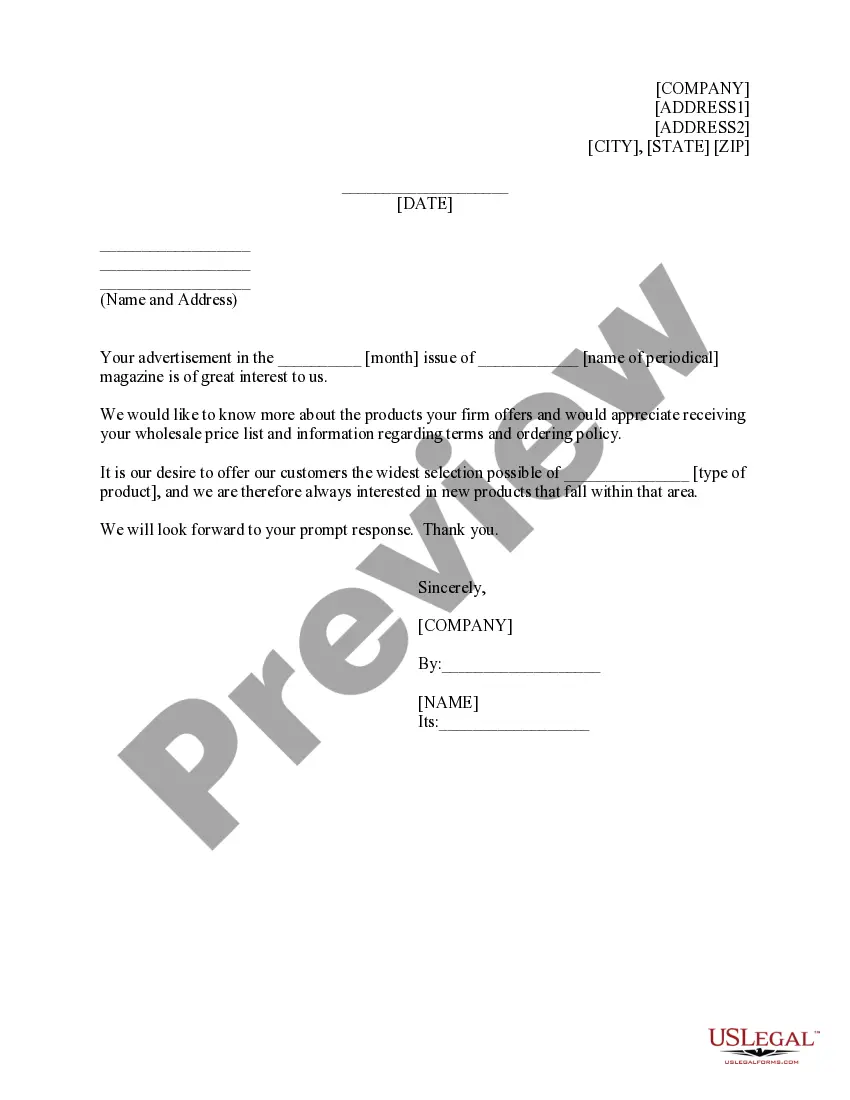

US Legal Forms provides a vast number of format templates, such as the Nebraska Design Agreement - Self-Employed Independent Contractor, which are designed to meet state and federal requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you wish, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Design Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Use the Preview button to inspect the form.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you’re looking for, utilize the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Typically, the business hiring the independent contractor drafts the agreement. However, both parties should review the document to ensure it meets their needs. A Nebraska Design Agreement - Self-Employed Independent Contractor can be customized to reflect the specific terms you agree upon. Consider using resources from US Legal Forms to access professional templates and guidance that can streamline this writing process.

Yes, having a contract as an independent contractor is crucial for protecting your rights and interests. A well-drafted Nebraska Design Agreement - Self-Employed Independent Contractor clearly defines the terms of the relationship, reducing potential misunderstandings. Additionally, it can serve as a legal reference if disputes arise. Without a contract, you may find yourself vulnerable to miscommunication and conflicts over work expectations.

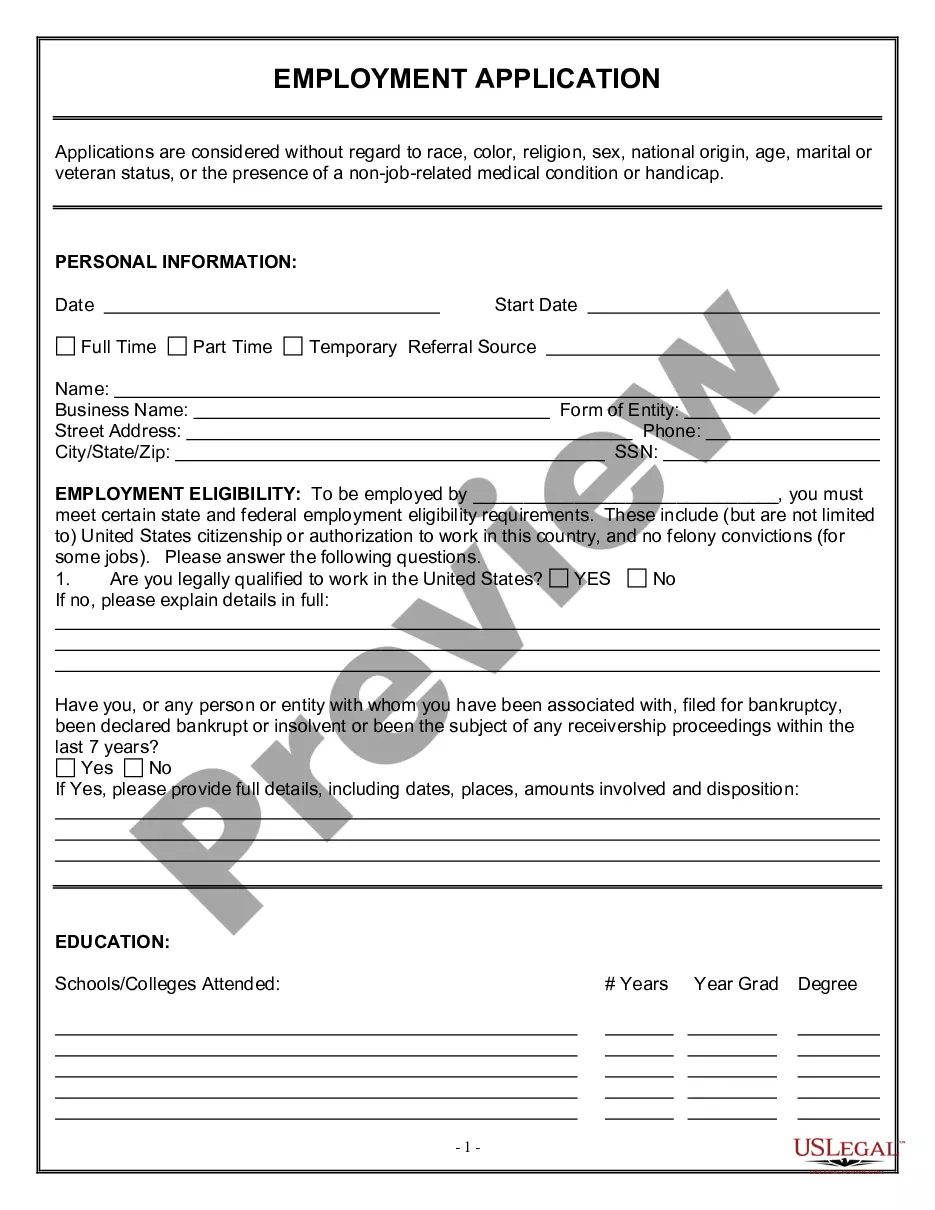

To create an independent contractor agreement, you should outline the terms of the relationship clearly. Start with the contact information for both parties, followed by the scope of work, payment terms, and deadlines. It is essential to specify the expectations and responsibilities of each party. Utilizing platforms like US Legal Forms can simplify this process, providing templates specifically designed for a Nebraska Design Agreement - Self-Employed Independent Contractor.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.