Nebraska Production Assistant Contract - Self-Employed Independent Contractor

Description

How to fill out Production Assistant Contract - Self-Employed Independent Contractor?

Are you situated in a location where you require documentation for potential business or personal reasons nearly every day.

There are numerous authentic document templates accessible online, but locating options you can rely on is not easy.

US Legal Forms offers thousands of document templates, including the Nebraska Production Assistant Contract - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

Once you identify the correct document, click Buy now.

Select your preferred pricing plan, provide the necessary information to create your account, and complete your order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Nebraska Production Assistant Contract - Self-Employed Independent Contractor at any time if needed. Click on the relevant document to download or print the template. Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Production Assistant Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

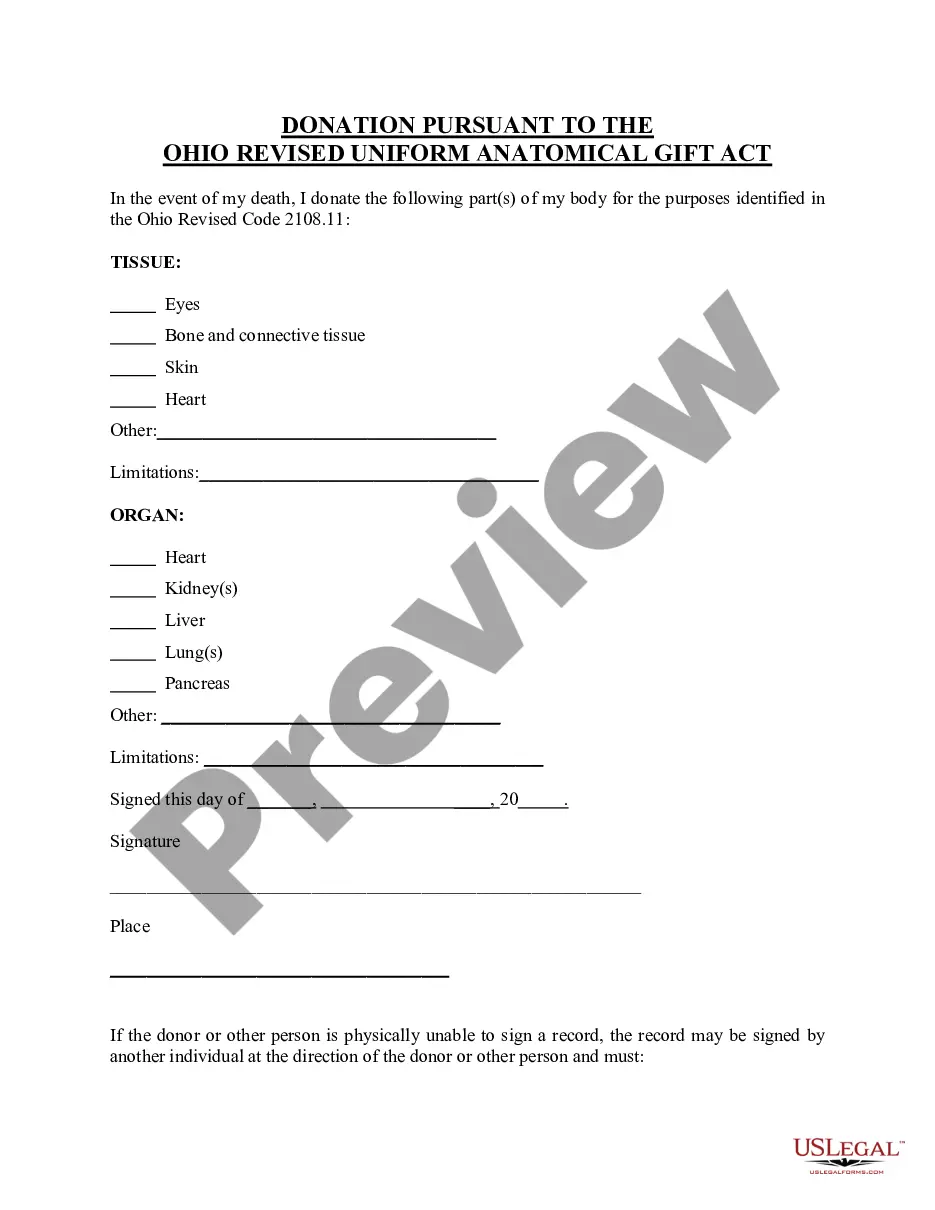

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the appropriate document.

- If the document does not meet your expectations, use the Lookup field to find the document that suits your requirements.

Form popularity

FAQ

To fill out an independent contractor agreement, begin by identifying the parties involved, including the contractor's full name and business details. Then, clearly outline the services provided, payment terms, and the duration of the contract. It's essential to include any necessary details specific to your situation, such as cancellation terms and confidentiality clauses. Utilizing a Nebraska Production Assistant Contract - Self-Employed Independent Contractor from USLegalForms can simplify this process by providing a structured template that ensures all essential aspects are covered.

Yes, an independent contractor is considered self-employed. This designation means they operate their own business and manage their own taxes. Using a Nebraska Production Assistant Contract - Self-Employed Independent Contractor can simplify this process by clearly outlining business terms and protecting both parties involved.

A production assistant can indeed be classified as an independent contractor, depending on their work arrangement. This classification depends on the level of control over their tasks and schedule. A solid Nebraska Production Assistant Contract - Self-Employed Independent Contractor lays out the guidelines, ensuring that both the production entity and the assistant understand their roles.

Certainly, an assistant can function as an independent contractor. This role typically gives the assistant the freedom to choose clients and projects. Establishing a Nebraska Production Assistant Contract - Self-Employed Independent Contractor ensures that the terms of the relationship are well-defined, making it easier to manage duties and payments.

Yes, a Production Assistant (PCA) can operate as an independent contractor. This arrangement allows the PCA to maintain flexibility in their work while being responsible for their own taxes and business expenses. By utilizing a Nebraska Production Assistant Contract - Self-Employed Independent Contractor, both parties can outline expectations, responsibilities, and payment terms clearly.

Yes, assistants can absolutely be self-employed. Many individuals working under a Nebraska Production Assistant Contract choose the self-employed route to gain flexibility and autonomy in their work. This status allows them to manage multiple clients, set their own hours, and have control over their professional life. It’s a rewarding way to showcase your skills while enjoying the benefits of independent work.

Yes, independent contractors file as self-employed individuals. When you enter into a Nebraska Production Assistant Contract as a Self-Employed Independent Contractor, you take on the responsibility of reporting your income to the IRS. This requires filling out a Schedule C form along with your personal tax return. Moreover, being self-employed allows you to deduct certain business expenses, making it essential to keep accurate records throughout the year.