Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract, designed to meet state and federal requirements.

When you find the correct form, click Get now.

Choose the pricing plan you want, fill out the necessary information to create your account, and complete the payment using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract at any time if needed. Just click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/state.

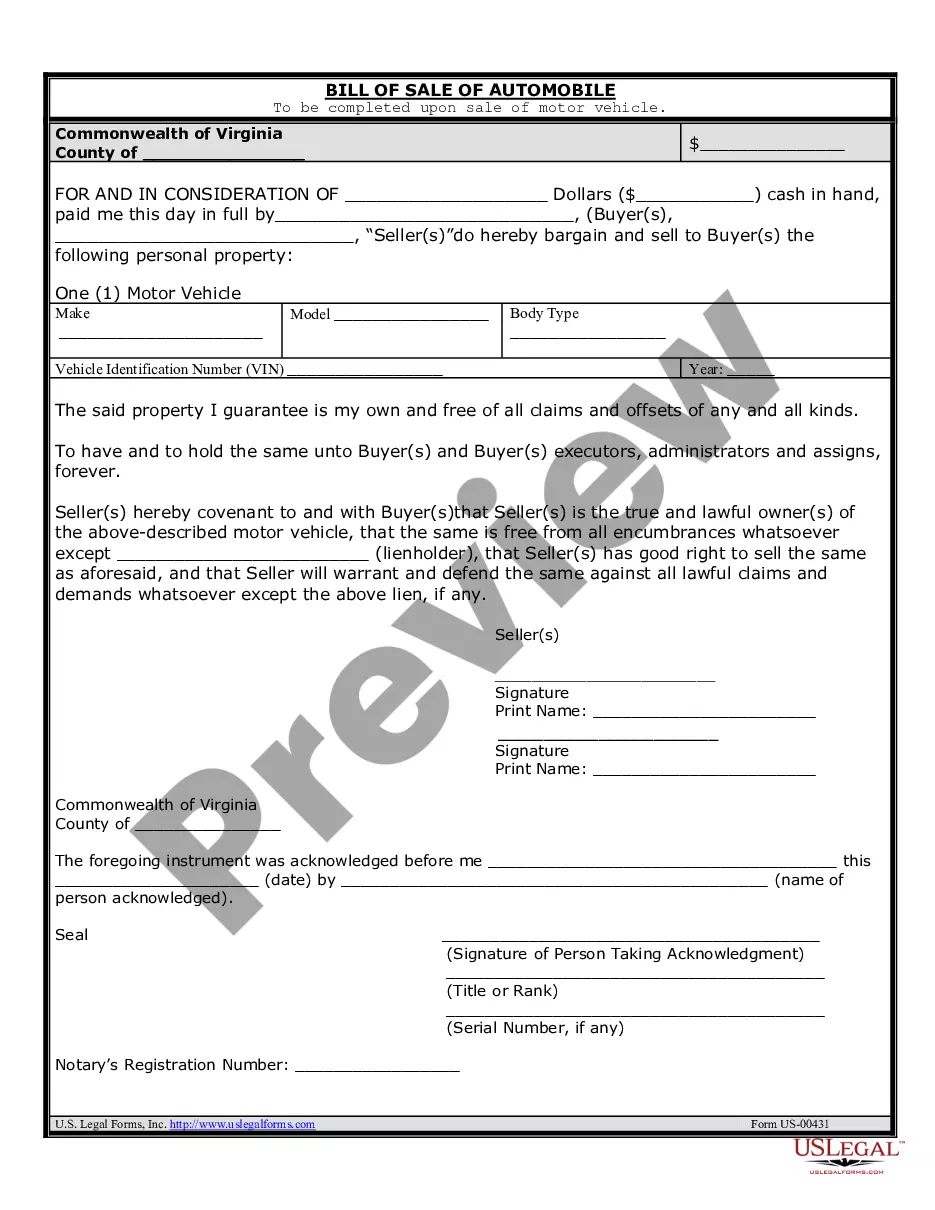

- Use the Preview button to review the form.

- Check the outline to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

To set up as an independent contractor, you will need a business plan, a reliable accounting system, and appropriate licensing or permits. It is crucial to draft a Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract to define your services and protect your interests. By taking these steps, you will lay a solid foundation for your contracting business.

Yes, independent contractors file as self-employed individuals. This status allows them to report their income directly and manage their own tax responsibilities. To ensure an accurate filing process, establish a clear Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract that outlines your work parameters and income sources.

To file as an independent contractor, you must gather financial documents, such as income statements and expense receipts. You will typically submit a Schedule C form with your individual tax return to report earnings. Additionally, having a thorough Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract can streamline your filing process by documenting your business activities.

Independent contractors must comply with various legal requirements, including tax obligations and proper licensing. They should also keep accurate records of their earnings and expenses. Utilizing the Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract can help ensure compliance with local regulations and protect the rights of all parties involved.

If you need to end the relationship with an independent contractor without a formal contract, it's advisable to communicate directly and politely. Discuss the reasons for termination and try to reach a mutual understanding. A well-structured Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract can simplify this process by outlining termination protocols.

A primary requirement for independent contractors is that they must have the freedom to manage their own work schedule and methods. This control helps distinguish them from employees, who typically receive more oversight. Formulating a comprehensive Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract can help reinforce this status.

Independent contractors must adhere to specific guidelines that set them apart from employees. They control how and when they perform their work, which means they possess significant autonomy. It is essential to establish a detailed Nebraska Self-Employed Independent Contractor Pyrotechnician Service Contract to clarify these rules and expectations.

To fill out a W-9 form as an independent contractor, provide your name and business name if applicable, along with your taxpayer identification number. Be sure to check the box for the type of entity, typically 'individual' for a Nebraska self-employed independent contractor pyrotechnician. Sign and date the form before submitting it to your client. For a guided experience, consider using resources from US Legal Forms.

Filling out an independent contractor agreement requires you to start with the contractor's information and a description of the services to be performed. Ensure you include payment details, timelines, and any special requirements relevant to the Nebraska self-employed independent contractor pyrotechnician service contract. Carefully review the document to avoid misunderstandings. Using US Legal Forms can help you maintain clarity and legal compliance.

To fill out an independent contractor form, begin by entering your personal information, including your name, address, and taxpayer identification number. Next, clearly state your services related to the Nebraska self-employed independent contractor pyrotechnician service contract. Make sure to review the form for accuracy before submission. You can find user-friendly forms on platforms like US Legal Forms to assist you in this process.