Nebraska Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

How to fill out Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

US Legal Forms - one of many most significant libraries of authorized forms in the States - provides a wide range of authorized document templates it is possible to acquire or produce. Making use of the website, you can get a huge number of forms for business and individual uses, categorized by groups, states, or search phrases.You can get the newest versions of forms such as the Nebraska Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp within minutes.

If you have a monthly subscription, log in and acquire Nebraska Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp in the US Legal Forms local library. The Download button will show up on each develop you perspective. You gain access to all previously delivered electronically forms within the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the very first time, listed here are simple instructions to help you get began:

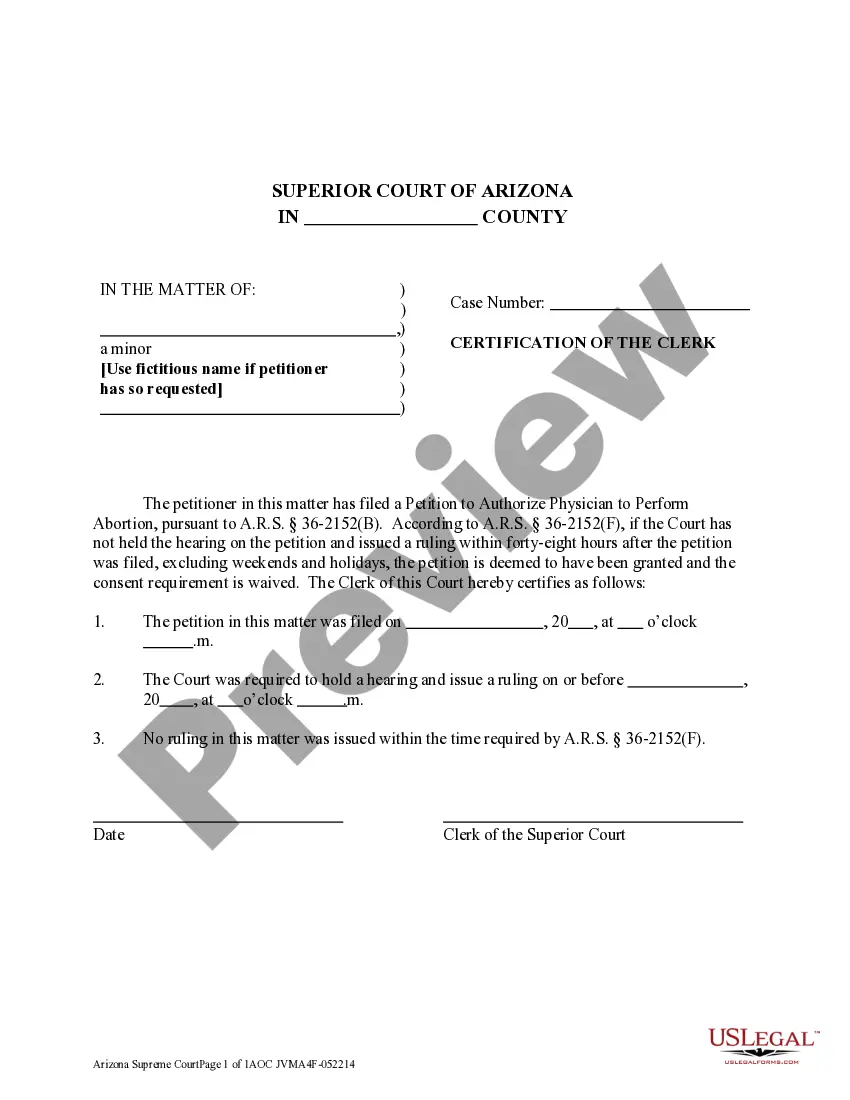

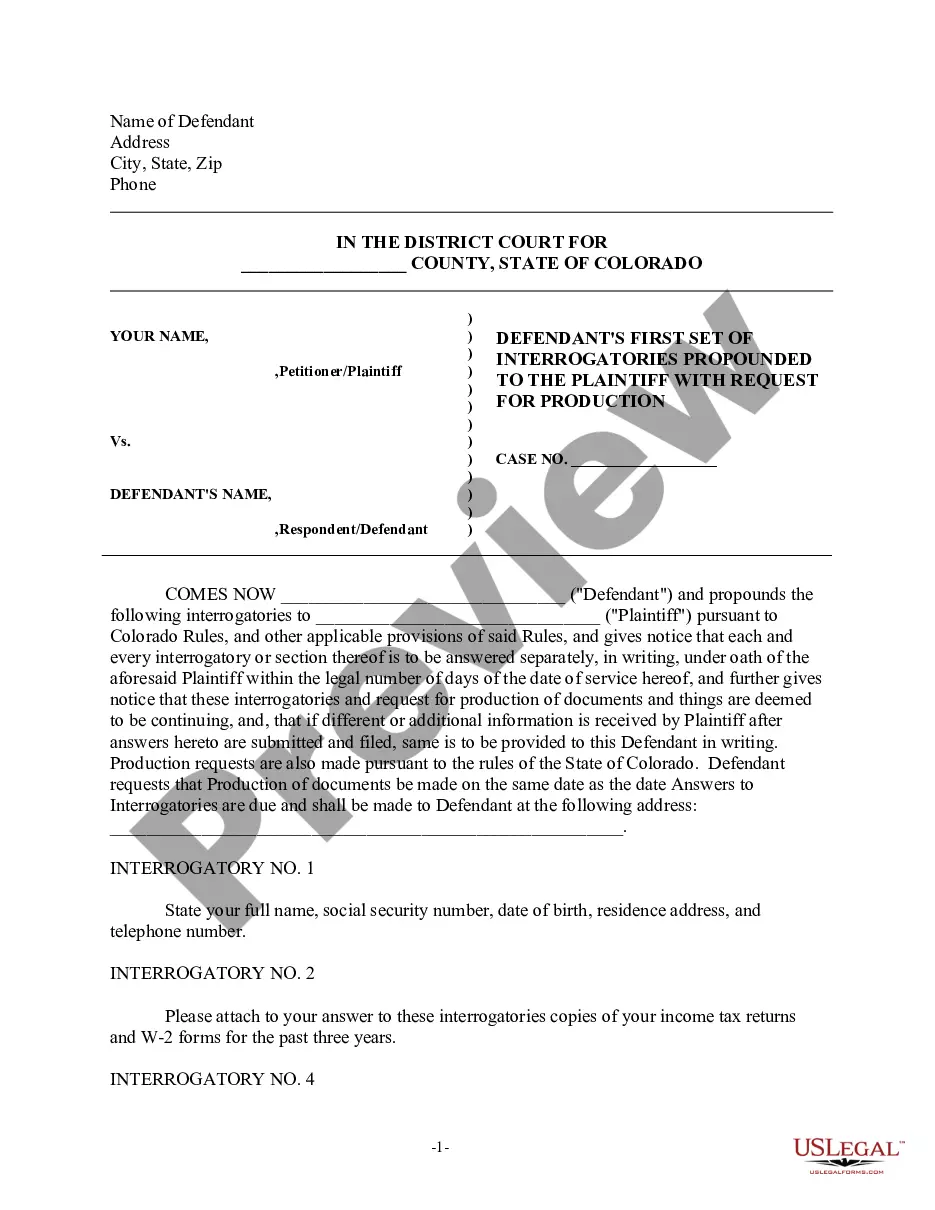

- Ensure you have selected the right develop for your personal area/area. Select the Preview button to review the form`s content material. Browse the develop outline to actually have chosen the right develop.

- In the event the develop does not suit your demands, use the Research field towards the top of the display screen to discover the one which does.

- If you are happy with the shape, validate your decision by clicking on the Purchase now button. Then, select the rates prepare you want and offer your qualifications to sign up to have an bank account.

- Process the transaction. Make use of charge card or PayPal bank account to finish the transaction.

- Pick the file format and acquire the shape on your own product.

- Make alterations. Complete, change and produce and sign the delivered electronically Nebraska Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp.

Each format you included in your account lacks an expiration time and is yours eternally. So, in order to acquire or produce yet another version, just check out the My Forms area and then click on the develop you require.

Gain access to the Nebraska Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp with US Legal Forms, one of the most extensive local library of authorized document templates. Use a huge number of skilled and condition-particular templates that meet up with your company or individual needs and demands.

Form popularity

FAQ

Fidelity began trading on the New York Stock Exchange under the symbol FNF.

Old FNF then distributed to its shareholders all of its shares of our common stock, making FNT a stand alone public company. Fidelity National Financial, Inc. - SEC.gov sec.gov ? Archives ? edgar ? data sec.gov ? Archives ? edgar ? data

With a 21% market share and more than $4 billion in premiums in 2020, First American Title is part of the top title insurance companies 2022, recognized as the largest from the list of title companies, with 41% more than the next-largest company. Top Title Underwriters for Home Sellers in 2022 - Richr richr.com ? blog ? top-title-underwriters-for-hom... richr.com ? blog ? top-title-underwriters-for-hom...

Fidelity National Financial, Inc. (NYSE: FNF), a Fortune 500 company, is an American provider of title insurance and settlement services to the real estate and mortgage industries. FNF generated approximately $8.469 billion in annual revenue in 2019 from its title and real estate-related operations. Fidelity National Financial - Wikipedia Wikipedia ? wiki ? Fidelity_National_Fin... Wikipedia ? wiki ? Fidelity_National_Fin...

Fidelity National Financial split the company into Fidelity National Financial and F&G Annuity & Life. The structure of the spinoff was the distribution of F&G Annuity & Life shares as a taxable dividend.

However, Chicago Title, Fidelity National Title and Commonwealth Land Title are all owned by one parent company, Fidelity National Title Group. Together, they represent 31% of the title insurance market, with more than $6 billion in business.

Our Class A Common Stock is listed on the New York Stock Exchange under the symbol ?FNT.? Fidelity National Title Group, Inc. - SEC.gov SEC.gov ? Archives ? edgar ? data SEC.gov ? Archives ? edgar ? data

Fidelity National Title Group is the nation's strongest and most respected providers of financial and real estate solutions. With a proud history dating back to 1847 and issuing the first title policy in 1876, they are the oldest title and escrow company in America and the largest, as well.