Nebraska Resident Information Sheet

Description

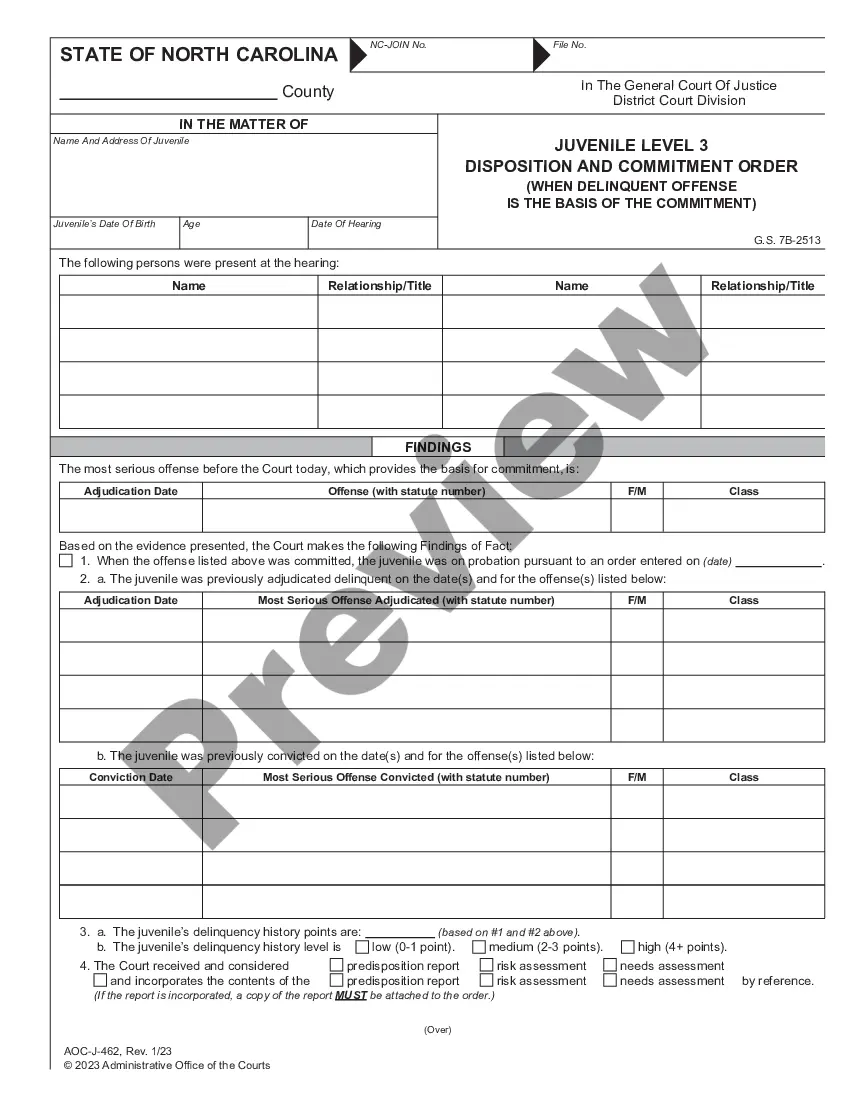

How to fill out Resident Information Sheet?

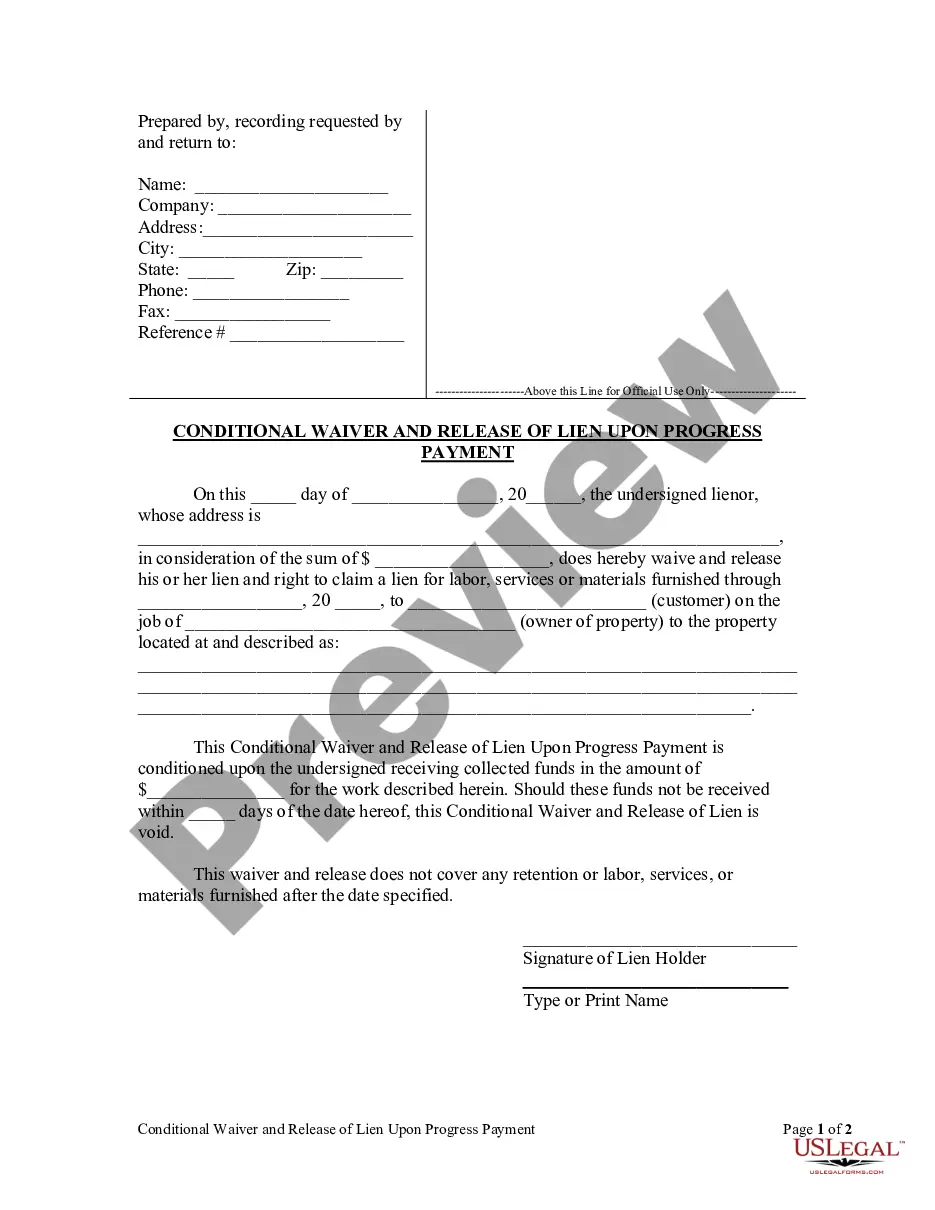

If you wish to acquire, obtain, or print approved document templates, use US Legal Forms, the top collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Nebraska Resident Information Sheet within a few clicks.

Every legal document template you acquire is yours permanently. You have access to each form you downloaded in your account. Visit the My documents section to select a form for printing or re-downloading.

Compete and acquire, and print the Nebraska Resident Information Sheet with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Nebraska Resident Information Sheet.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nebraska Resident Information Sheet.

Form popularity

FAQ

A person of legal age or an emancipated minor who for a period of 12 months shall have established a home in Nebraska where he or she is habitually present, and shall verify by documentary proof that he or she intends to make Nebraska his or her permanent residence.

How to Establish Domicile in a New StateKeep a log that shows how many days you spend in the old and new locations.Change your mailing address.Get a driver's license in the new state and register your car there.Register to vote in the new state.Open and use bank accounts in the new state.More items...?

Allowances claimed on the Form W-4N are used by your employer or payor to determine the Nebraska state income tax withheld from your wages, pension, or annuity to meet your Nebraska state income tax obligation.

Your physical presence in a state plays an important role in determining your residency status. Usually, spending over half a year, or more than 183 days, in a particular state will render you a statutory resident and could make you liable for taxes in that state.

To meet these requirements, you must be continuously physically present in California for more than one year (366 days) immediately prior to the residence determination date (generally the first day of classes) and intend to make California your home permanently.

To establish a domicile in another state, you can take steps such as:Sell your house, list it for sale, or rent it out for an extended time to third parties.Move your personal belongings from your former residence to your new one.Try to avoid going back to the previous state for as long as possible.More items...?

Resident. A resident is an individual whose domicile is Nebraska, or an individual who is physically present in this state and maintains a permanent place of abode within this state for an aggregate of more than six months. Nebraska residence will be determined by Nebraska law.

A Resident of Nebraska is an individual that is domiciled in the state. If the individual is not domiciled in the state but maintains a place of abode within the state and is present for 183 days or more, they will be considered a resident.

Individuals seeking to establish resident status for tuition purposes who are subject to the 12 months minimum requirement must have established a home in Nebraska at least 12 months prior to the time at which they request such a determination.