Nebraska Personal Representative Request Form

Description

How to fill out Personal Representative Request Form?

Selecting the most suitable legitimate document template can be challenging.

Of course, there are numerous templates accessible online, but how do you locate the legitimate form you require.

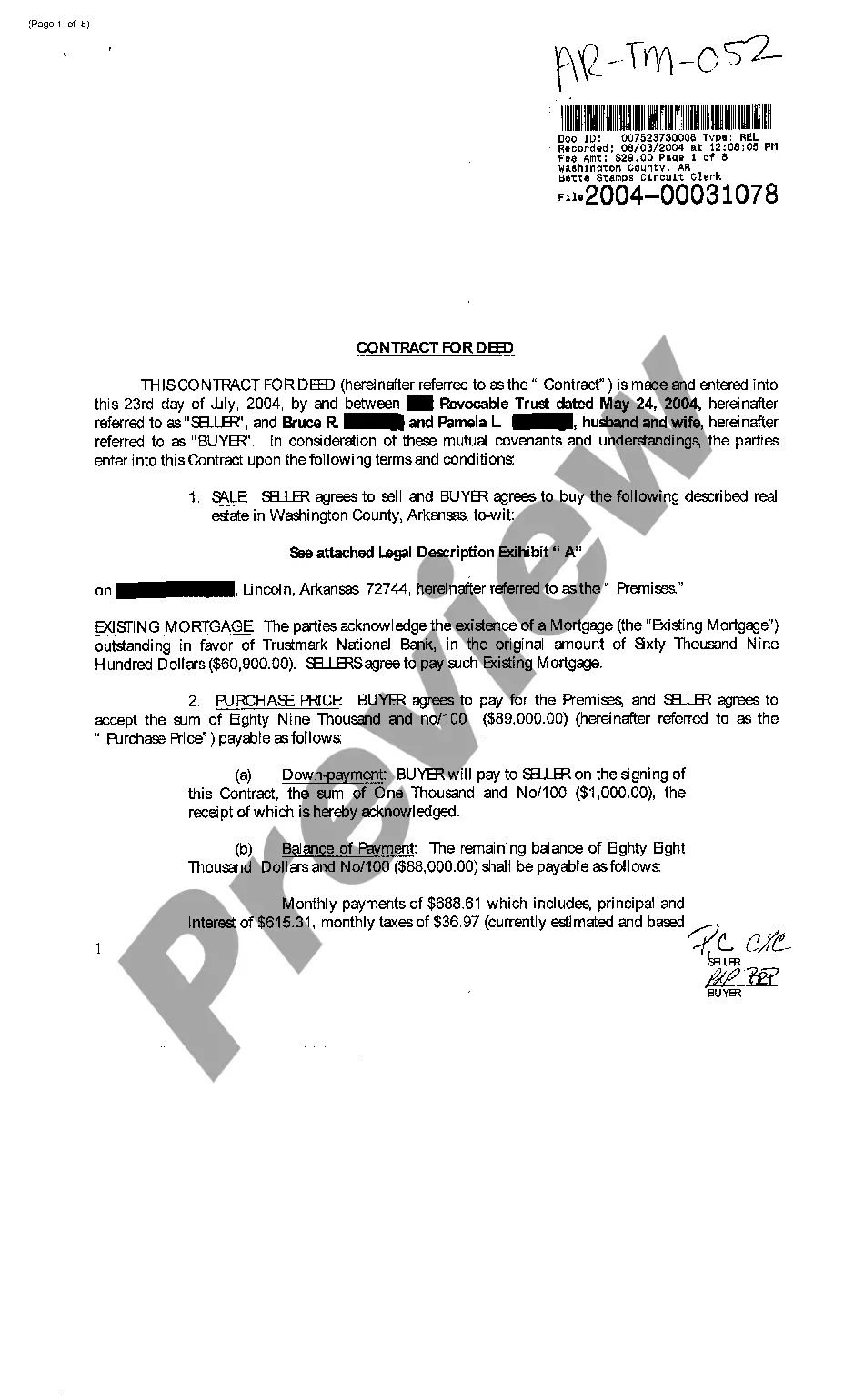

Visit the US Legal Forms website. The service provides a vast array of templates, including the Nebraska Personal Representative Request Form, which you can utilize for both business and personal purposes.

You can examine the form using the Preview option and review the form outline to confirm it is suitable for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and select the Acquire option to locate the Nebraska Personal Representative Request Form.

- Use your account to browse through the legitimate forms you may have previously acquired.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you're a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your city/region.

Form popularity

FAQ

A person who has been issued with a grant to administer a deceased person's estate. In practice, the term is commonly used in the broader sense of a person who is entitled to apply for a grant and administer the estate.

A Small Estates Declaration provides confirmation that a Grant of Representation is not being applied for, and confirms that the money is going to be paid to the correct person, who is responsible for dealing with the Estate.

When Is Probate Required in Nebraska? Probate is not always necessary, and this is true whether the decedent died testate or intestate (died with or without a valid will). All wills do not need to be probated. A decedent's estate's need for probate depends mostly on the assets they leave behind and their total value.

What Is a Small Estate? Nebraska Revised Statute §30-24, 125 recites the guidelines. Basically, if a decedent's estate involves less than $50,000 in probatable personal property and/or $50,000 or less in real estate, no probate is required.

How to Avoid Probate in Nebraska?Establish a Living Trust.Title assets in Joint Tenancy.Title property as Community Property With Right of Survivorship or Tenancy by the Entirety.Open accounts and hold deeds that are TOD or POD (Transfer on Death; Payable on Death)

Step 1 Wait 30 Days. The person who fills out the form, known as the affiant must wait at least thirty (30) days before getting the affidavit notarized.Step 2 Assess Estate.Step 3 Fill out the Form.Step 4 Collect the Property.

To be eligible for simplified probate, the estate must be valued at less than $50,000. If real estate is part of the estate, it must be worth $50,000 or less after subtracting the mortgage and any liens.

Obtaining a Grant of Probate is needed in most cases where the total value of the deceased's estate is deemed small... Going through the process of probate is often required to deal with a person's estate after they've passed away.

A personal representative is under a duty to settle and distribute the estate of the decedent in accordance with the terms of any probated and effective will and this code, and as expeditiously and efficiently as is consistent with the best interests of the estate.