Nebraska Employment Position Announcement

Description

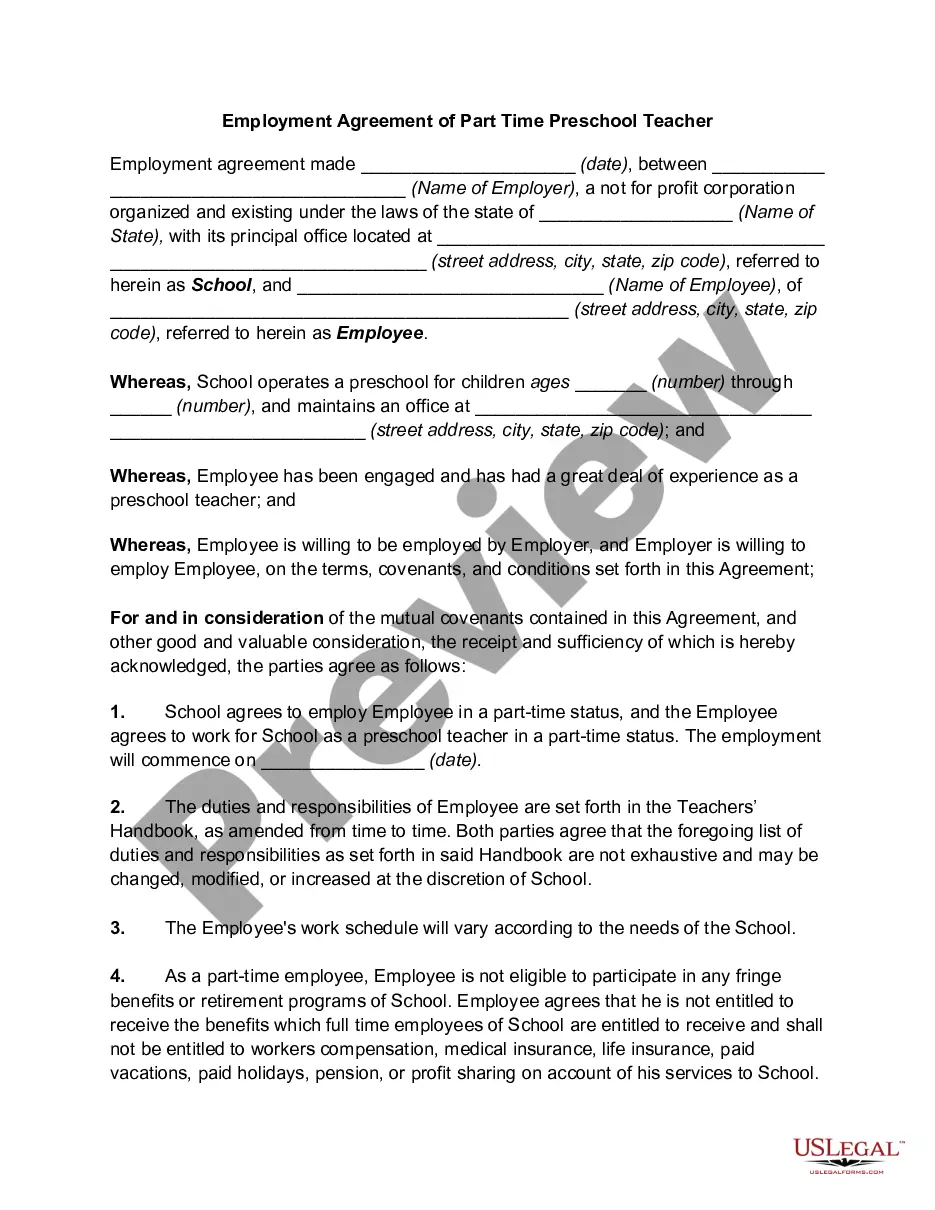

How to fill out Employment Position Announcement?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates for you to download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Nebraska Employment Position Announcement in mere seconds.

If you have a monthly subscription, Log In and download the Nebraska Employment Position Announcement from your US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms within the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the saved Nebraska Employment Position Announcement.

Every form you add to your account has no expiration date and is yours to keep permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the desired form.

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form’s content.

- Read the form description to confirm that you have selected the right one.

- If the form doesn’t meet your needs, utilize the Search box at the top of the page to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button. Then, select your desired payment plan and enter your information to sign up for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form onto your device.

Form popularity

FAQ

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar.

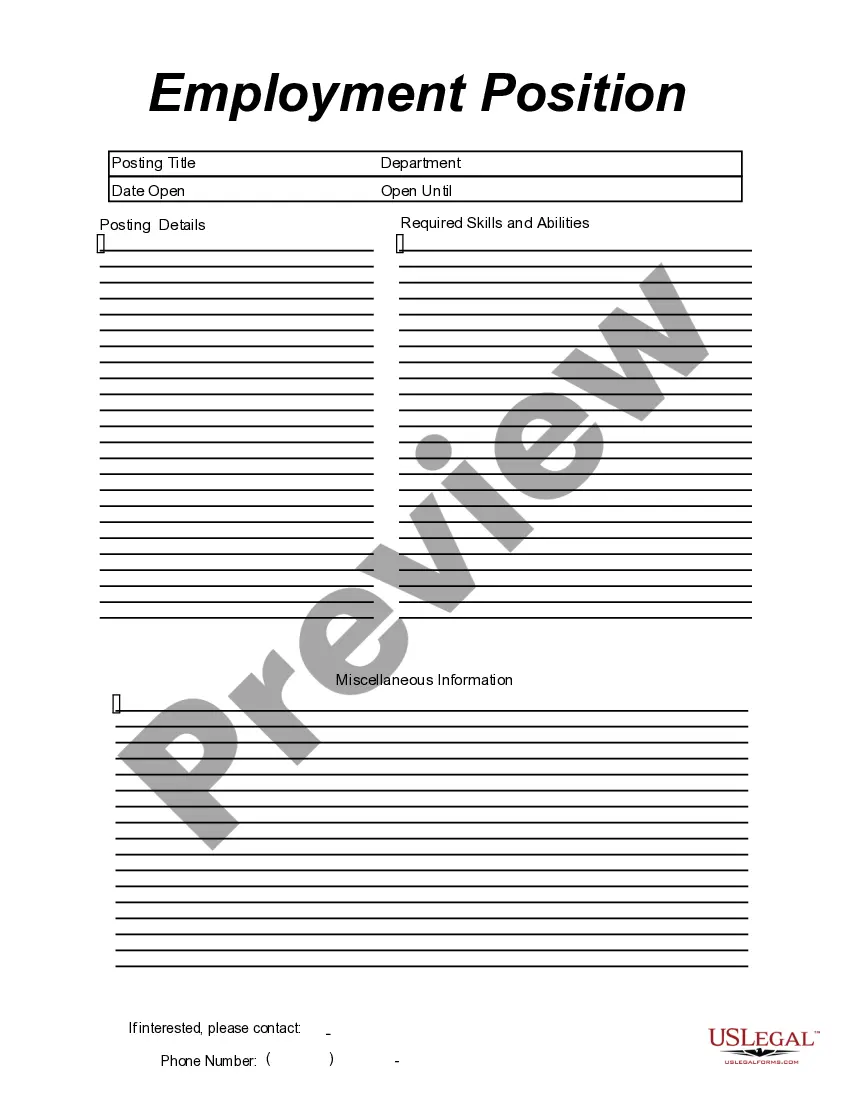

What to include in your job postingsA relevant job title. In other words, a job title that job seekers actually search for.Keywords.The About Us section.Specific job responsibilities.Pay info.Benefits.Location, location, location.Information overload.More items...

Employers can be assigned to a category 20 rate in any of three different ways: A new construction company without the required prior experience will automatically be assigned this category, An employer who is delinquent with their quarterly reports, or.

How to write an effective job advertisementUse an accurate job title.Give a description of the company.Clearly list duties and responsibilities.List the skills and qualifications necessary.State the job location and working hours.Give some insight into salary and benefits.Give contact information.22-Nov-2021

How will Vacation, Severance, or the receipt of Other Payments affect my eligibility to receive benefits? Benefits may be denied or reduced for any week for which your employer has made or will make such payments. Certain other types of payment from employers may be disqualifying or deductible from benefit payments.

How to write a job announcement emailStart with a greeting.List your company name and the job title.Provide a brief job description.Highlight the desired skills and qualifications.State the job location.Include benefit and salary information.Explain how to apply.Sign your name.

The Nebraska Department of Labor (NDOL) announced today that Nebraska's preliminary unemployment rate for December 2021 is 1.7 percent, seasonally adjusted. The rate is down 0.1 percentage points from the November 2021 rate of 1.8 percent and down 1.7 percentage points from the December 2020 rate of 3.4 percent.

Workers who do not have a return date within 16 weeks of their layoff or furlough are required to search for work in order to remain eligible for unemployment benefits. Employers can apply for a two-week extension beyond the 16 weeks.

The taxable wage base for employers in UI Tax Categories 1 through 19 is $9,000. Employers pay tax on the first $9,000 earned by every worker during the calendar year. Category 20 employers will pay on the first $24,000 earned by every worker during the calendar year.

File for weekly benefits at neworks.nebraska.gov while your claim is processing. You have from Sunday to Saturday to file your claim for the previous week. If you don't file your claim on time, your benefit payments may be affected. Report your gross earnings (before taxes are deducted) each week.