Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Have you been in the placement in which you will need documents for both business or individual uses just about every day time? There are plenty of lawful record layouts available online, but locating kinds you can rely isn`t straightforward. US Legal Forms provides thousands of kind layouts, like the Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that happen to be composed to meet state and federal demands.

Should you be currently informed about US Legal Forms website and have a merchant account, just log in. Following that, you may obtain the Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse web template.

If you do not offer an account and want to begin using US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for the correct town/county.

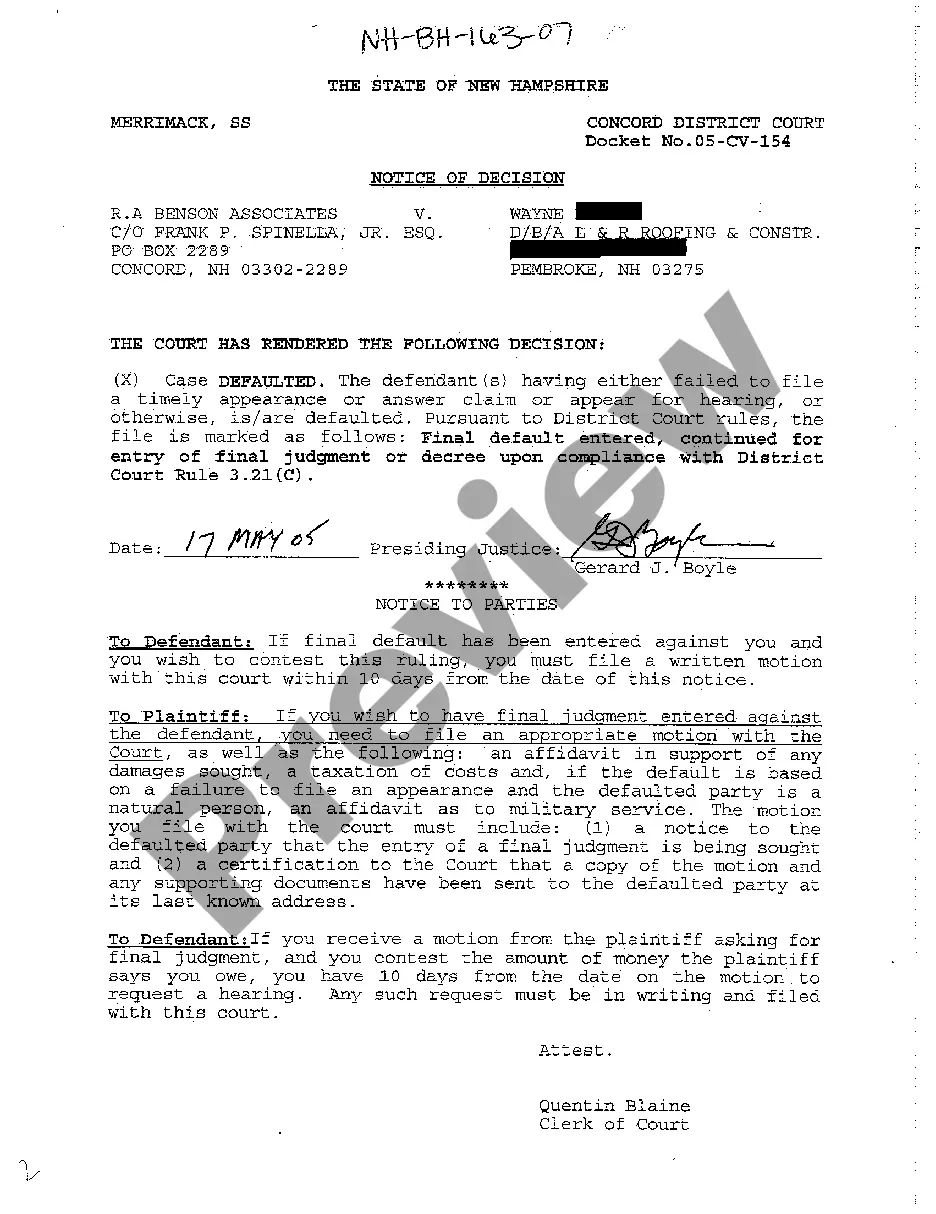

- Take advantage of the Preview button to examine the shape.

- Look at the outline to actually have selected the appropriate kind.

- In the event the kind isn`t what you`re looking for, use the Research discipline to obtain the kind that fits your needs and demands.

- Whenever you find the correct kind, simply click Get now.

- Select the rates strategy you would like, submit the desired details to generate your bank account, and buy the order using your PayPal or charge card.

- Decide on a handy paper file format and obtain your duplicate.

Discover all of the record layouts you may have bought in the My Forms menu. You may get a extra duplicate of Nebraska Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse whenever, if needed. Just click the necessary kind to obtain or produce the record web template.

Use US Legal Forms, the most substantial selection of lawful varieties, to save time and prevent mistakes. The service provides skillfully manufactured lawful record layouts which can be used for an array of uses. Make a merchant account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

An expert adviser can help you navigate the rules and pass on more of your wealth. After taking inheritance tax advice you will: Understand how the rules apply to your situation. Get expert recommendations on how to pass on your assets in a tax efficient way.

Get a head-start on planning and follow these 7 easy steps: Take Inventory of Your Estate. First, narrow down what belongs to you. ... Set a Will in Place. ... Form a Trust. ... Consider Your Healthcare Options. ... Opt for Life Insurance. ... Store All Important Documents in One Place. ... Hire an Attorney from Angermeier & Rogers.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Ideally, your child can sign a prenuptial or postnuptial agreement to negotiate that their future inheritance is separate from marital property.

What Do I Do With a Cash Inheritance? Give some of it away. No matter where you are in the Baby Steps, giving should always be part of your financial plan! ... Pay off debt. ... Build your emergency fund. ... Pay down your mortgage. ... Save for your kids' college fund. ... Enjoy some of it.

Don't Assume You'll Get It. First of all, if you're expecting a large inheritance one day but have yet to receive the money, don't count on it. ... Take It Slowly. ... Seek Advice If You Need It. ... Pay Off Debts. ... Invest the Rest. ... Understand the Tax Implications. ... Splurge If You Must, but Don't Go Crazy.

Some examples of goals you may want to use this money for include retiring the way you want, paying off your debt, or purchasing a new home. Spend some time in thought, then meet with your advisor to review your options and identify the most appropriate course of action and map out a plan to implement it.

There are a variety of ways that money can be left to your children, including wills, trusts, or by naming them beneficiaries of retirement plans, life insurance, and 529 plans. The best ways to leave your children money are through estate planning tools, such as wills and trusts.