Nebraska Sample Collaboration Agreement

Description

How to fill out Sample Collaboration Agreement?

If you want to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Utilize the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal use are categorized by classifications and states, or keywords.

Every legal document template you download is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and print the Nebraska Sample Collaboration Agreement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to acquire the Nebraska Sample Collaboration Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Nebraska Sample Collaboration Agreement.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the guidelines below.

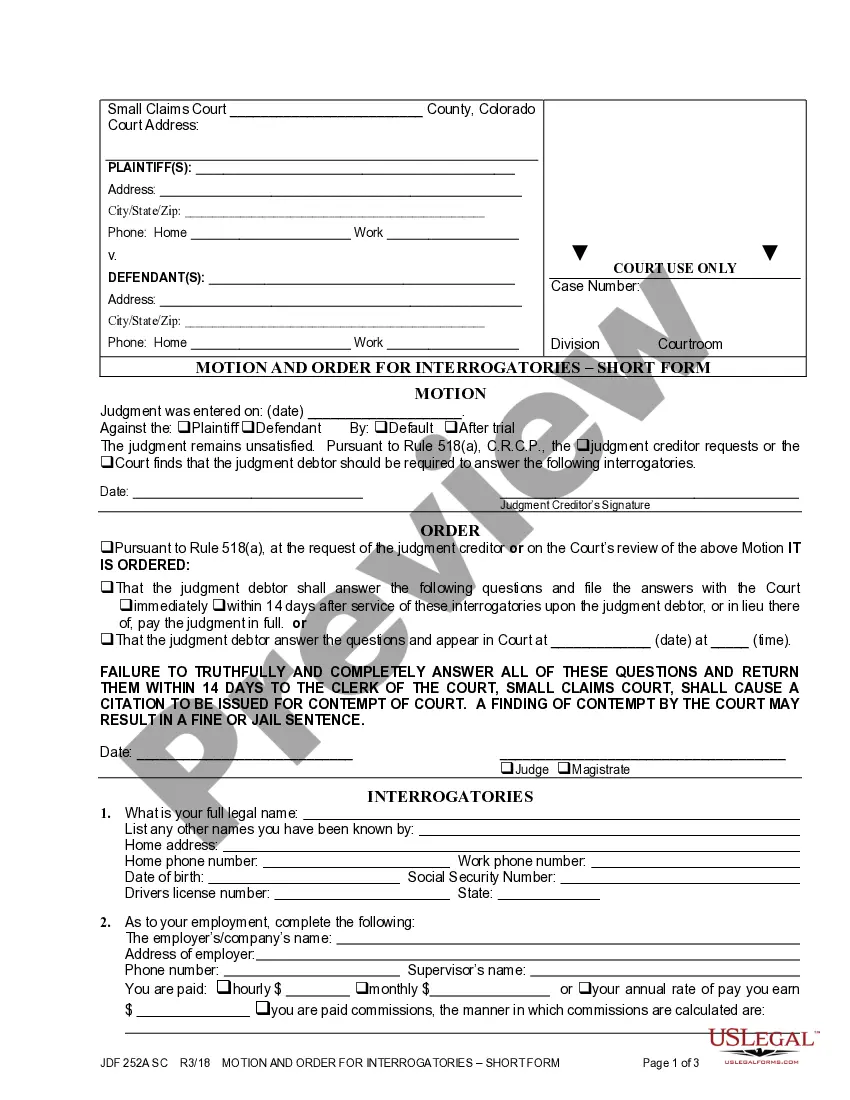

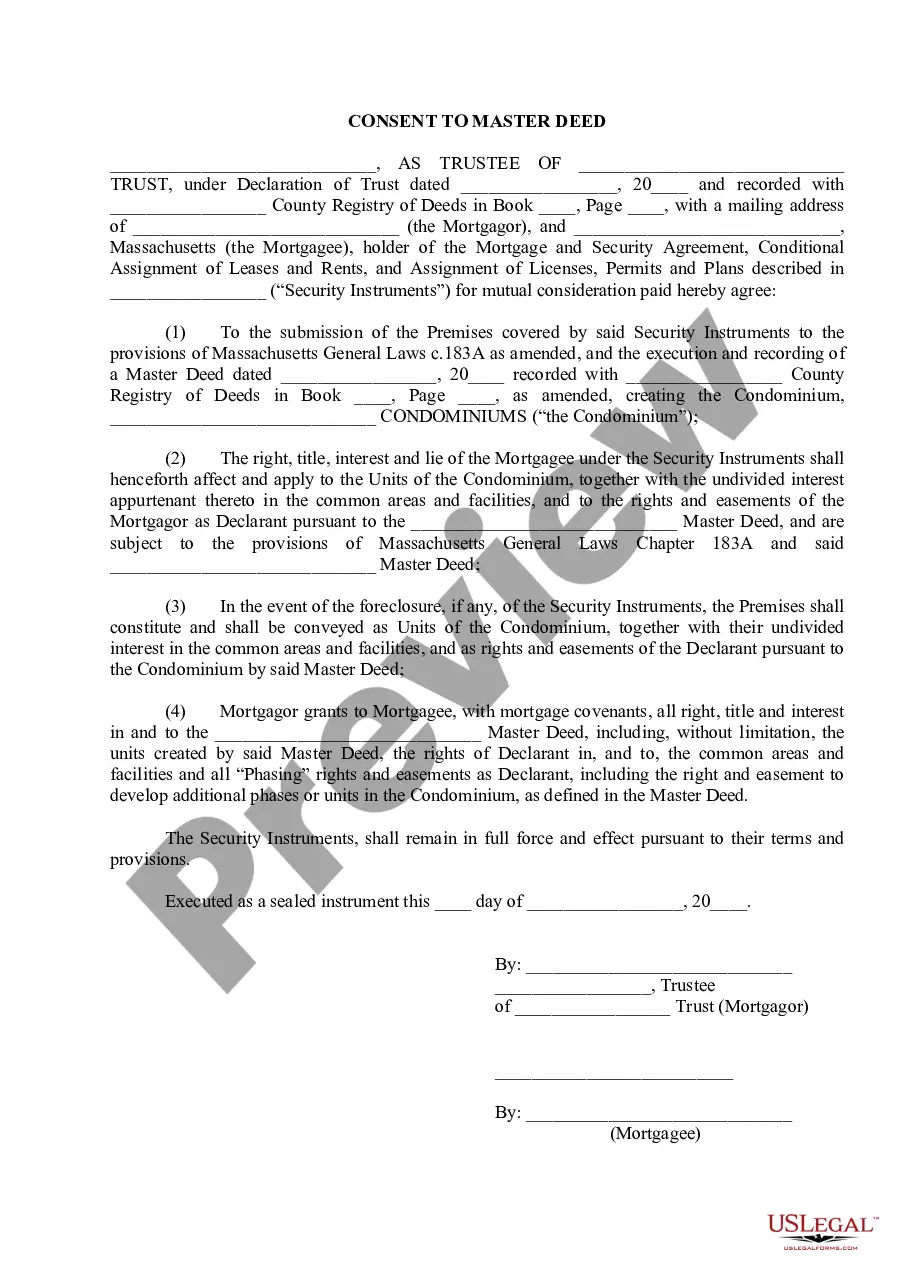

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's details. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal form format.

- Step 4. Once you have located the form you desire, click on the Download now button. Select the pricing plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Nebraska Sample Collaboration Agreement.

Form popularity

FAQ

No Composite Filing. The Department does not provide for the filing of composite income tax returns.

4 Types of Partnership in BusinessGeneral Partnership. This partnership is the most common form of business cooperation.Limited Partnership. Limited Partnership (LP) is a type of business partnership that is formal and has been authorized by the state.Limited Liability Partnership.Limited Liability Limited Partnership.

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

A composite return is an individual return filed by the passthrough entity that reports the state income of all the nonresident owners or, in some cases, the electing members, as one group.

States that do allow composite returns include: Alabama, Connecticut, Delaware, Idaho, Wisconsin, South Carolina, Massachusetts, Michigan, North Dakota, New Hampshire, Tennessee, Texas, Nebraska, Oklahoma, Utah, Arizona, New York and Vermont, as well as the District of Columbia.

A partnership agreement must contain the name and address of each partner and his contribution to the business. Contributions may consist of cash, property and services. The agreement must detail how the partners intend to allocate the company's profits and losses.

You can opt out anytime.Name of your partnership.Contributions to the partnership and percentage of ownership.Division of profits, losses and draws.Partners' authority.Withdrawal or death of a partner.