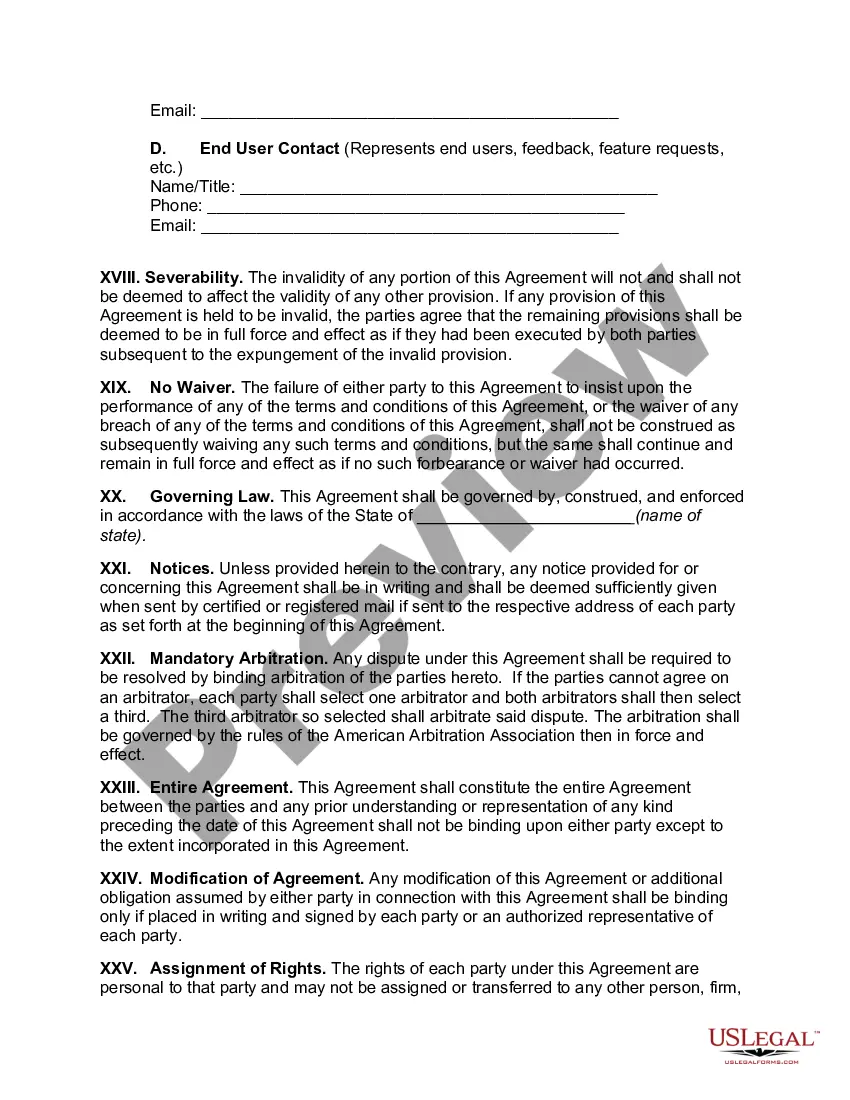

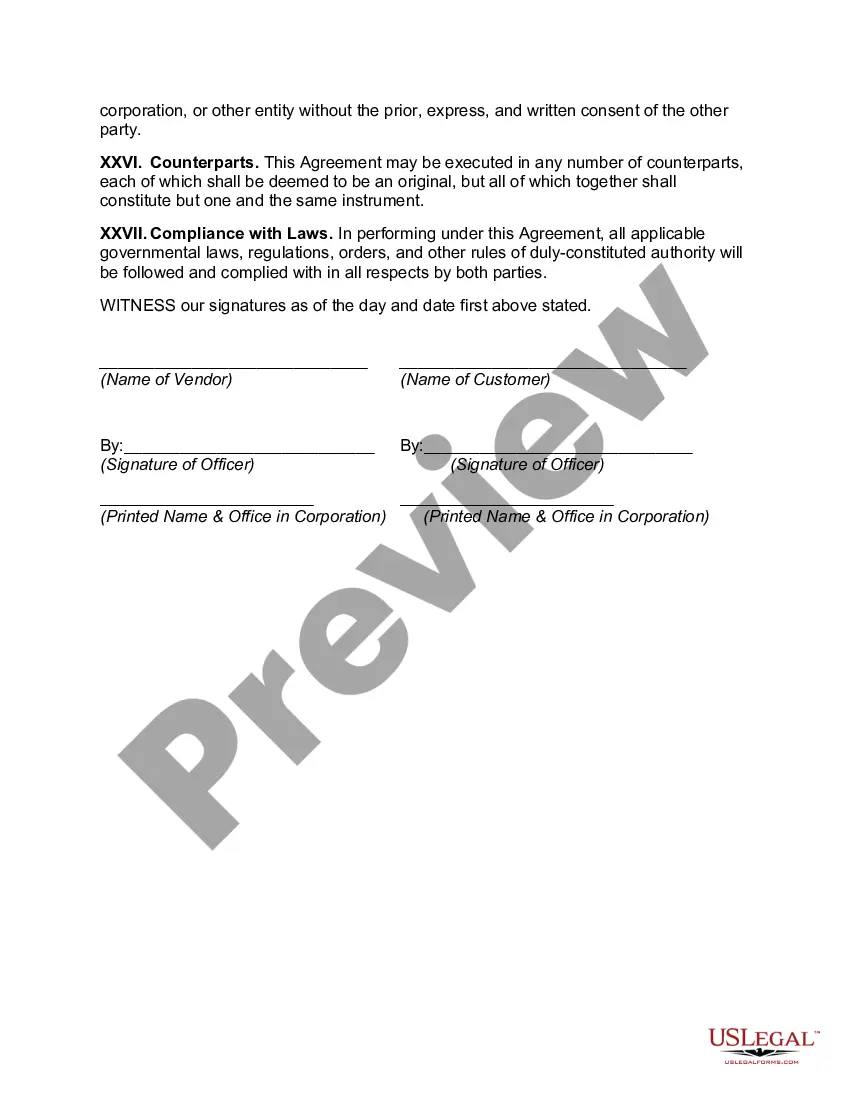

Nebraska Software Maintenance and Support Agreement

Description

How to fill out Software Maintenance And Support Agreement?

If you require thorough, download, or print official document templates, utilize US Legal Forms, the leading collection of official forms, readily available online.

Employ the site's easy-to-use search feature to find the documents you need.

A wide range of templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose your preferred pricing plan and provide your details to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Nebraska Software Maintenance and Support Agreement in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Acquire button to locate the Nebraska Software Maintenance and Support Agreement.

- You can also access forms you have downloaded previously in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate state/country.

- Step 2. Use the Review method to examine the form's details. Don't forget to review the specifics.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the official form format.

Form popularity

FAQ

Sales of canned computer software are taxable as retail sales in Illinois. Sales of custom software, which is prepared to the special order of the customer, are not taxable.

The GST is imposed on the supply of taxable property and services in the remaining provinces and territories, with the addition of a provincial sales tax or a retail tax depending on the jurisdiction. There is no provincial sales tax in Alberta or in Canada's three territories.

Computer Software Maintenance AgreementsCharges for maintenance agreements to maintain computer software that include free or reduced-price upgrades, enhancements, changes, modifications, or updates are taxable.

Services in Nebraska are generally not taxable.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

No. Services performed to merely test machinery or equipment are not considered taxable repair or maintenance labor. However, if any repairs are made to the machinery or equipment, the total amount charged, including the charge for testing, is taxable.

Examples of other real property services include landscaping, garbage removal, building or grounds cleaning, janitorial services, structural pest control and real property surveying. Real property services that involve repair are generally taxable services.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.