Nebraska Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

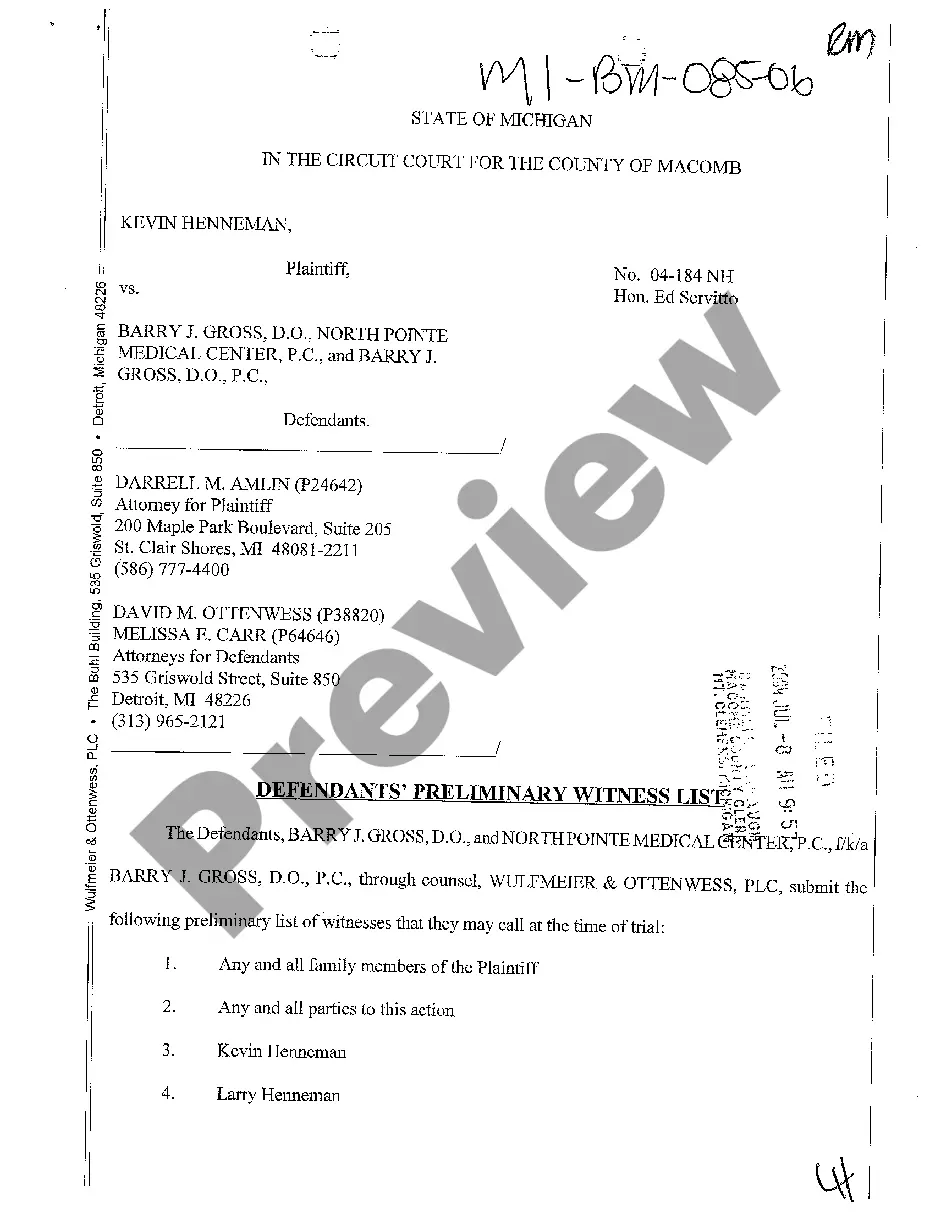

Description

How to fill out Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

Discovering the right authorized document template can be a struggle. Obviously, there are plenty of templates available on the net, but how can you get the authorized form you want? Utilize the US Legal Forms internet site. The assistance gives a huge number of templates, including the Nebraska Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, that you can use for business and private needs. All of the varieties are checked out by professionals and fulfill federal and state specifications.

In case you are previously authorized, log in to your account and then click the Download switch to get the Nebraska Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor. Use your account to look with the authorized varieties you might have bought formerly. Visit the My Forms tab of your account and acquire another version of the document you want.

In case you are a fresh consumer of US Legal Forms, listed below are easy guidelines that you should follow:

- First, make sure you have selected the correct form for the town/region. You may examine the form making use of the Review switch and read the form description to make certain it will be the best for you.

- In the event the form does not fulfill your requirements, use the Seach field to find the appropriate form.

- Once you are certain that the form is acceptable, select the Buy now switch to get the form.

- Pick the costs strategy you need and type in the required information. Make your account and pay for the transaction utilizing your PayPal account or charge card.

- Select the file structure and obtain the authorized document template to your system.

- Complete, revise and produce and indication the attained Nebraska Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor.

US Legal Forms is the largest catalogue of authorized varieties for which you can discover different document templates. Utilize the service to obtain professionally-produced documents that follow state specifications.

Form popularity

FAQ

Under Nebraska Workers' Compensation Law, there are 10 factors which are considered in determining whether a person is an employee or an independent contractor: (1) the extent of control which, by the agreement, the employer may exercise over the details of the work; (2) whether the one employed is engaged in a ...

Workers who perform most of their work using company-provided equipment, tools, and materials are more likely to be considered employees. Work largely done using independently obtained supplies or tools supports an independent contractor finding.

If a worker is employed by a company directly, they are an independent contractor. If the worker is hired to perform a specific task for a general contractor, they are a subcontractor.

For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes. Employment and labor laws also do not apply to independent contractors.

The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.