Nebraska Sample Letter regarding Invoice for Services Rendered

Description

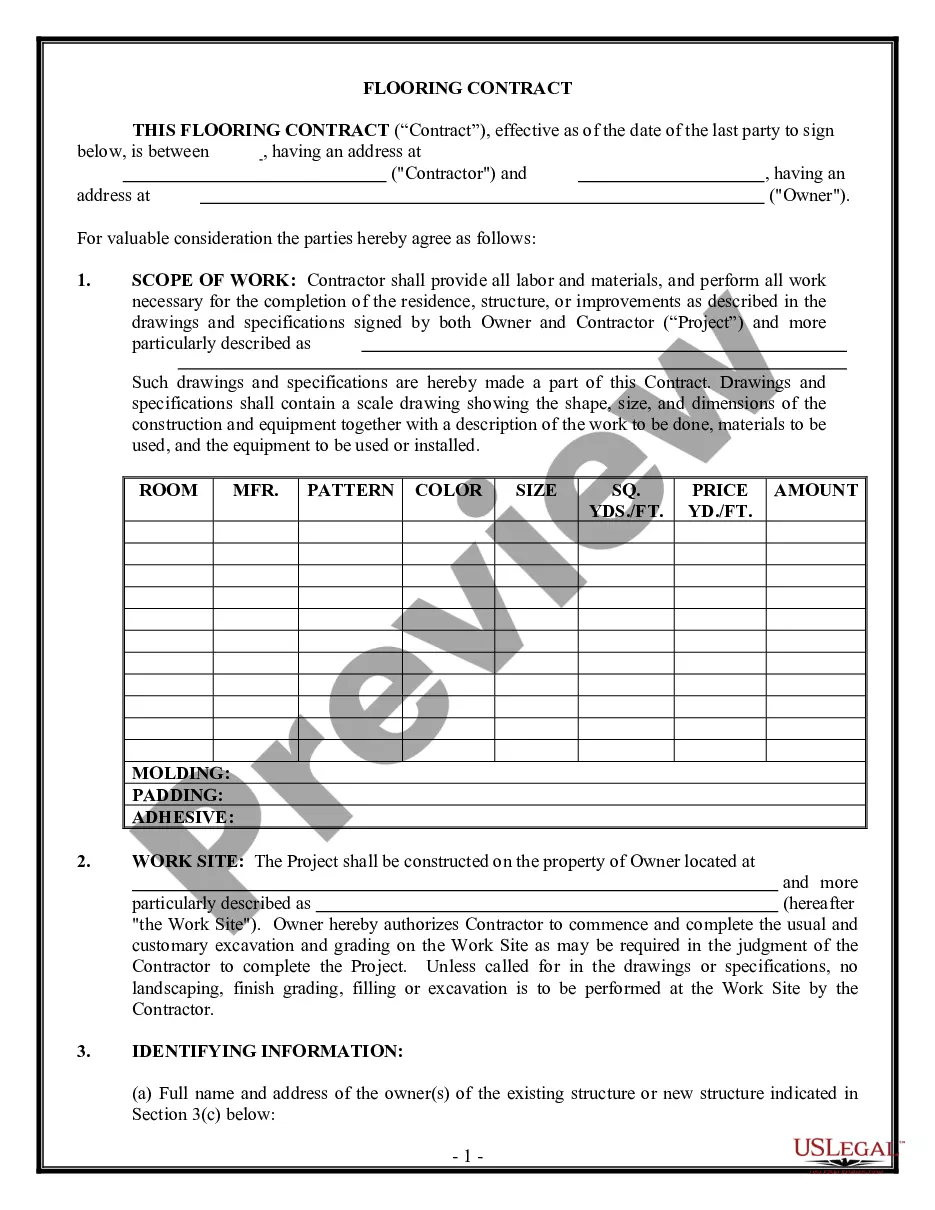

How to fill out Sample Letter Regarding Invoice For Services Rendered?

US Legal Forms - one of several greatest libraries of legal kinds in America - delivers an array of legal file layouts you are able to obtain or produce. While using internet site, you can find a huge number of kinds for enterprise and person uses, categorized by types, says, or keywords.You can find the most up-to-date models of kinds much like the Nebraska Sample Letter regarding Invoice for Services Rendered in seconds.

If you already have a subscription, log in and obtain Nebraska Sample Letter regarding Invoice for Services Rendered from your US Legal Forms catalogue. The Down load button will show up on each develop you perspective. You get access to all earlier downloaded kinds within the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, allow me to share straightforward instructions to help you began:

- Ensure you have chosen the proper develop for your personal city/region. Select the Review button to examine the form`s content material. Read the develop outline to ensure that you have selected the correct develop.

- When the develop doesn`t match your specifications, use the Research field towards the top of the display to find the one who does.

- When you are satisfied with the shape, affirm your choice by clicking on the Purchase now button. Then, pick the prices plan you prefer and provide your credentials to register for an bank account.

- Procedure the financial transaction. Use your bank card or PayPal bank account to complete the financial transaction.

- Select the formatting and obtain the shape on your product.

- Make changes. Load, revise and produce and sign the downloaded Nebraska Sample Letter regarding Invoice for Services Rendered.

Each format you added to your account lacks an expiry date and it is yours eternally. So, if you would like obtain or produce another copy, just check out the My Forms segment and click on around the develop you want.

Obtain access to the Nebraska Sample Letter regarding Invoice for Services Rendered with US Legal Forms, by far the most considerable catalogue of legal file layouts. Use a huge number of expert and status-specific layouts that satisfy your company or person needs and specifications.

Form popularity

FAQ

13. Nebraska Resale or Exempt Sale Certificate. FORM. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the Nebraska sales tax for the following reason: Check One ? Purchase for Resale (Complete Section A.) ? Exempt Purchase (Complete Section B.)

Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges, and If you provide repair or maintenance services.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Food for human consumptionNoneMeals provided by hospitals or other institutions to patients or inmatesNoneMeals provided to students and campersNoneSchools and school-related organizationsNone4 more rows

A Nebraska Energy Source Exempt Sale Certificate Form 13E must be filed by every person claiming a sales and use tax exemption when it has been determined that more than 50 percent of the purchase of electricity, coal, gas, fuel, oil, diesel fuel, tractor fuel, coke, nuclear fuel, butane, propane, or compressed natural ...

The Nebraska Beginning Farmer Personal Property Tax Exemption Program enables property used in production agriculture or horticulture, valued up to $100,000, to be exempted for the beginning farmer or rancher.

013.01 A sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's business. The property may be resold either in the form or condition in which it was purchased, or as an ingredient or component part of other property.