Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years within moments.

If you already have a monthly membership, Log In to download the Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make changes. Complete, modify, print, and sign the downloaded Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years through US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of expert and state-specific templates that fulfill your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are some simple steps to get started.

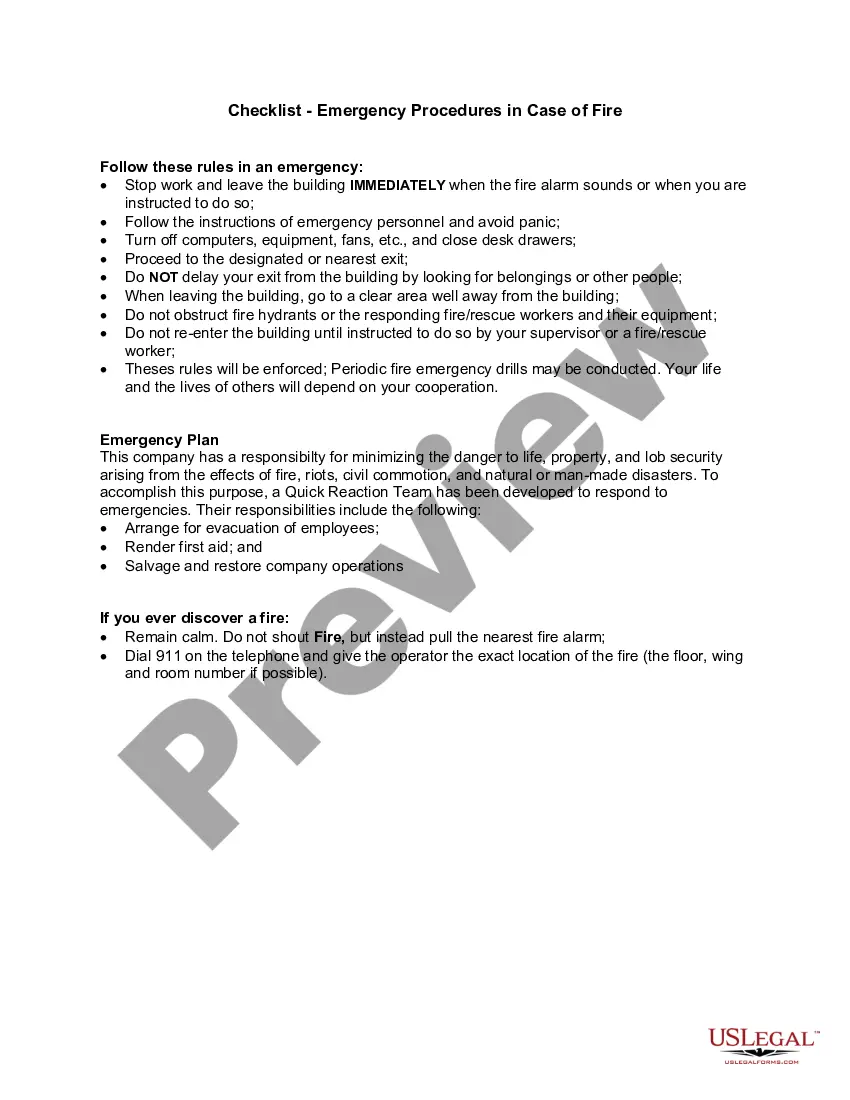

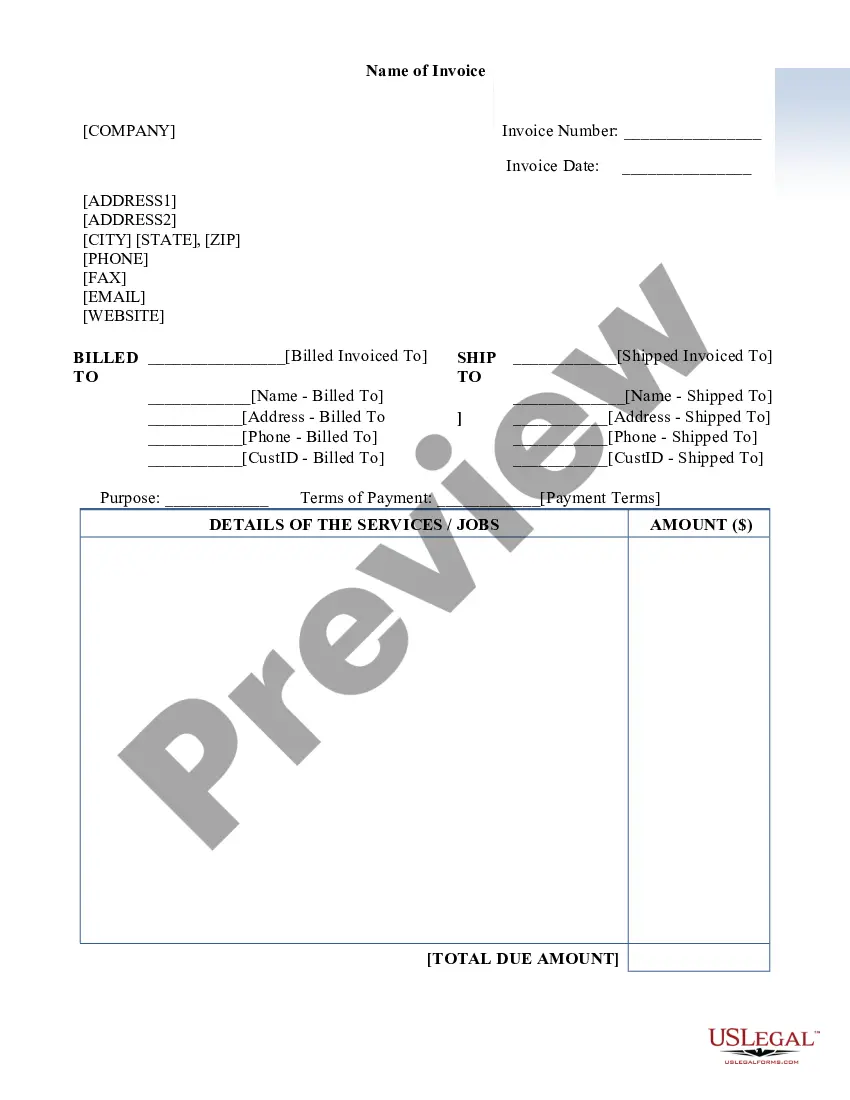

- Ensure you have selected the correct form for your area/state. Click the Preview button to review the form's contents. Check the form outline to confirm you have selected the right one.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find the suitable one.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the pricing plan that suits you and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

If a trustee becomes incapable of performing their duties, the Nebraska Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years may have provisions for appointing a successor trustee. This ensures that the trust administration continues smoothly without disruption. Having a clear plan in the trust document reduces the potential for conflict among beneficiaries. Consulting with legal experts can help navigate this transition effectively.

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

A grantor retained interest trust is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income from or enjoyment of those assets for a period of years. When the trust terminates, the assets are passed on to others.

Since a GRAT represents an incomplete gift, it is not a suitable vehicle to use in a generation-skipping transfer (GST), as the value of the skipped gift is not determined until the end of the trust term.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

A grantor retained annuity trust (GRAT) is a financial instrument used in estate planning to minimize taxes on large financial gifts to family members. Under these plans, an irrevocable trust is created for a certain term or period of time.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

Grantor Retained Income Trust, DefinitionA GRIT is a type of irrevocable trust, meaning the transfer of assets is permanent and can't be reversed.